In America, we value youth and wealth. We’re afraid of getting old, and we’re afraid of dying poor. It’s why we end up reading terrifying headlines like “Clinic to Offer ‘Young Blood’ Transfusions.”

It’s only natural that the intersection of these cultural values results in powerful narratives about people who are both young and successful – “wunderkinds.”

People like Bill Gates, who was just 20 when he started Microsoft. Or Steve Jobs, who was only 21 when he co-founded Apple. Or Mark Zuckerberg, who co-founded Facebook in his college dorm room. (And who was portrayed in The Social Network as a “punk genius billionaire.” He did not like that.)

Investors are always looking for the next Apple or Facebook or Microsoft. And for good reason! Everyone wants to hit it big with investments like those. But it’s not good to get hooked on one compelling story – the business wunderkind – if it makes you blind to other success stories.

Youthful enthusiasm certainly has its advantages. But it’s not everything.

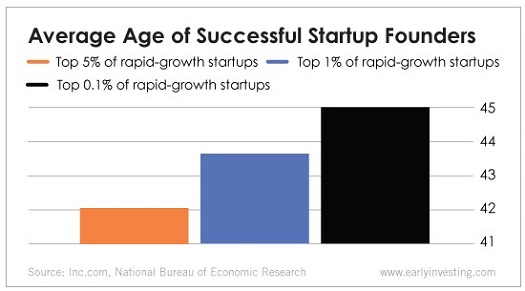

In fact, research from the National Bureau of Economic Research (via Inc.) has found that the average age of a successful startup founder is about 42. When looking at the top 5% of high-growth startups, researchers found the average age was slightly older, at 42.1. For the top 1%, the average age was 43.7. For the top 0.1%, the average age was 45.

It makes sense. With age comes experience. Early Investing Co-Founder Andy Gordon, for one, would agree:

One of these days, a millennial who has the acumen, maturity and experience of somebody twice her age will convince me her startup is investment-worthy. That day hasn’t come yet… I prefer 30 years or older to the 20-somethings. The founders of LinkedIn would fit the bill nicely. They averaged 36 years old. The founders of Facebook and Google would have been too young, so my rule isn’t foolproof. But the stats bear me out. The average age of “unicorn” founders when they began their startups was 34.

Investors, take note: Everything a startup does – its marketing, its sales, its branding, its business plan, its execution – depends on its team. When you dig into a startup’s numbers and start to consider making an investment, talk to its founders. Grill them about market need, product-market fit, scalability, growth prospects and hiring.

Are they addressing a real need? Do they have a solid business plan? Do they have the entrepreneurial chops to execute?

Management is a critical component of a startup’s success, so getting to know the founders is an integral part of an investor’s due diligence.

Don’t fixate on a select few Mark Zuckerbergs. And don’t dismiss founders with more years – and experience – under their belts.