Real estate is the oldest asset class in the world . It’s also one of the most appealing. Land provides income, capital gains and practical value to its owner.

But that doesn’t mean it’s a perfect investment. Problems like illiquidity and overregulation have long restricted this asset class to the wealthy. And as we all learned from the housing market collapse of the late 2000s, land can be overvalued.

Today, a growing group of entrepreneurs is working to solve these problems. And they’re using the power of the world’s youngest asset class – cryptocurrencies – to do it.

Blockchain real estate projects are democratizing the real estate market. They’re using crypto technology to bypass unnecessary middlemen, intrusive governments and inefficient pricing systems.

In the process, they’re making land ownership accessible to regular people. And they’re creating new cryptocurrencies with huge amounts of upside.

Before we reveal our top three blockchain real estate tokens, let’s look at some of the problems these bold new cryptocurrencies are solving.

What’s Wrong With the Real Estate Market?

The purchase, sale and ownership of land has always been a tricky business. That’s because a real estate market depends on a reliable set of records of who owns what.

In fact, some of the oldest known written documents are land transfer records. This one from the ancient city of Sumer is over 5,000 years old…

Real estate markets could not exist without detailed record keeping. But this record-keeping process can also be a hassle.

In order to buy a house, you (or a title company) has to go to the local courthouse and find the current owner’s title to the house. Then you have to pay any outstanding debts on the property (plus taxes and administrative fees), complete the transaction and file a new title.

This is an unnecessarily lengthy process that involves several fee-collecting middlemen. That’s why real estate is so illiquid compared with other assets. Stock investors can buy or sell fractional shares in a business with a few clicks of a mouse. But real estate investors may have to wait months to complete a single transaction.

What’s more, you can’t buy or sell a fraction of a house without a cumbersome timesharing agreement. So the only people who can invest directly in real estate are people who can afford it.

Real estate investment trusts (REITs) might seem to solve this problem, but REIT investors are just trading shares of a holding company – not shares of the real estate itself.

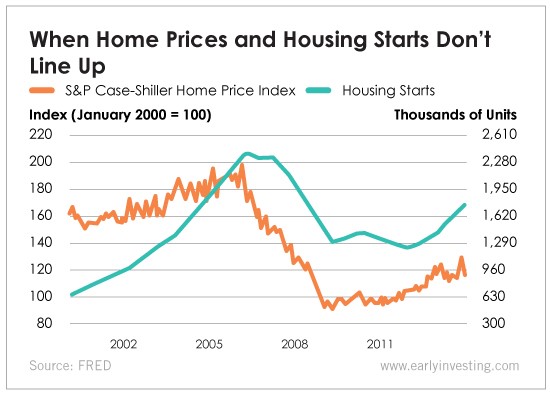

This illiquidity leads to inefficient and inaccurate pricing. Nobel Prize-winning economist Robert J. Shiller argues that this is how 2007-style housing bubbles form.

When prices go up, people build more houses. But due to the inefficiency of the real estate market, prices are slow to come back down in response to the increased supply.

Eventually, this leads to a situation where the number of pricey new houses exceeds the number of willing buyers – and then the market crashes.

In sum, there’s a lot wrong with our society’s current method of buying and selling real estate. That’s why a new generation of entrepreneurs and blockchain experts is trying to find a better way.

How Blockchain Technology Can Democratize Land Ownership

As we mentioned earlier, the reason why real estate markets are so complicated and illiquid is because of the painstaking record-keeping process that must accompany each transaction. This record-keeping process runs through the government, which isn’t exactly known for efficiency.

But in the last few years, a faster and higher-tech alternative to the county courthouse has emerged: the blockchain.

For readers who may not be familiar with it, the blockchain is a public, tamper-proof digital ledger that records the ownership and transactions of virtual tokens. It’s the technology behind cryptocurrencies like bitcoin and Ethereum.

Blockchain technology has lots of uses beyond currency speculation. In fact, its transparency and immutability make it ideal for keeping track of real estate titles.

By creating secure digital records of ownership that anyone can see, blockchain real estate tokens can bypass all the middlemen currently required to buy property. They could make title companies, real estate brokers and even county courthouse records obsolete.

And perhaps most importantly, real estate blockchain tokens would make partial ownership of property possible without a timesharing agreement. This would bring real estate within reach of less wealthy investors. If two people split the cost of a house, the blockchain could simply record that each person owns 50% of the title. That’s not possible with today’s paper title system.

As you can see, blockchain real estate tokens solve almost all of the problems with the $217 trillion real estate market . They allow people to buy and sell property faster, more securely and more affordably. As a result, these tokens have tremendous upside as investments.

