New Recommendation: Whim

More Dating, Less Texting

By Adam Sharp, Co-Founder, First Stage Investor

I’m excited to announce our newest recommendation. It’s a dating app called Whim.

Unlike a majority of dating apps today, Whim is focused on facilitating actual dates.

The problem with many other dating apps is that there’s not much real dating going on. It’s mostly texting back and forth to “get to know” someone.

Whim claims that on most apps, it takes 12 days of back-and-forth via texting and messaging before an actual face-to-face date happens!

I confirmed this with several of my younger single friends who happen to use dating apps. Most of their time on dating apps is wasted chatting and messaging with people they never end up meeting in person.

I also heard from a number of folks that people they had great conversations with via text often weren’t a great match in real life.

Whim CEO Eve Peters is on a mission to change that.

The Problem With Existing Dating Apps

A recent article in Glamour magazine titled “Dating App Culture Is Being Reconsidered, and We’re All About It” sums up the problem well.

Remember that insanely long Tinder [a popular “hookup” app] messaging thread of yours? You and Taylor had everything in common: diehard Vols fans, running addicts, spicy tuna roll enthusiasts. You even both were listening to Eric Church’s album Mr. Misunderstood on repeat like whoa. And then, nine rounds of ghosting later, you managed to never actually get together in-person.

Sound familiar? Yup, us too. In fact, you’ll probably be totally unsurprised to hear that nearly 80% of messages on dating apps go unanswered. Ain’t modern love grand?

Single people are getting tired of dating apps that focus on texting.

The Glamour article continues…

Thankfully, a new wave of apps and innovative features is hoping to combat this pinball-like maze of finger swirls and tapping tangos and put the focus back on connecting.

Take, for example, Whim, a dating app that does away with the whole concept of messaging. Since many of us hate the constant stream of scheduling and text exchanges that comes with online dating, Whim’s design can get you from behind your phone screen into that cute art gallery you’ve been meaning to check out without a massive (and ultimately fruitless) time-suck. You select what nights you’re available and what area you’ll be in, and when you match with someone you’re given a day and time that works for both of you – and even a suggestion on a fun place to meet.

Bravo to the Whim team for scoring such a prominent placement in a widely read magazine.

We’ve identified the problem with existing market leaders. Now let’s focus on the Whim app and how it solves the problem.

Whim: Laser Focus on Real Dates

Here’s the main reason I like Whim. From the start, the service is all about creating good matches and setting up real dates.

When new users join Whim, one of the first things they do is enter their calendar availability. The images below show what it looks like.

After entering their availability, users can easily browse profiles of potential matches. When both parties express interest in each other, Whim helps set up a date based on both of their calendars.

It’s an elegant, simple solution to the most frustrating aspect of online dating today (too much texting, not enough real interactions).

The tagline on Whim’s homepage reads “Dating, Not Texting.”

That’s the core differentiator Whim has, and it’s served the startup well so far.

Progress per Dollar (Traction)

To date, Whim has raised very little money.

Yet, as of October 2016, more than 12,000 users have joined. The startup reports that 70% of matches on its platform result in a date. That’s far higher than the industry average of 11% (according to Whim).

So far, Whim has done a lot with a little. And as you probably know, that’s one of my favorite signals in startup investing.

Here are some key metrics for Whim’s dating app:

- It has 40% month-over-month growth in number of dates.

- It has 20% month-over-month growth in users.

- It claims to facilitate six times more actual dates than industry leaders.

Leadership

I’ve spoken with Eve Peters a few times now. Every time, I’ve come away impressed with her tenacity, drive and ability. She is dedicated to making this business succeed.

Eve is a graduate of Stanford and Cal Berkeley. She has work experience in the dating industry and is passionate about creating a better matchmaking app.

Importantly, Eve built Whim for people like herself. In the Glamour article I mentioned earlier, she explained the “why”:

Often, the people who I was most excited about based on our pre-date conversation were the biggest disappointments in real life.

In other words, people who are “attractive” over chat/text may not be a good match in real life. I believe Eve is onto something here.

It’s better to go out and meet real people rather than waste time texting with strangers who you may not “click” with at all in person.

That’s the core of Whim’s value proposition. I believe it gives Whim a good chance at becoming a large successful dating service.

Whim plans to make money by offering premium accounts in the near future. For now, however, it is focused on increasing the size of its user base. This is a critical part of building a dating site, and Whim has shown promise in that area to date with its 12,000-plus users.

How to Invest

Whim is raising money on Republic.co. (Note: This is not a typo. It’s Republic.co, not .com.)

