During the first few years of bitcoin’s existence, its users were largely libertarians and cryptography enthusiasts. People who believed in the idea of an independent currency secured by a unique cryptographic solution.

Of course, there has always been a portion of its base consisting of speculators and investors. And I bet most of its early true believers would admit they also like the price appreciation that comes as adoption grows.

Over the last year, however, things have changed. Bitcoin is suddenly a $109 billion entity. That number represents the market cap (the total value of all coins in circulation today). You get that $108 billion by multiplying the current number of coins (16.7 million) by today’s price ($6,522 as I write).

The New York and Silicon Valley money crowds have officially taken notice. Many of them started out simply drooling over the returns. But a portion of them have fallen in love with the underlying idea and tech.

The result is an ongoing explosion in the number of funds dedicated to investing in cryptocurrencies (what I like to call “crypto”) and tokens.

CNBC’s Brian Kelly recently said that about 70 crypto hedge funds have recently launched at a “frantic pace.”

One of those funds is Kelly’s own Digital Asset Fund. I happened to meet one of the investors at a conference, and he seemed very pleased with the fund’s performance thus far.

AngelList founder Naval Ravikant co-founded one of the first crypto hedge funds in 2014, called MetaStable.

Naval is one of the best angel investors on the planet. He invested in Uber in its first round when its valuation was about $5 million. That’s just one of his many great early-stage investments.

MetaStable raised $60 million in a year when the price of bitcoin ranged from $770 to $300. So I’d imagine it’s doing quite well…

And now billionaire Mike Novogratz has announced a $500 million fund dedicated to investing in crypto.

As reported by Bloomberg…

“With a $500 million hedge fund, Novogratz will be able to capture trading opportunities that require more scale, as well as wield influence with developers, entrepreneurs and regulators. Of course, he’ll also make money on other people’s money: The person familiar with his fund, who has seen early versions of marketing documents, said it will charge investors a 2% management fee and 20% of profits, with a two-year lockup.”

Novogratz made a killing in cryptocurrency when he first bought $500,000 worth of Ethereum at less than $1. As I write this, it trades around $331. The trader told Bloomberg that he’s taken $250 million in profits so far.

Three of the premier venture capital firms in the world – Sequoia, Union Square Ventures and Andreessen Horowitz – are also investing heavily in the space. To say this is the smart money would be a bit of an understatement.

All of this interest from sophisticated investors has caused the price of bitcoin to rise from around $1,000 at the start of this year to a recent peak of $7,400.

And while all the new hedge funds have brought more institutional interest in cryptocurrencies, we’re still talking small time here.

Let’s compare the size of bitcoin ($100 billion) to some other common investments:

• Ethereum: $31 billion

• Alphabet (Google) market cap: $698 billion

• S&P 500 companies’ combined market cap: $23 trillion

• Total estimated U.S. household wealth: $96 trillion.

With the total cryptocurrency market valued at around $208 billion today, we’re talking about a small drop in a very large bucket.

The vast majority of financial institutions can’t even buy cryptocurrency because it’s not a recognized security. It would go against their charters, which put restrictions on the types of assets they can purchase.

Bitcoin ETFs would give the entire financial world a simple way to buy in. These have been in the works for more than three years, but the SEC has thus far rejected them.

Most recently, it denied the Winklevoss Bitcoin ETF in March 2017. It should be noted that Dalia Blass has been tapped to head the SEC’s Division of Investment Management, which regulates – and approves or disapproves – ETFs. She also happens to work for the law firm that represents the Winklevoss twins… so there’s hope.

I’m not sure how much longer regulators can stall on the issue. With bitcoin volume surging to more than $2 billion per day this year, the demand is clearly there.

Tyler Winklevoss said his team is committed to bringing the fund to market…

“We remain optimistic and committed to bringing the Winklevoss Bitcoin ETF to market, and look forward to continuing to work with the SEC staff. We began this journey almost four years ago, and are determined to see it through.”

If they succeed, the implications for bitcoin would be substantial. This would provide a way for every investor and money manager to buy bitcoin from their retirement or brokerage account. Demand would skyrocket overnight.

