Investments: Why the Day-to-Day Matters for the Long Run

By Adam Sharp

Dear First Stage Investor Member,

Welcome to issue No. 2 of First Stage Investor.

And welcome new members. We just hit 4,400 subscribers, way ahead of projections.

And that’s a great thing. Because the larger we are, the more influence we have.

There have been three recent developments along those lines.

- Our contacts at SeedInvest have offered to do exclusive webinars (with founders raising money) for First Stage Investor. This is a great chance to get a feel for the leadership.

- We’re in discussions with a major equity crowdfunding portal to get exclusive access to hot deals for members. This will help ensure there’s room for everyone to get in.

- We’re exploring ways to work with the folks at NextGen Crowdfunding. They have built a number of useful data tools specifically for equity crowdfunding. Their educational material is high-quality as well. The company was kind enough to set up a preview for First Stage Investor members at this link. (You can also create a free account.)

We’ve only just begun to explore these types of benefits for members, and we’ll keep you updated as they progress. There is a lot we can do.

As a reminder, our research is 100% independent. We don’t accept any commissions, fees or payments of any kind from the startups we recommend, the portals that list them, or the partners we work with to deliver better services to you.

Editor’s note: If you haven’t read issue No. 1 yet, you may want to do so first. Andy and I covered some basics in there that’ll be good to know going forward.

Now that housekeeping’s out of the way, let’s get started.

Our mission is to help you build a portfolio of high-quality early-stage investments.

To that end, we’re going to be covering quite a bit in this issue, including…

- Tracking your investments

- Our investment thesis

- The BrewDog USA deal, which is now LIVE

- SeedInvest vs. Wefunder (the two leading portals in this emerging space).

Tracking Your Investments

With stock investments, it’s easy to see how the company’s doing. Just check the share price.

Private investments are different. Some founders will provide detailed monthly investor updates. Others will be less frequent.

The primary measure of private companies is valuation. But valuations (and underlying share prices) change only when a company raises a new round of funding.

So we need a way to track these investments between fundraising events and updates from management.

Luckily, there are a lot of easy online ways to track what your startups are doing.

One is through social networks. Follow your companies on Facebook, Twitter, LinkedIn, Instagram and AngelList. Some will be more active than others, so don’t be alarmed if they don’t have much of a media presence. Some startups intentionally keep a low profile; others just haven’t gotten there yet.

And here are two free services that will email you updates on your portfolio. I use both, as they tend to cover different sources.

Google Alerts is a great tool for tracking private companies. Get notified whenever your company is mentioned on the web. Simply create an alert for its name, and you’ll be notified when there’s news about it.

Owler.com is a free tool I use daily. Sign up, add your portfolio companies and it’ll let you know when a company is in the news, raises money, blogs, posts to YouTube and more. Owler sends a morning update with news about companies you’re tracking.

Also sign up for the company’s newsletter if it has one.

Our Investment Thesis

First Stage Investor’s thesis is simple. Invest in fast-growing companies that have shown themselves to be highly efficient with capital.

The best measure of a startup is its “progress per dollar.” If it’s raised millions but doesn’t have much to show for it, that is obviously a red flag. But if it’s “bootstrapped” its way to serious traction on little cash, that is something that deserves further examination.

Of course, it’s a little more complex than that. We also look for companies operating in fast-growing sectors.

There are certain sectors we’re keeping a close eye on.

- Self-driving cars/taxis/trucks/buses/tractors/drones: We’ll see the first self-driving taxis within years. The opportunity is beyond large here. This is the future of transportation.

- Machine learning/AI: Machine learning can, in the right hands, be an extremely powerful tool. We’ll be watching for the right applications of this transformative technology.

- Fintech: From online mortgages to robo-advisers running 401(k)s, the investment world is going digital. We will be on the lookout for standout opportunities across the fintech space. Of particular interest to us is the ECF space itself, which is currently about a $30 million/year investment market in the U.S. We believe it’ll be a $30 billion market one day, so we will be ready if and when we see opportunities to invest in the portals that list these opportunities. It’s an overlooked area in the fintech space, and we will look to take advantage of that.

Of course, we’ll also be keeping an extra eye on consumer startups with promising brands. Equity crowdfunding is the perfect fundraising model for these types of businesses. It creates a very positive cycle.