Republic is a relatively new platform, but one I’ve gotten to know well and have high expectations for. The founder, Kendrick Nguyen, was a big part of making AngelList the high-profile platform for accredited investors it is today.

So, if you don’t already have an account at Republic, you can open one here. (It’s free.)

Once you’re logged in, go here.

Then click the blue “Invest in Whim” button.

After clicking “invest” and entering your desired investment amount, you’ll be guided through the investment process. We recommend using the option to fund directly from your bank account. Everything is securely processed with Republic’s payment system.

How You Can Help

If you’re single, download the Whim app and give it a try!

If you’re not looking, tell your single friends and family members about it.

Currently, Whim is available only for iPhone. An Android version should be out soon.

Risks

This company has a limited operating history. As with all startups, there is a chance it will fail. The company could fail to attract enough users or fail to raise money for continued operation.

That said, I believe Whim is an excellent investment when you consider risk vs. reward.

Also, remember that these types of investments are not liquid… meaning you can’t sell your shares easily.

We recommend investing small amounts in a large number of promising startups. Building a large diverse portfolio of startup investments gives you the best chance of hitting a major winner.

It’s also important to remember that the amount each person can invest per year is capped based on income or wealth – or both. Don’t invest it all in just a few companies. Our advice is to invest small and build a large portfolio. The minimum investment on this deal is $100.

Additional Notes

Online dating is a large and fast-growing industry. For a good overview on the size of this market and where it’s headed, read this article on Nasdaq.com.

More Whim press coverage can be found here:

Deal Summary

Minimum investment: $100

Security type: Convertible note (a debt note that will convert into preferred shares upon future financing)

Valuation: $5 million cap or 20% discount (your shares will convert at a maximum valuation of the company at $5 million, or a 20% discount to the next round’s price)

Industry: Social media and dating

Raising up to: $500,000

Opportunity closes: 12/31/2016

Equity Crowdfunding Playbook

Part 1: A Special Risk-Reward Equation

By Andrew Gordon, co-Founder, First Stage Investor

Editor’s Note: This is Part 1 of a 12-part series called the First Stage Investor Equity Crowdfunding Playbook. Read more about the playbook here.

Investing in startups gives you the kinds of benefits you can’t get anywhere else in the stock market. Yes, these are riskier investments, but there are ways to limit the risk.

Put both sides together and you have a very special risk-reward equation.

Take advantage of high-growth pre-IPO companies. Manage risk. Today, I’ll give your first lesson on how to do both.

The Incredibly Shrinking Upside of Your Current Portfolio

The kinds of gains you could have gotten from Amazon (more than 35,000% since its IPO), Microsoft (over 53,000%) or Apple (nearly 16,000%) are nowhere to be found in our public stock exchanges.

The new reality? Companies are waiting longer to tap the public markets.

The kind of growth that makes investors serious money is now taking place before companies go public.

Think of the most exciting and fastest-growing companies…

Uber, Airbnb, Snapchat, SpaceX, Pinterest, Spotify, Stripe, Slack, DocuSign, Instacart, GitHub, Warby Parker, Evernote, Fab, Kabam, Lending Club, GoPro…

The list goes on and on.

What do all these companies have in common?

- Their amazing growth is making their investors very rich.

- None are publicly listed.

- By the time they do go public, they will have experienced around 90% of their total past, present and future growth.

- And the investors who will benefit the most (by far) from their success are EARLY INVESTORS.

But only those early investors who understand their road to riches is paved with losers.

These Are Hall of Fame Numbers

The truth is most of your startup investments will fail.

You have to stomach losing. Otherwise, you can’t become a successful early investor.

But look at it from the perspective of a baseball player. He fails two out of three times at bat.

It’s so ingrained into the culture of baseball, it’s not thought of as failure. In fact, a .300 batting average is considered to be very good.

Hall of Fame outfielder Ty Cobb ended his career with a .366 batting average over 24 seasons – the BEST career batting average in the history of Major League Baseball.

A recent study shows that early-stage investors bat .400. High enough for these portfolios to make big profits. I’d say those are indeed Hall of Fame investing numbers.

And we have an incredibly powerful force to thank.

In fact, Einstein called it “the most powerful force in the universe.”

He was talking about compound interest. You can see it in action with startup companies.

Some grow revenues by 100% to 1,000% per year, year after year. Most startups can’t keep up this pace. But those that do?

This ultra-rapid compound growth creates a rich vein of value that early-stage investors readily tap into.

While some of these companies falter at some point, many do extremely well and earn early investors between 10X and 36X returns (and sometimes much more).