Let’s look at the three most exciting blockchain real estate tokens on the market today…

Propy (PRO)

What it is: Propy is an Ethereum-based blockchain platform and token for buying and selling homes. PRO tokens were issued by California-based Propy Inc. in an ICO from August 2017 to September 2017. At the time of writing, one PRO token is worth roughly $1.58.

How to buy it: Now that Propy’s ICO is over, you can buy PRO tokens on the secondary market at many popular cryptocurrency exchanges. These include www.etherdelta.com and www.hitbtc.com.

Why you should buy it: Propy holds the distinction of being the first blockchain platform to host an actual real estate transaction.

Back in September, TechCrunch founder Michael Arrington bought a $60,000 apartment in Kiev from local developer Mark Ginsburg via PRO smart contracts. Arrington was able to complete the purchase without ever setting foot in Ukraine.

The full Propy platform is still in development, but this proof-of-concept sale puts it miles ahead of many other similar real estate blockchain platforms.

Like all cryptocurrencies, PRO tokens have seen quite a bit of price volatility in the last couple of months. But they’re still up almost 100% from when they started trading…

Rentberry (BERRY)

What it is: Rentberry is an Ethereum-based blockchain platform and token for the rental market. California-based Rentberry Inc. recently issued BERRY tokens in an ICO that ended on February 28.

Rentberry is more than just a payment platform for renters and landlords. The platform features a bidding mechanic for renters to increase price efficiency. It also allows investors to crowd fund renters’ security deposits by lending them small amounts of BERRY tokens with interest.

One BERRY token equals 0.0004 Ethereum. That makes one BERRY token worth roughly $0.35 at the time of writing.

How to buy it: Unfortunately, due to legal restrictions, U.S. investors could not participate in the Rentberry ICO. Other investors, however, were able to buy BERRY tokens at www.cryptonomos.com.

U.S. investors will eventually be able to purchase BERRY tokens on the secondary market through many popular cryptocurrency exchanges.

Why you should buy it: Rentberry isn’t quite as far along in its development as Propy, but it’s targeting an even hotter part of the real estate sector: rentals.

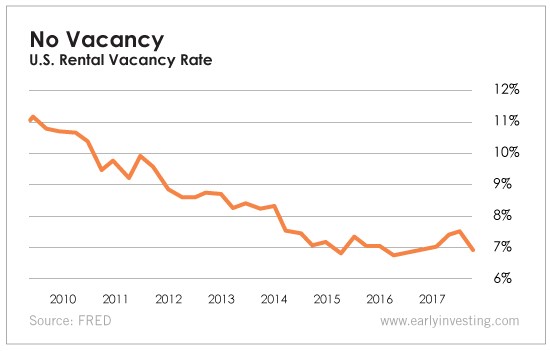

The Great Recession is almost a decade behind us at this point, but many consumers are still squeamish about buying homes. That’s why the rental vacancy rate has continued to tumble since the recession…

Atlant (ATL)

What is it: Atlant is essentially a cross between Propy and Rentberry. It’s an Ethereum-based blockchain platform for buying, selling or renting real estate. United Kingdom-based Atlant Inc recently wrapped up its ICO for the ATL token, which ran from September to November of last year.

At the time of writing, one ATL token is worth roughly $0.56.

How to buy it: Now that Atlant’s ICO is over, you can buy ATL tokens on the secondary market at many popular cryptocurrency exchanges. These include www.etherdelta.com and www.hitbtc.com.

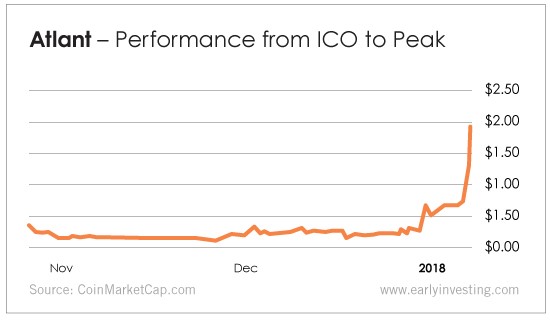

Why you should buy it: ATL tokens provide some built-in diversification within real estate blockchain, as the Atlant platform is used for both buying and renting properties. And its tokens have already shown substantial upside.

Almost all cryptocurrencies gained value in the late-2017 bitcoin boom, but the ATL token has a truly remarkable track record. It rose in value by almost 2400% in the two months after the end of its ICO.

ATL tokens have pulled back in value since then – but given the diversified nature of their platform, it’s quite possible that they’ll repeat their dazzling performance.

Good investing,

The Early Investing Research Team

P.S. 167 Times Bigger Than Bitcoin!

New digital currencies are delivering profits faster than we’ve ever seen. Find out how just $10 could hand you a fortune from a trader who’s collected wins of 600%… 1,981%… and more than 3,500%. Click here.