Fans of the brand become investors. Investors become fans of the brand.

BrewDog, the beer maker from our special report that came with your membership, is a perfect example of the investor-fan model, as you’ll see in the next section.

BrewDog first came to my attention in 2009, when the company did its first ECF round in the U.K. BrewDog has taken advantage of ECF like nobody else has. It has used it as its near-exclusive funding mechanism.

Using that approach, it’s been the fastest-growing food/drinks company in the U.K. for three years running.

This is the future of early-stage capital formation. It lines up all the right incentives. It empowers individual investors. And it gives startups and small businesses a much-needed way to access funding.

So we’re keeping an eye out for businesses that can use equity crowdfunding to accelerate their businesses faster than any other means of funding.

BrewDog USA Opportunity Is Now Live

The good news for BrewDog gets better: It’s now a live deal for ECF investors in the U.S.

As you may remember, BrewDog started in Scotland and has taken the U.K. (and Europe) by storm, going from $0 to $58 million in annual sales in less than a decade.

Now it’s targeting the largest beer market in the world, the U.S. For comparison…

- The U.K. beer market is $20 billion.

- The U.S. beer market is $112 billion.

Important information: The deal we’re recommending is BrewDog USA. You’re investing in BrewDog’s U.S. operation (which it is almost done building, more below). You’re not investing in the U.K. company.

BrewDog is almost certain to be a hit here. I know craft beer connoisseurs who are eagerly awaiting the arrival of its top-selling Punk IPA in the States.

It will definitely be a hit in Ohio, where BrewDog’s 100,000-square-foot brewery will bring hundreds of much-needed jobs.

The company plans to invest $30 million in its U.S. brewery and headquarters. By year three, it will be capable of making 852,000 barrels per year. That’s roughly 272 million 12-ounce beers.

BrewDog USA’s “campus” will have a pub, visitor center and restaurant. You can see BrewDog’s official page about the new HQ here.

The brewer is also receiving substantial tax and benefit packages from local governments.

Turning the beer business into a major success almost seems like a given. It’s possible the brewer could be a top five craft beer in the U.S. in the near future. When you factor in the restaurant business, we’re talking potential to be as big (or bigger, eventually) than Sam Adams (NYSE: SAM), which is valued at $2.3 billion.

Sam Adams, however, is doing around $1 billion in revenue per year. BrewDog has a lot of catching up to do, and this will take time.

But this is a special brand.

BrewDog has near-100% year-over-year growth in the U.K. And that’s organic growth, meaning its advertising budget is zero.

Inc. magazine even ran an article about BrewDog titled, “How to Break Out with a Marketing Budget of Zero.”

It doesn’t need ads. The beer is spreading virally on its own. That’s a rare and beautiful thing.

BrewDog’s U.S. Pub Plans

BrewDog’s plan to roll out its own craft beer bar/restaurants is another interesting part of the equation.

These BrewDog pubs are an absolute hit in the U.K. and other parts of Europe.

I checked reviews on all the major travel sites, and they’re mostly four- and five-star (on average) reviews. And they’re real reviews. (It’s easy to spot fake reviews if you know how real people type on the web.)

BrewDog U.K. did around $16 million in sales at its 44 worldwide pubs. (Remember, we’re not investing in the U.K. business.)

I think a craft beer chain is an amazing idea. And I suspect it will work even better in the U.S. than it does across the pond. So there’s potential for the company to build that into a large business… with great margins on beer it brews itself. BrewDog says it eventually plans to sell around 10% of its total beer brewed in its own pubs. This revenue will be extremely high-margin. A pint of beer produced at scale costs maybe $0.25 and retails for at least $5 in a pub.

The first pub will be on-site at the brewery. The second will be in downtown Columbus, not far from the HQ.

Shareholders will also get rewards with the deal, including…

- 5% off BrewDog restaurants

- Two free tickets to the company’s annual shareholder beer, music and food festival

- Free tours of the brewery

- 20% off company merchandise.

This is a smart move, and it’s part of why we’re recommending BrewDog USA. This company is savvy. It wants its investors to be its biggest fans and customers. And vice versa.

Of the thousands of people who are likely to invest in BrewDog USA, a good percentage will end up buying the product (30%, perhaps?). If it tastes good, and the bottle looks cool, and it has a good name, it will grow organically – without the company having to buy poor-performing mass-market TV ad spots.