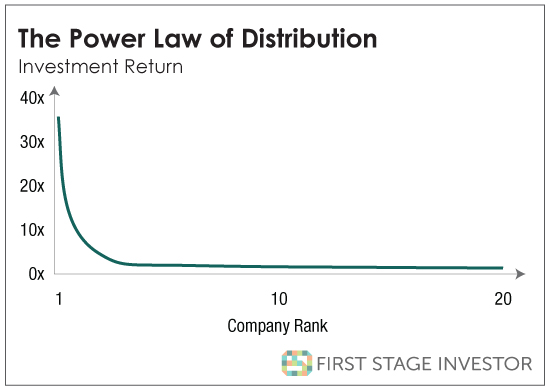

This dynamic is called the power law of distribution (short for distribution of returns). A few big winners cancel out the many losers with ample profit to spare.

Here’s how it’s visualized…

As you can see, returns are very skewed. Most companies end up gaining between 0 and 1X.

But the companies that do well can offer life-changing returns.

Doing the Math on Portfolio Size

So how do you know how many companies it’ll take to make your portfolio successful?

If you’re an early-stage (seed or Series A) investor who has backed 10 startups, six will fail (on average), according to a recent study by private equity fund-of-funds Horsley Bridge Partners.

So, what happens to the remaining four?

One to three will hit it big. This is according to another study done by the Kauffman Foundation.

Now, there are two ways to hit it big.

One is through an IPO. Roughly 8% to 10% of your big winners go this route. The average return is 36X, according to a study by venture firm Top Tier (assuming you make follow-on investments).

The other way is through a buyback. In the same scenario, you make 10X.

So this is how the math will work…

Let’s say you invested $1,000 each in 10 companies. Kauffman says you’ll have one to three big winners. And Top Tier says that it’s 90% likely they will be buyouts. One buyout winner would give you a 10X, or $10,000, return. Three buyout winners would give you a $30,000 portfolio profit.

So a 10-company portfolio would give you modest returns.

Let’s jump to 40 startup holdings to see if a bigger portfolio makes a difference.

The number of big winners would be four to 12 – with a high likelihood of at least one 36X winner. Okay, then let’s take the middle road and assume eight big winners, including a 36Xer.

With $1,000 invested in each, you’ve made $70,000 via buyout winners and $36,000 via an IPO winner. Your total profit is $106K, or 2.65X gains.

(In this scenario, I’m assuming your non-big winners produce no profit or losses. My thinking being a third loses all, a third breaks even and a third averages 2X gains.)

Not for Armchair Academics

I’m pretty sure the authors of the three studies I’ve used would protest my mixing and matching their results.

If I were an academic, I would surely get kicked out on my backside.

Thank goodness I live in the real word.

Listen, there’s a dearth of data-rich studies on startup portfolio returns. I had to take liberties.

But you should note that the Kauffman study found returns to be in the 2.6X vicinity for every 3 1/2 years.

Pretty close to my 2.65X calculation above.

(And when you take into account paper profits, Kauffman says the 2.6X return hands you a 27% profit every year.)

The More, the Better

The big takeaway?

The more companies you can put into your portfolio, the better.

Ten isn’t enough. Twenty is better. Multiples of 20 better still.

I know that sounds like a lot. But if you followed up on our recommendations, you would invest in about 20 startups a year. In two years, you’d be up to 40. In three years, you’d be up to 60… and so on.

As for affordability…

I used $1,000 invested in each startup to make the math easier. There is nothing magical about $1,000. If you can’t afford $1,000 (to reach a portfolio of 40 or more), then go lower.

Do These Two Things

The power law of distribution predicts few but huge winners scattered among many losers and modest gainers.

To own one of these big winners, you have to…

- Choose your startups wisely and be sure to properly diversify across sectors and places

- Keep building up your startup portfolio, month in and month out.

Do those two things and you will significantly increase your chances of profiting handsomely from a portfolio of startup holdings. And we’ll be helping you with both.

P.S. In the next issue, we will identify all the main players in the startup ecosystem and your special place in it.