There is already one publicly traded option: the Bitcoin Investment Trust (OTC: GBTC). But I don’t recommend it. It trades at a huge premium to the price of bitcoin (which once again shows that the demand is there).

If you don’t want to purchase crypto directly from an exchange (which I recommend), there is a much better way to go about it…

Bitwise’s Bitcoin ETF Alternative

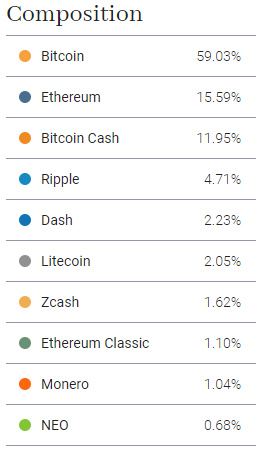

Bitwise aims to be the “Vanguard of cryptocurrency.” The financial technology (fintech) startup just revealed its first investment product, the HOLD 10 Private Index Fund. It’s a basket of the top 10 cryptocurrencies by market cap…

As you can see, this fund invests in a nice basket of crypto, with more than 59% of it in bitcoin. The diversification in other coins helps spread risk but still gives sizable exposure to bitcoin.

Co-founder Hunter Horsley told Coindesk…

“We want to create a meaningful and secure way to own a portfolio of cryptocurrency. We feel that, today, it’s too hard and it’s too expensive.”

The company plans to charge 2% per year, with no additional fees. That’s a bargain compared to most crypto hedge funds, which take at least 20% of profits, plus 2% annually.

Bitwise has attracted notable Silicon Valley investors, including Ravikant.

For now, the HOLD 10 fund is available only for accredited investors. This is likely due to the fact that the SEC hasn’t approved any bitcoin ETFs yet, but I fully expect Bitwise to go after the broader market eventually.

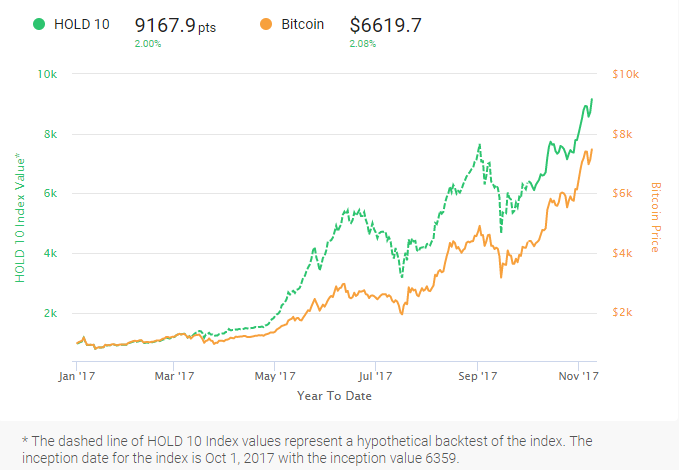

And the performance numbers look promising…

In a back test, the HOLD 10 Index had a higher return, better Sharpe ratio and lower volatility than bitcoin had. And I like that the fund is passively managed. Having the market determine the fund’s crypto weighting is better than some “expert’s” guess.

Bitwise is one startup I am excited about and am keeping a close eye on. And there are more on my radar as well.

Investing in Cryptocurrency Startups

Most cryptocurrencies are decentralized, meaning they don’t have a corporate entity that one could invest in.

A typical cryptocurrency such as bitcoin is governed by its users, miners and usually a nonprofit foundation.

So there’s no way to invest in bitcoin as a company. You can buy coins, but there is no stock or equity.

However, there is a dynamic and fast-growing community of private businesses (like Bitwise) being built around crypto today.

If crypto continues to take off, these companies could be the financial giants of the future.

I’ll tell you about a few of the crypto startups I’m watching, and why I’m excited about the increasing number of these companies using equity crowdfunding.

Coinbase

Founded by Brian Armstrong in 2012, Coinbase has grown exponentially to become the world’s largest cryptocurrency exchange.

With 10.8 million users and 36 million wallets, Coinbase is a force in the crypto community.