See the full list of rewards here on BankRoll.Ventures.

BrewDog USA: The Deal

This round values BrewDog USA at $350 million.

I had hoped they’d price it a little lower, given that production isn’t underway yet.

I still believe it’s a good investment, even with a bit of a premium price. Sometimes in early-stage investing, it’s worth paying the premium that comes along with a proven team and true product-market fit.

Let’s look at some potential math. If BrewDog works in the U.S. like it has in the U.K so far, we could be talking about a $280 million-per-year business in five years or so. (The U.S. is five times the market size.)

It should happen much faster this time around, as leadership already knows how to scale. The team is also making a larger and more efficient facility, since they have far more access to capital. And they should have absolutely no trouble getting distribution. It’s a hot brand, well-known in the industry.

BrewDog USA has a lot going for it.

Its founders are going after a market five times the size of the one they’re winning in the U.K.

They could turn the restaurant chain into a billion-dollar business.

They hired Sam Adams veteran brewer Tim Hawn as head of production in Columbus.

The U.K. business is big – $58 million in 2015 – and growing very fast – 93% in the first half of 2016. I can’t stress enough how rare this type of organic growth is.

If it can replicate that success here (and I think it will), it’ll easily be worth more than $350 million. But you should realize going in that it will take years to grow into this valuation. There’s a strong expectation it can, but there’s always a risk.

The minimum is only $95. If you’re new to early-stage (or small cap) investing, consider taking advantage of that.

And remember, there are legal restrictions on how much you can put into these types of investments each year. (Sorry, I don’t make the rules.) Later in this issue, Andy gives some guidelines on how much you can invest. This FAQ on Wefunder has some good information as well. (Look under “How much am I allowed to invest?”) You don’t want to spend your whole yearly limit on just a few investments. There will be some early-stage deals down the road you don’t want to miss.

To invest in BrewDog, you’ll need to sign up for BankRoll.Ventures. Click here to do so: www.bankroll.ventures/deal/brewdog/.

Then click the “Login/Register” button in the upper right-hand corner.

And then proceed with the investment steps and complete your investment. I recommend using ACH transfer if it is an option. This is like a direct debit from your checking account.

Barrow’s Intense

A couple of weeks ago, you received a recommendation for Barrow’s Intense Ginger Liqueur.

This promising craft liquor company is an early-stage deal. This is a “seed” round of funding.

Unfortunately, the deal filled up faster than expected. Barrow’s decided to raise only $100K in this round.

I regret that not everyone was able to get in on this deal, and am looking forward to an upcoming piece of legislation called the Fix Crowdfunding Act. This should increase the max raise for a Title III fundraise from $1 million to $5 million and make reporting requirements less of an issue so that quality companies like Barrow’s won’t have to cap their rounds at $100K.

We may also get another crack at Barrow’s in its next round.

I spoke with the founder, Josh Morton, recently, and he is fired up by the vote of confidence. If and when the company does another round of equity crowdfunding, First Stage Investor members should get first dibs.

Master the System, Beat the Crowd: What You Need to Know About Private Investing Portals

By Andy Gordon, Co-Founder, First Stage Investor

Some people take to online investing like fish to water. And other people…

Well, not so much. It feels more like a chore – like they’re never going to get used to it.

Sort of like how I felt when I took scuba diving lessons with Cecily, my wife. She took to it like, well, a fish to water. And me, well, terra firma never felt so good as it did after a scuba diving session.

My objective today is to make you feel as comfortable as possible using the startup websites – also called portals – to invest.

I’m not going to say, “I’ve done it, it’s fun, go ahead and give it a whirl. You’ll love it.”

That’s like Cecily telling me, “Andy, I have fun scuba diving, so why can’t you?”

But, between you and me, I have a lot more fun making online investments than I do scuba diving.

Maybe – just maybe – you’ll enjoy it almost as much as I do.

Two Portals to Know

I’ll be talking to you about two portals. There are many more – a good dozen, if you’re counting.

But right now, two loom as the most important and most established. Both offer high-quality startup deals and plenty of choices on their sites.

That’s the main thing they have in common.

But they go after different groups of startups.

One portal, Wefunder, features companies raising under rules limiting startups to $1 million per year. These rules are sometimes called Reg CF rules.