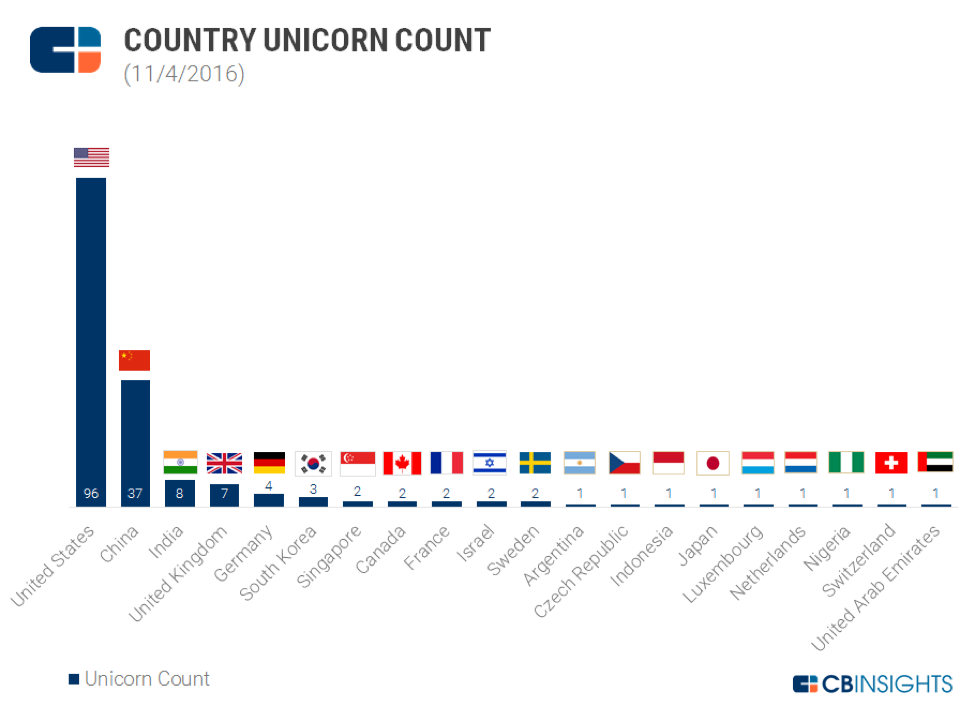

CHART OF THE MONTH

Unicorn Growth Around the World

As you can see, the United States pretty much owns the market when it comes to Unicorns. (Remember, Unicorns are private companies valued at $1 billion and above.)

While Silicon Valley gets all the attention, the number of Unicorns cropping up around the world is growing… slowly but surely.

What this chart illustrates is that there are many hubs of innovation around the world, and we’re keeping our eyes on these places.

China and India should continue to separate from the pack – especially India, with its huge (and growing) young demographic relying more and more on mobile.

Latin America is also making quiet progress. In case you missed it, or if you’re new to First Stage Investor, check out our exposé on the startup scene in that region.

December Portfolio Review

There have been several developments in the companies in our portfolio this month, from expanding product lines to attention-grabbing spots at world-renowned trade shows. Let’s take a look at a few.

DSTLD Continues to Expand Product Line

When we talked to the founders at DSTLD while vetting the company, they promised us they would build out their product line. We agreed it was the right strategy to take maximum advantage of their growing universe of customers.

Every time we go to the site these days, we see something new. Last time, it was men’s wallets. The time before that, it was long wool coats.

It’s a big reason why November’s average order value was 13% higher than the previous month’s. Revenues were 51% better than October’s.

No surprise, then, that DSTLD had a very nice Cyber Monday, pulling in $113,000 in a single day.

Virtuix Production Accelerating

Virtuix is picking up the pace of its Omni deliveries from China. The VR company will be shipping out one container per week to Austin from now until January 28, when the Chinese New Year takes place.

After that, the company says it will be 100% comfortable with relying solely on the quality control done in China and will skip Austin’s quality control inspection. At that point, it plans to begin shipping directly to U.S. customers.

Non-U.S. preorder customers, however, will not get the Omni product. Instead, Virtuix is offering a full refund (plus interest), citing high shipment costs along with the cost of production being higher than earlier estimates.

Not great news, but we should note that the company is already sending product to its Chinese joint venture partner, Leyard. So, the Chinese market – with its huge potential payoff – is still very much in play.

As is, of course, the U.S. market. Outside the U.S. and China, Virtuix says that it is currently shopping for distribution partners. As such, its full refund offer represents only a minor setback for the company.

Fortunately, its biggest markets – the U.S. and China – aren’t affected. They’re the two markets Virtuix has rightly been targeting from the very beginning.

In addition to the uptick in production, the company is seeing an expansion in its visibility.