Coinbase has processed more than $25 billion in transactions in 2017, according to a Fortune article published in August. It also offers crypto payment processing tools for roughly 40,000 merchant accounts.

The company just announced a $100 million round of funding at a $1.6 billion valuation. Investors in its latest round include top venture capital firms IVP, Greylock and Spark Capital.

This August fundraise made Coinbase the first crypto “unicorn” startup (one that has grown to a $1 billion-plus valuation). Its earliest investors include members of FundersClub, an online investment platform for accredited investors.

The company’s explosive growth has caused some growing pains, however, and Coinbase is struggling to keep up with customer service inquiries. U.S. laws dictate that it follow certain rules designed to prevent money laundering, and partly as a result, the company’s pipeline is clogged.

The good news is it appears to be putting the new round of capital to good use, having recently launched phone support for users. If it can overcome these issues, Coinbase is well-positioned to become a dominant financial institution in this new market.

Bittrex

Bittrex is a fast-growing and disruptive cryptocurrency exchange.

The biggest difference between Bittrex and Coinbase is the number of digital currencies they offer.

Coinbase offers three: bitcoin, Ethereum and Litecoin.

Bittrex allows users to trade 200 different cryptocurrencies, including all the top ones offered by Coinbase. The other 197 “altcoins” are what really set Bittrex apart.

Altcoins have exploded in popularity over the last year, as the price of Ethereum rose from less than a dollar in 2016 to $294 today, giving it a $27 billion market cap.

On Bittrex, users can search for the next big opportunity. Many of the coins on this exchange are tiny, with market caps in the low millions.

Bittrex also offers a flat trading fee of 0.25%, while the fees on Coinbase vary and tend to be higher.

The one drawback to using Bittrex is that you can’t buy coins directly with dollars or other fiat currency, as you can on Coinbase.

Still, it’s a great example of a disruptive startup shaking up the incumbents of a new industry. By offering users a much wider selection of alternative cryptocurrencies, Bittrex is gaining ground on crypto powerhouse Coinbase.

Bittrex’s founding team has deep experience in web security, having worked at Amazon, Blackberry and Microsoft.

With a talented team, great tech and impressive growth, Bittrex is definitely a crypto startup to watch.

Crowded Startup Pipeline

We’re just beginning to see how transformative and disruptive the crypto market can be.

An entire ecosystem of new financial technology is being created. This sort of thing doesn’t happen very often, to say the least.

Many crypto startups will launch over the next few years, and some are likely to become the fintech titans of tomorrow.

We’ve already started to see a few high-quality crypto deals utilize equity crowdfunding.

Just last month we recommended one to members of our research service, First Stage Investor. It’s called Balance, and it’s building a user-friendly financial dashboard app that tracks not only your traditional financial transactions, but your crypto ones too. Soon users will be able to buy and sell cryptocurrencies directly through its app, and many more features are in the works.

The deal was quite popular, and it filled up after the company raised the maximum allowable $1.17 million. With a focus on simplicity and ease of use, Balance is well-positioned to help bring crypto to the mainstream.

Balance is among the first crypto- and blockchain-related startups to utilize equity crowdfunding, and it certainly won’t be the last.

I can’t reveal any details yet, but developments are coming that will merge the equity crowdfunding and crypto worlds in ways I couldn’t have even imagined a year ago.

But there are other opportunities I am excited about right now…

Today’s Biggest Profit Opportunity

I’ve been a crypto trader for years. And what’s going on right now in digital currencies is absolutely crazy.

I bought into Ethereum at less than $10… before it jumped to $355.

I got in on Antshares at $1.50. Then it jumped to $10.71.

And I obtained 27,000 coins in another digital currency for just $0.185 apiece.

Those coins trade at more than $4 each.

It’s not to brag about my personal winnings, but rather… because this has got to be one of the most exciting and unusual profit opportunities in the history of the markets.

I have put together a free presentation detailing this whole opportunity, and three digital currencies that I believe are the next to ignite.

You can watch it free of charge here.

Good Investing,

Adam Sharp