The other portal, SeedInvest, features companies raising under “mini-IPO” rules that allow them to raise as much as $50 million.

We consider both to fall under equity crowdfunding, but it’s early in this market, so the terminology varies.

Size Determines the Portal

This distinction between the two portals is one of the most important things you should know.

As companies get older… and grow bigger… their funding also needs to get bigger.

Just starting out, companies can get by with a small raise – let’s say about $500,000 to $1 million. That fits perfectly into what the Reg CF rules allow.

As I said, that’s Wefunder’s territory. These companies are typically raising their seed rounds – usually their first or second round.

But once companies have more time to grow, their financial needs outgrow the million bucks Reg CF rules allow…

One million dollars doesn’t get you far when you have a dozen employees… you want to hire four more… and you’re thinking of scaling. These startups want to raise multiple millions.

Typically, companies raise money exceeding $1 million in a later round – Series A – which comes right after seed rounds.

That’s where SeedInvest comes in. There, companies can raise up to $50 million.

How Much You Can Invest

We’ve given you five recommendations so far. Can you tell just by the amount they’re raising which website they raised on?

- Virtuix: $10 million to $15 million target

- DSTLD: $6 million target

- 8tracks: $11 million target

- BrewDog: $50 million target

- Barrow’s Intense: $50,000 to $100,000 target.

If you said that the first four are “mini-IPO” raises because they’re all more than $1 million, congratulations. Three of these four can be found on the SeedInvest site.

The fourth – BrewDog – is targeting the mini-IPO limit of $50 million. That’s why it’s on another site that specializes in “mini-IPO” raises, BankRoll.Ventures.

If you said that Barrow’s Intense is raising on the Wefunder website, you’re correct. Its target is $100,000 max, well under $1 million.

Ready or not, here’s the next question: What’s the smallest amount you can invest?

Investors on Wefunder can put in as little as $50 to $100, depending on what the company raising money decides. The minimum for Barrow’s Intense is $200. It’s low, but not bottom-scraping low.

The larger raises SeedInvest does usually come with higher minimums. Virtuix had a minimum of $1,000. DSTLD – a minimum of $500. But 8tracks’ minimum is $99 – unusually low for a “mini-IPO” raise.

We’ve covered a lot of ground so far. We’re almost done. Just a couple more things.

Annual Investment Limits: It’s the Law

So how much of your income or net worth are you allowed to spend on startups each year? The rules are simple for a mini-IPO raise on SeedInvest… and a bit more complicated for ECF raises on Wefunder.

Let’s go with the simpler rules first. That would be SeedInvest and the mini-IPOs it lists.

For non-accredited investors (those making less than $200,000 a year or showing a net worth of under $1 million, personal home not included), the percentage to remember is 10%.

You can invest up to 10% of your income or net worth in startups every year. And you get to choose the larger of the two.

The Reg CF rules that Wefunder follows are more complicated and, to tell you the truth, they give me a headache. The government has made this really confusing. But we’re stuck with them, so take your time when you read what follows.

If you make up to (but no more than) $40,000 per year or your net worth maxes out at $40,000 per year, you can invest as much as $2,000 a year in startups.

And if you make more than $40,000 but less than $100,000? That puts you in another category, in which case you can invest up to 5% of your income or net worth.

And if you make more than $100,000 or your net worth is more than $100,000, you can invest up to 10% of either.

For accredited investors, there are no limits.

Information Found on the Portals

Okay, just one more thing. What information do the portals provide on their sites?

Every single company filing under ECF rules must file a Form C with the SEC. Wefunder makes that available on a startup’s page (toward the bottom).

Form C gives you basics like number of employees, type and number of shares offered, total assets, cash reserves, debt, cost of goods and net income.

Though not required, most companies listed by Wefunder also provide a “pitch deck.” It’s like a business plan but not as detailed, and the information is presented via slides. For example, the deck for Barrow’s Intense is 16 slides. Decks typically run from 12 to 24 slides.

What’s more, Wefunder tries to anticipate the questions you’d ask – like who are the startup’s customers and what makes its products unique. Wefunder then makes this Q&A available to you on the startup’s Wefunder page.

On the other hand, companies raising more money via SeedInvest have to provide more information. Reasonable, right? The more money you want, the more information you need to divulge.

