The largest crime syndicate in America isn’t the mob. It’s not any street gang either.

That’s because it’s all above board and legal. They own your politicians. They own the airwaves and media…

I’m talking, of course, about the pharmaceutical industry.

Companies like Pfizer, Merck and Sanofi profit from misery. They’re the largest drug pushers in the world.

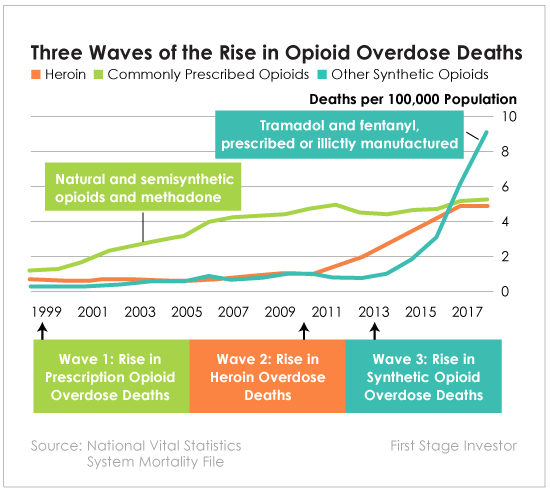

Opioid overdoses kill 46 Americans every single day. That’s nearly 17,000 people each year. The worst part is it’s all completely legal.

They even have doctors pushing their products for them. Despite all of the addiction and death, doctors are still handing out opioid painkillers like candy.

Every year since 2006, there have been more than 200 million new opioid prescriptions. Apparently the Hippocratic oath doesn’t count for much with Big Pharma’s money on the table.

The opioid epidemic is an American crisis engineered by the pharmaceutical industry. It’s a tragedy felt in both large coastal cities and the heartland.

From Dixieland to New England, from the heartland to the Pacific coast, people are suffering, and it’s the drug industry’s fault.

Opioids are just the tip of the iceberg; Big Pharma’s sins are many.

These companies have run experiments on children. They’ve threatened the doctors who refused to push their drugs… They might have gone even further than that.

That’s why I’ve dubbed them collectively “Murder Inc.”

The pharma industry is without a doubt evil. But the five companies in this report are the worst of the worst.

If you’ve got these stocks in your portfolio, ditch them. If you’re thinking of buying them, don’t. They’re unethical. And they’re financially unsustainable.

It’s time to get acquainted with the worst of the worst…

The American Outlaw

Pfizer (NYSE: PFE) has earned its place as the poster boy for evil pharmaceutical companies.

All the routine corporate abuses are there…

Pfizer routinely dodges taxes and artificially raises prices. But Pfizer is uniquely nasty in ways that only a pharmaceutical company can be…

One of Pfizer’s most popular and profitable drugs is Viagra.

The “little blue pill” is used by millions of men to maintain sexual potency into their golden years. It can also kill you.

Believe it or not, erectile dysfunction usually has very little to do with a man’s genitals. It generally means there’s a problem with his heart.

Pfizer was well aware of that fact…

But it didn’t encourage men to seek help for their underlying heart problems. Instead, it advertised Viagra through the use of dubious medical studies and semantics.

As a result, 130 men died from untreated heart disease because Pfizer had convinced them they just needed to buy its drugs. Pfizer had to put a warning label on Viagra, but it still pushes it as a cure-all for men who need a cardiologist, not a pharmacist.

It gets much worse.

Back in 1996, Pfizer ran experiments on children. A meningitis outbreak in northern Nigeria gave Pfizer the opportunity to test Trovan, its new broad-spectrum antibiotic.

The company sent a team to Kano, a small town on the edge of the Sahara. The team took over a hospital and treated 100 meningitis-stricken kids with Trovan.

Of the 100-child test group, only five survived.

That’s a 95% death rate compared with the 20% death rate of completely untreated meningitis. Yes, Pfizer actually managed to make meningitis deadlier.