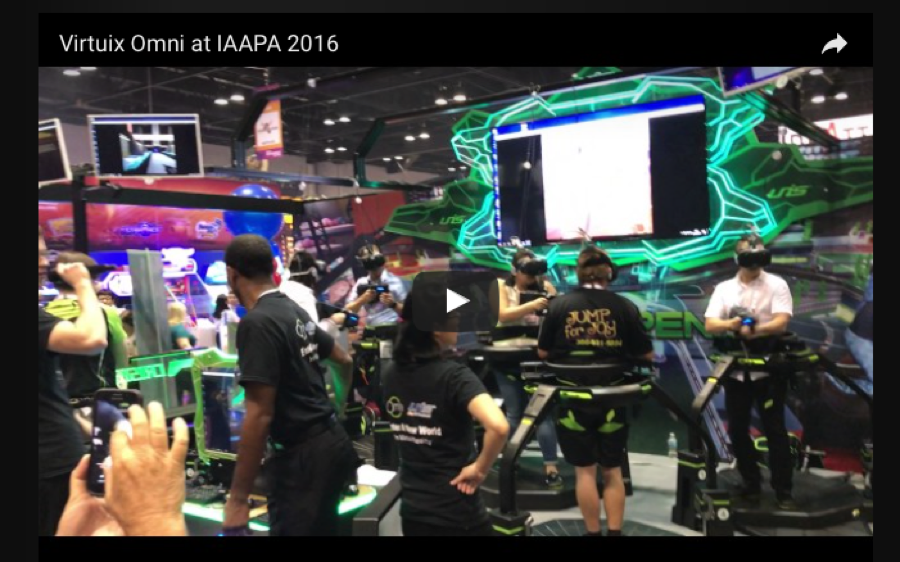

The Omni continued to draw crowds at trade shows from around the world – including Orlando, Florida, Las Vegas, Nevada, and Melbourne, Australia – in the weeks leading up to the Thanksgiving holiday.

Below is a picture of the five-Omni setup at the IAAPA Attractions Expo in Orlando.

Remember, commercial operators pay Virtuix additional licensing fees. The money helps Virtuix stay funded while it continues to deliver on its backlog of Omnis.

The Omni doesn’t just work for games that use Virtuix’s game development kit… it also works with a lot of VR games “out of the box.” They don’t require any developer tweaks.

Virtuix reviewed two of these games recently – Chernobyl VR and Alice VR.

Click here to watch the gameplay videos. Here are a couple of stills from the Alice video gameplay…

A Message From the CEO of VetPronto

Editor’s Note: Below is an update from Joe Waltman, CEO and co-founder of VetPronto (a prior recommendation that is now closed). The company is doing well and expanding its vet network nationwide. See details on how you can help (optional) below.

November was an encouraging month. In spite of two appointment-reducing events (the election and Thanksgiving), we were still able to increase revenue by 14% to approximately $75K. Most of this increase is from appointments in our new markets (more details below).

KPIs

November Revenue: $74,902

November Appointments: 271

Average Appointment: $276.

Achievements

Our new markets are looking good. Most of our new markets are already outpacing San Francisco, which had five appointments and $935 of revenue in its first month.

Challenges

Hiring and retaining vet techs: We rely on a growing number of vet techs (i.e., nurses) to help with administrative tasks and in-appointment vet support. As is pretty common in the vet industry, there is high turnover among these vet techs. We have been spending more energy recruiting and training these techs lately. We need to do a better job finding high-quality techs and making sure they are happy working with VetPronto.

Recent Testimonials

From Twitter…

VetPronto, a super convenient & high quality vet house call service, just launched in NY, Chicago, Atlanta & DC.

From Facebook…

One of my portfolio companies, VetPronto, which is a house call veterinary service, just launched in New York, Chicago, Atlanta, Washington, D.C., and Tampa Bay. If you are a pet owner in one of those cities (or know one), be sure to check them out. House calls offer the highest quality and most convenient vet care, and VetPronto has an amazing network of veterinarians.

First Stage Investor Portfolio

| Company | Date Recommended | Sector | Series | Valuation | Investment Type | Round Status |

|---|---|---|---|---|---|---|

| Whim |

12/15/2016

|

Social Media and dating |

Seed

|

$ | Convertible Note | Open |

| Keen Homes |

11/23/2016

|

Internet of Things |

Series A

|

$6,000,000 | Preferred | Open |

| Magic Instruments |

11/17/2016

|

Consumer Electronics |

Seed

|

$12,000,000 | Convertible Note | Open |

| VetPronto |

10/12/2016

|

On-Demand |

Seed

|

$5,000,000 | Convertible Note | Closed |

| BrewDog USA |

09/01/2016

|

Consumer | $350,000,000 | Common | Open | |

| Barrow’s Intense Ginger Liqueur |

08/17/2016

|

Consumer Goods |

Seed

|

$4,000,000 | Preferred | Closed |

| DSTLD |

08/03/2016

|

Apparel |

Series A

|

$22,000,000 | Preferred | Open |

| Virtuix |

07/26/2016

|

Virtual Reality |

Series A

|

$35,000,000 | Preferred | Closed |

| 8Tracks |

07/26/2016

|

Music |

Series A

|

$28,000,000 | Preferred | Closed |