Instead of a bare-bones Form C, startups must file an “offering circular.” They’re from 50 to 200 pages long. (DSTLD’s offering circular is 169 pages long, for example.) The circular provides everything Form C does and much more. Revenue, costs, assets and growth numbers are broken down. Risks are spelled out. Capital structure is detailed. Lots of good information.

It’s required reading for Adam and me. So if you don’t want to spend the time, we have your back.

Both sites require you to register with them in order to invest. Both ask how much you make and own. If you want, SeedInvest can give you anonymity when you make your investment. Wefunder does not.

Wefunder charges you a 2% fee – quite reasonable. SeedInvest doesn’t charge you anything. It makes money off the companies, not off the investors. Which means no management fees, expense fees or carried interest is deducted from your wallet.

Luckily, I don’t have to tell you everything about these two sites. Both have an FAQ section. SeedInvest’s is here and Wefunder’s is here.

We know both sites well. We’ve met the founders of both. They have our phone numbers and we have theirs. We talk a lot. (See our conversation with Wefunder’s Mike Norman that accompanies this article.)

So this I can say with certainty: They want to give you the best experience possible. So let us know what you like and don’t like, and we’ll pass it on. Email us at mailbag@earlyinvesting.com.

And yes, last time we talked to Mike (president of Wefunder) and Ryan Feit (CEO and co-founder of SeedInvest), they asked us to ask you for feedback.

Mission accomplished.

“Big Inspirational Ideas”: An Interview With Wefunder’s Mike Norman

Written by Adam Sharp

Mike Norman, founder of the equity crowdfunding portal Wefunder, was instrumental in opening up private investing to everyday investors. Adam has been in touch with Mike for a while. Back in June, they had a conversation about the finer details of ECF. Here’s an excerpt from that conversation.

Adam: This is a brand-new market. How has the response been so far from new users?

Mike: Well, for us, we have done more investments from unique investors in the last four weeks than over the last four years of the company combined. In terms of unique investors that we serve, we are seeing a lot of folks come in and make these first-time investments, which is really exciting.

I think that is a big testament to the interest out there. Companies that tend to do well are ones with the really big inspirational ideas.

Adam: There are limits to how much one person can invest in Regulation Crowdfunding deals annually. Who is responsible for keeping track of that?

Mike: The portals are responsible for making sure that individuals know what their limits are so that they don’t invest more than that.

Adam: How do you determine income for those purposes? Is it self-reported?

Mike: It is all self-reported. We have a calculator that shows investors what their limits are based on their income and net worth so they don’t go above them.

Adam: I know there are some restrictions on how companies can market these deals. Can you explain?

Mike: They can definitely reach out and say, “Hey, we are raising money. Want to come look at this page?” They can’t talk about the offering anywhere outside of the actual fundraising page on our site. They can talk about general business information that does not pertain to the offering itself and then mention that they are raising funds.

Adam: And you cannot decide which companies appear on your portal?

Mike: That is correct.

Adam: So as long as they comply with the rules, you pretty much just have to act as a conduit.

Mike: Yes. Exactly. Unless there is some kind of warning sign – say, fraud. If there was fraud, we would be obligated not to put them up.

Editor’s Note: If you’re interested in reading our entire conversation with Mike, here’s the link right here.

This month’s special guest is Patrick Little, a contributing editor and researcher for First Stage Investor. Patrick works closely with both me and Andy and shares a passion for equity crowdfunding.

What Keeps the Buzz Going? A Look at a Brewing Success Story

By Patrick Little, Contributing Editor, First Stage Investor

I’m sure you’ve noticed the common theme to the recommendations in this month’s First Stage Investor: Both companies make one-of-a-kind alcoholic beverages.

And while Adam and Andy are excited about both BrewDog and Barrow’s Intense, the boozy thread that ties the two together was pure coincidence.

Having worked on Early Investing for the last year, I know the mission of First Stage Investor is to direct readers to the best equity crowdfunding deals out there, not to promote one industry or another in each issue.

But, if recommendations in one issue happen to fit into a theme… well, we’ll drink to that.

Coincidence notwithstanding, Adam and Andy thought it seemed appropriate to look at another private booze maker that has been successful, and to consider if their recommendations are following a similar blueprint.

They tapped me for the job, and I gladly accepted. I like to consider myself a beer connoisseur, having frequented many craft beer festivals and visited many craft breweries during my time.