The Trovan team packed up and left. It had its data. And it left behind dozens of broken families to bury their children.

It took until 2009 for the company to finally quietly settle a case later brought against it. Pfizer paid out $75 million in the civil suit. But that’s barely a slap on the wrist for a $235 billion company.

Unsurprisingly, Pfizer is still causing trouble. In 2015, Pfizer bought Hospira. The company was a large manufacturer of generic sterile injectable drugs – everything from saline solutions to vital anesthetics for childbirth.

These generic sterile injectable drugs are the most common pharmaceuticals used in hospitals.

And somehow, Pfizer screwed the pooch. Since 2015, poor conditions in Pfizer’s facilities combined with some regulatory overreach has created a shortage of 102 vital drugs that will continue into 2020.

Pfizer promised to remedy the situation by 2019.

To top it all off, Pfizer isn’t just an evil corporation to invest in. It’s also a foolish one to put your money into.

Like many Big Pharma companies, its business model of constantly pursuing the next big drug patent has Pfizer up to its eyes in debt. Its patents are running out of time, and its promises of new drugs have yet to materialize.

The company carries $41.74 billion in debt, dangerously close to its yearly revenue of $53.6 billion. Some analysts have classified it as a “zombie stock.” We can only hope someone puts this shambling corpse down before it hurts more people.

The German Import

There was a time not so long ago that Merck (NYSE: MRK) was considered a model company.

Since the company split from its German parent after World War I, it’s had a sterling reputation. It was considered the model pharmaceutical company.

But the public perception surrounding Merck was wrong.

The well-publicized Vioxx scandal opened many eyes. I’ll get to that, but the company was negligent at best – and downright evil at worst – long before that.

Back in the 1960s, Merck managed to push an arthritis treatment called Indocin through the FDA even though it hadn’t adequately tested its safety.

In the 1970s, Merck was among dozens of pharmaceutical companies sued by women who developed vaginal cancer from diethylstilbestrol (DES). It was known that DES caused cancer in animals. But Merck sold it anyway.

And, of course, there was the Vioxx scandal. That’s when Merck’s mafioso behavior came to light.

Through a network of compliant and corrupt doctors, a heavy advertising budget, and good honest intimidation, Merck pushed an arthritis drug called Vioxx onto the market.

Vioxx hit the market in 2001 and quickly started killing people. The drug had a high likelihood of causing heart attacks. Merck knew that well before it pushed it to the market.

That’s why the company issued an internal “hit list” of 36 doctors who criticized Vioxx. The list detailed doctors to be “neutralized.”

Despite the company’s best efforts to intimidate doctors and flood medical journals with pro-Vioxx propaganda, the truth came out.

From 2002 to 2004, there were numerous studies done on Vioxx. All of them pointed to the drug’s link to cardiovascular problems.

Mounting pressure and a mountain of lawsuits finally convinced Merck to take Vioxx off the market in 2004.

In 2007, Merck paid out $4.85 billion to settle its myriad legal battles. The cash went into a fund that’s used to pay out the nearly 50,000 individual plaintiffs and hundreds of class-action lawsuits.

While that amount is nothing for a $208 billion company, Merck is in much the same fiscal boat as Pfizer.

It carries $19.8 billion in debt. And that number grows every year. That’s almost as much as the company makes in profit from pharmaceuticals.

The business model these companies are operating on is completely unsustainable. And it makes them bad investments. Especially as the cannabis market begins to disrupt Murder Inc.’s stranglehold on our health and well-being.

The French Connection

The next member of Murder Inc. lives in Paris but has a long reach…

Sanofi (Nasdaq: SNY) makes treatments for a variety of infectious and cardiovascular diseases, myriad vaccines, and, most importantly, insulin…

Sanofi is one of three companies that control more than 99% of the world’s insulin market.

Synthetic insulin isn’t a new drug, though.

Modern, injectable insulin has been available to the public since 1922. Its creators sold the original patent for just $1. They believed it should be available to all.