To be sure, BrewDog and Barrow’s have quite different stories. BrewDog, the wildly popular Scottish brewery gearing up to hop the Atlantic, is generating some serious buzz in the United States. The brand-new brewing facility in Columbus, Ohio, is set to be operational later this year. Once that happens, there’s no telling how successful this company could be.

Barrow’s, on the other hand, is still just getting started. You likely noticed this just based on the deals these companies are offering ECF investors; they’re quite different.

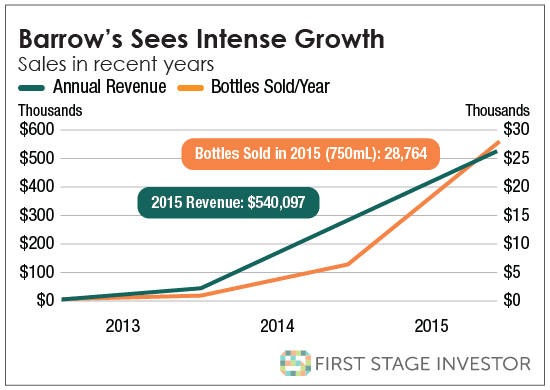

Based in Brooklyn, Barrow’s has seen its sales figures grow steadily since 2013…

According to Barrow’s, the fast and explosive growth still to be seen comes down to three words: Just taste it.

New Belgium: The Model to Follow

New Belgium is an example of a private brewing success story. It’s a story both BrewDog and Barrow’s seem well on their way to mimicking, each in their own way.

For those unfamiliar, New Belgium is – depending on who’s counting – the third- or fourth-largest craft brewery in the United States.

Most famous for its signature Fat Tire amber ale, New Belgium has at least a dozen beers available for purchase year-round. Additionally, it has several seasonal offerings and is constantly tinkering with new recipes and rolling out exceptional new flavors.

The company can be traced back to 1988.

Jeff Lebesch, an electrical engineer, went on a biking excursion in the Belgian countryside. Along the way, he was taken by the diversity of beers at the Belgian alehouses he visited. They were much more interesting and complex than the standard mass-produced, watered-down lager he had grown accustomed to.

Soon, he wanted to know all about the artisan process of crafting these different styles of beer…

Upon his return from Belgium, Jeff had a vision. He wanted to create a world-class beer with integrity that consistently exceeded consumers’ expectations… all while fostering a vibrant culture that was socially and environmentally conscious.

Quite a lofty goal, wouldn’t you say?

In 1991, New Belgium Brewing Company was officially born. Jeff and his wife Kim Jordan began bottling Fat Tire and a Belgian dubbel beer called Abbey in their basement.

From there, the operation grew steadily.

In 2014, the company sold more than 945,000 barrels worth of beer. That’s roughly 310 million 12-ounce bottles of the good stuff and a remarkable 20% increase from the previous year.

Growing demand forced the company to expand operations. It opened a second facility in Asheville, North Carolina, just last year.

Several years ago, I visited New Belgium’s headquarters in Fort Collins, Colorado. It’s a funky place run by weird and interesting people who are passionate about craft beer.

Employees have an unparalleled devotion to New Belgium. It’s partly because they love the beer, but mostly because they become owners in the company after one year of employment.

All things considered, New Belgium’s success can be attributed to two things: the quality of its product and an unwavering devotion to Jeff’s founding vision.

Next in Line

When looking at BrewDog, the fiercely independent beer maker we’ve recommended for this issue, it’s easy to see some strong parallels with New Belgium.

First and foremost, each company has a signature brew.

For New Belgium, it’s Fat Tire.

BrewDog touts its Punk IPA as the company’s “scene-stealing flagship… that has become a byword for craft beer rebellion; synonymous with the insurgency against mass-produced, lowest common denominator beer.”

Each company is devoted to its unique ethos and culture, which, along with tasty beer, is a bedrock of success.

New Belgium crafts beer in deference to the great Belgian brew masters. Meanwhile, BrewDog crafts beers to, in a sense, throw the Molotov cocktail at the beer-drinking establishment. As different as these premises may seem, both are focused on enhancing the beer-drinking experience for customers.

Even more so than BrewDog, Barrow’s story is still being written.

It is, of course, not a beer company. It makes liquor.

However, similar to New Belgium, a pillar of Barrow’s success is the quality and integrity of its ingredients. “No extracts, no chemicals,” Barrow’s says on its website, “just lots and lots of fresh Ginger.” That’s with a capital “G.”

Again, the Barrow’s success story will come down to three words: Just taste it.

That’s what it’s all about.

A Toast to Future Success

So what makes a booze maker succeed? A nifty story? Or superior taste?

Barrow’s and BrewDog have both. You don’t have to choose.

An Interview With Mark Lynn, Co-Founder of DSTLD

Mark Lynn is the Irish-born co-founder of DSTLD, the LA-based startup that designs and manufactures luxury jeans. Mark is no stranger to the startup world. He launched his first startup as a teenager, and his passion and expertise only grew from there. By his mid-20s, Mark had his hand in more than a half-dozen startups. He co-founded Club W, an e-winery that has become one of the biggest wineries in the U.S. Andy Gordon recently chatted with Mark to get the inside scoop on DSTLD.

Andy: DSTLD isn’t your first rodeo, is it?

Mark: I started young. While attending high school, I sold my first startup. I didn’t make a lot of money. But I was 17 at the time. It sure seemed like a lot. And it hooked me. Since then, I’ve tried my hand at several startups. Sports clubs. Media software. Payments solutions software. Real estate. A boutique hotel. And – can you believe – a pizza chain. All of this by the age of 26, by the way. I’m also the co-founder of the fastest-growing e-winery Winc, formerly known as Club W.

Andy: I’m impressed. You didn’t mention university though.

Mark: No. I started university in Colorado. I lasted all of six credits. It wasn’t for me. Later on, I did end up taking classes from Harvard Business School’s Executive Education program.

Andy: How did you end up with DSTLD?

Mark: The other founder, Corey Epstein, was a high school buddy of mine. We lost touch with each other for a few years, then reconnected completely by accident. We were on the same flight. I thought how he was positioning DSTLD made so much sense to me. I started as an advisor to the company and then joined Corey as a co-founder six months later.

Andy: Tell me more about how he was positioning DSTLD, if you don’t mind.

Mark: Sure. He told me jeans are unnecessarily expensive. High-quality jeans are hard to make, but a lot of the price consumers pay goes to the middleman retailer. Cut that out but keep quality very high and you have something very different and attractive to offer customers.

Andy: Makes sense.

Mark: That’s the basic idea. But it has all these other cool things. Like doing all the design in-house. Creating a great online platform. And keeping a finger on the pulse of all the real-time data you’re generating. On a daily basis, you know which products are hot and which are fading.

Andy: And DSTLD has been able to execute on all these cool ideas?

Mark: Absolutely. It doesn’t hurt that we’re based in LA. We have access to the best denim fabric, the best washhouse… and we hired awesome designers. They were local. And we’ve kept our costs low and passed on enormous savings to the customer.

Andy: So what’s your biggest challenge at this point?

Mark: Becoming truly sustainable. A big part of that will be increasing our customer lifetime value. We’ve already come a long way. Less than a year ago, we were at $100. Now we’re doing about $180. When we hit $200, we’ll have the margins to generate increasing profits as we expand. We’re not far off.

Andy: No, you’re not. Any other big challenges awaiting you and Corey?

Mark: Expanding beyond our jeans product line. It’s key. Eventually, we expect only about 25% of our revenue to come from our jeans products.

Andy: Any progress so far?

Mark: Great progress. We’re offering leather jackets, men’s belts and sunglasses. Our biggest success so far has probably been the T-shirts we introduced just last month. We’ve already sold 2,000. We were hoping to do that in three months, not one. So we’re off to a promising start in our product lines.

Andy: Any last words?

Mark: We’re also seeing revenue pick up quite a bit. We think investors getting our shares now are getting a pretty good deal. I know what growing a startup and making it into a success feels like. And I’m feeling very confident about DSTLD.

Andy: Thanks, Mark. I happen to agree with your assessment. And I also know what a successful startup looks like!

Editor’s Note: We made our recommendation of DSTLD available to members beginning August 3. But if the recommendation slipped through the cracks, or if you need to refresh your memory, you can read our full report on DSTLD right here. The company is currently raising on SeedInvest. In our report, we tell you exactly what you need to do to make an investment.