Unfortunately, the University of Toronto couldn’t manufacture insulin fast enough. And Eli Lilly and Novo Nordisk were able to buy the rights and create a duopoly.

Sanofi entered the market later with its own insulin. In fact, Sanofi’s Lantus is America’s leading insulin.

Still, insulin remained fairly cheap for most of the 20th century. In the past 20 years, however, the price has more than tripled.

Eli Lilly, Novo Nordisk and Sanofi all collaborated to jack up the price of insulin. As a coldhearted business move, it makes sense. New cases of diabetes, particularly Type 2, have skyrocketed in developed nations.

But insulin isn’t something you can go without. People have died as a direct result of these companies’ profiteering.

At the height of the insulin price hikes, one carton of Lantus cost $280 without insurance. In the United States’ neighbor Mexico, that same carton of insulin cost just $50.

Since then, a lawsuit from Minnesota’s attorney general and public outcry have convinced Sanofi to lower the prices of some of its insulin to just $99…

It’s still almost double the price in the U.S. than in the rest of the developed world.

Sanofi maintains its stranglehold by abusing patent law.

Sanofi’s original patent for Lantus expired in 2000. But the company has filed 74 secondary patents for the drug. If approved, the company will have a 37-year monopoly.

Unfortunately, given the rising rates of obesity and diabetes worldwide, and especially in America, Sanofi and its ilk will profit handsomely.

Most of the company’s patents are in the U.S. European authorities would have thrown them out.

With no threat of generics competing with Lantus, Sanofi will be able to continue overpricing it with impunity.

That’s the truly evil thing about Sanofi, and all of Murder Inc. for that matter. In a truly free market, these drugs would be affordable.

But Sanofi and its ilk use the government to maintain artificial control over markets that should be free.

That’s not capitalism, it’s corporatism… Murder Inc. has bought and sold enough of Congress to use the state’s power to bludgeon the competition.

These companies not only are predatory, but also are corrupting democratic governments. It’s just another reason we’re glad to see the cannabis industry taking them on.

The Menace From Montreal

Montreal’s Bausch Health Companies (NYSE: BHC) is little more than a mask worn by Valeant Pharmaceuticals. That name may ring a bell…

A few years back, there were a number of stories of Big Pharma companies buying up old drugs and jacking up the prices. Unfortunately, these stories brought Martin Shkreli’s smug smile to the fore. But his Turing Pharmaceuticals was far from the worst offender.

Valeant’s entire business model revolved around making patients choose between financial ruin and death. It was a company run by wolves in sheep’s clothing.

Valeant CEO Mike Pearson was a hedge fund manager who cloaked blatant price gouging and predatory practices in talk about helping people with more research and development (R&D) funding.

Valeant was struggling when Pearson was brought on as chairman in the mid-2000s. In 2008, he claimed that just by cutting costs, he could get Valeant’s stock to $40.

Pearson took an axe to the R&D budget, and within three years, he achieved his goal. Anyone who held Valeant stock in 2008 got a fivefold return.

Valeant also took advantage of low interest rates in the wake of the 2008 financial crisis. It was easy to take out loans, and Pearson did just that.

He bought out more than 100 companies with those loans. During his shopping spree, he merged Valeant with a Canadian company called Biovail.

Pearson was able to use its Canadian base of operations and the company’s properties in Luxembourg and the Bahamas to pull off a tax inversion of epic proportions.

The remade company had a much leaner budget. But it wasn’t making any new drugs. So what’s a pharmaceutical company to do? Buy old cheap drugs and hike up the prices – that’s what.

One of Valeant’s most notorious purchases was Nitropress. It’s an old drug. It first showed up in 1928 and is used in the treatment of high blood pressure. After Valeant bought Nitropress, it raised the price by more than 200%.

Isuprel, another drug used to treat heart diseases, was bought by Valeant at the same time. Isuprel’s price shot up 500% overnight.

Cuprimine was the worst. Cuprimine is used to treat a rare genetic condition called Wilson’s disease, which prevents the body from metabolizing copper. Without Cuprimine, Wilson’s disease is a death sentence. Valeant jacked the price up more than 5,700%.

What’s almost as bad is that Pearson was incentivized to do all of this. Most of his compensation came in the form of Valeant stock. For every company he bought out and every drug he jacked the price up on (subsequently destroying lives), Pearson saw his net worth go up.

Valeant was caught and punished and then went under. But the company has learned nothing. It changed its name to Bausch Health Companies and replaced Pearson with Joe Papa.

It’s compensating him in exactly the same way. If he can get Bausch’s share price up to the $270 it was, he’ll be sitting on a fortune of $500 million. Bausch clearly isn’t run by any fast learners.

Don’t be tempted to buy in for short-term profits, though. Bausch will almost certainly go the same way as Valeant…

Especially considering the cannabis industry’s disruption of Murder Inc.’s abusive practices.

The Demon Druggist of Hatfield

The fifth member of our Murder Inc. rogue’s gallery got its start in America, but it’s now based in Hatfield, England. Mylan (Nasdaq: MYL) is best known as the maker of the EpiPen autoinjector.

The EpiPen is usually used to treat anaphylaxis, a sudden onset allergic reaction that can kill if left untreated. People with severe allergies rely on the EpiPen. Many carry a couple on them at any given time. Schools often keep a stockpile of them too.

EpiPens and other types of autoinjectors have been on the market since the late 1970s. They were originally developed to combat the effects of nerve gas. Mylan did approximately zero percent of the work in developing the mechanism.

Before Mylan bought exclusive rights to the EpiPen in 2007, it cost about $57. Shortly after Mylan bought the rights to the EpiPen, the price was spiked up to $100. From 2007 to 2016, the price soared beyond the $600 mark.

Mylan raised the price of EpiPens primarily because it could. The company has a stranglehold on the allergy autoinjector market. It has a 98% monopoly.

Teva Pharmaceutical came close to introducing a generic EpiPen in 2016. But it was denied FDA approval.

The FDA also took another generic competitor to Mylan’s EpiPen off the market in 2016. Mylan introduced its own $300 generic EpiPen shortly thereafter.

Without any competition, Mylan has no reason at all to innovate to make the EpiPen better. Because of that, the technology has stalled and hasn’t improved at all since Mylan bought it.

Mylan certainly does have friends in the government. Heather Bresch, Mylan’s CEO, is the daughter of West Virginia Sen. Joe Manchin.

The company takes advantage of that connection and intense lobbying to pay little to nothing in taxes.

Mylan has a long history of tax dodges. Back in 2016 when EpiPen prices hit their peak, the company bought Abbott Laboratories and used it to reincorporate in the Netherlands.

While it was doing that, Mylan managed to get the U.S. government to declare it an American company. It needed to use American antitrust laws to fight a Teva Pharmaceutical takeover attempt.

But Mylan’s latest tax dodge strikes a little closer to home for its CEO. The company bought 99% stakes in five different coal processing companies between 2011 and 2016. Selling refined coal as opposed to ordinary gives your company a tax credit.

Through its refined coal sales, Mylan managed a negative 294% tax rate in 2016. Between that and the tax inversion, the company paid nothing in taxes while reaping massive profits on medicine developed by the army using public money.

Take the Fight to Murder Inc.

These five companies are the worst of the worst. There are unfortunately dozens more. Dropping or avoiding these stocks is one way to take the fight to the companies poisoning the American people.

As I’ve shown, you can’t trust the government to crack down on them. We have to do it ourselves. Murder Inc.’s days are numbered.

It might seem bleak now, as these companies are still enormous. But the rise of the cannabis industry is the first nail in Murder Inc.’s coffin.

There’s a fortune to be made from the beginning of the end for Murder Inc. You can find that in our ready-made Murder Inc. Disrupter Portfolio. Take the fight to Big Pharma while making enormous profits.