A playbook to navigate crypto markets for the next five years – and why cryptocurrency NEEDS to be part of your portfolio.

For all of crypto’s nine-year history, the market has been dominated by retail investors – people like you and me.

Professional (institutional) investors have stayed on the sidelines. And not necessarily by choice.

You see, most financial firms have a “charter” that determines what they can invest in. And almost all of those charters say they’re allowed to invest only in regulated securities and commodities.

But governments around the world have been slow to provide insight on how cryptocurrencies should be classified.

All of this is changing. And it’s changing quickly.

Regulatory agencies around the world, including the Securities and Exchange Commission (SEC) and Commodities Futures Trading Commission (CFTC), have finally begun to offer clarity on how these assets will be classified and regulated.

The head of the SEC recently said that bitcoin and ethereum are not securities and that more clarity will follow soon.

Regulated cryptocurrency custody solutions are being rolled out by major financial players like the New York Stock Exchange’s parent company, Intercontinental Exchange (ICE).

Fourteen crypto exchange-traded funds (ETFs) are awaiting SEC approval.

Institutional investors need custody solutions like these to enter the crypto markets.

The stage is set for a crypto boom, the likes of which the world has never seen. Here’s how we see the next five years playing out and how I plan to help our Members profit from it.

It Doesn’t Take Much to Move Crypto Markets

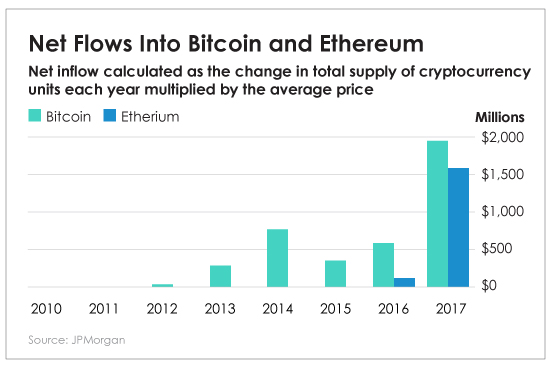

According to a JPMorgan study, the total amount invested into bitcoin and ethereum (net inflows) from 2009 to late 2017 was only $6 billion.

That $6 billion in inflows created $300 billion in market capitalization at the time. (The market cap has dropped since then.)

An injection of just $6 billion into these two assets led to massive gains. Bitcoin rose from less than $1 in 2009 to thousands of dollars today, and ethereum rose from less than $1 to hundreds today.

Here’s a chart from the JPMorgan study, showing inflows into bitcoin and ethereum by year.

What this study shows is a little money injected into crypto markets goes a very, very long way. And $6 billion is absolute chump change in the institutional world.

Why can so little money move this market so much? Primarily because a large percentage of the people who buy crypto hold on to it long term. Most of us don’t plan to sell for years or decades. On top of this, cryptocurrencies like bitcoin have a fixed supply (21 million for bitcoin). More supply can’t be created to meet demand.

Now that it’s finally becoming possible for large institutions to buy into crypto markets, we believe we’re set up for a period that will surpass 2017’s monster bull run.

Bitcoin Leads the Way

Many new crypto investors make the mistake of ignoring bitcoin in their portfolio. They’re too busy trying to find the next bitcoin.

This is a worthy goal, but we don’t recommend skipping bitcoin. Bitcoin is a fundamental and necessary part of every cryptocurrency portfolio.

Bitcoin has the longest track record, the most proven security, the highest number of developers and contributors, and the strongest brand name.

Bitcoin will almost certainly be the asset behind the first ETF, and it will be highly sought after as institutional investors enter the market.

Bitcoin plays an important role in the crypto world. It’s “digital gold,” and it acts as a reserve currency in this nascent market.

We believe bitcoin could even surpass gold in terms of total value one day. Today, the bitcoin market is worth around $119 billion. The gold market is at least 50 times larger.

Altcoins Will Follow, Eventually Surpass Bitcoin

Needless to say, we’re big bitcoin bulls. BUT money is the largest market in the world. There’s room for dozens of coins to succeed.

New cryptocurrencies are constantly rising up to challenge bitcoin. They’re finding faster, more efficient ways to transfer value over the internet. We’re certain that eventually one or more of them will succeed.

This is why we spend so much time evaluating “altcoins” – alternative cryptocurrencies.

Because altcoins are 1/100th or even 1/500th the size of bitcoin today, the upside here is enormous.

The key to making money on altcoins in the next few years is simple. Find the coins that will attract institutional investors!

As the first wave of institutional money begins flowing into crypto markets, the bulk of it will go into bitcoin and a few other “blue chip” cryptos.

Institutional investors will quickly become comfortable with the idea of owning cryptocurrencies. Once that happens, they will start seeking out the most promising altcoins.

And what institutional investors value in coins is simple: real world uses, great communities, amazing developers, sustainable tokenomics and good governance systems.

The altcoins that end up being accumulated by institutional investors will offer gains similar to the ones experienced by early bitcoin adopters. That’s why this is the focus of much of our research today.

Why You Need to Add Crypto to Your Portfolio

The upside for bitcoin and other cryptocurrencies is tremendous. But they also have a gift that hasn’t been explored or discussed much. And it’s a feature that adds to cryptos appeal as an investment.

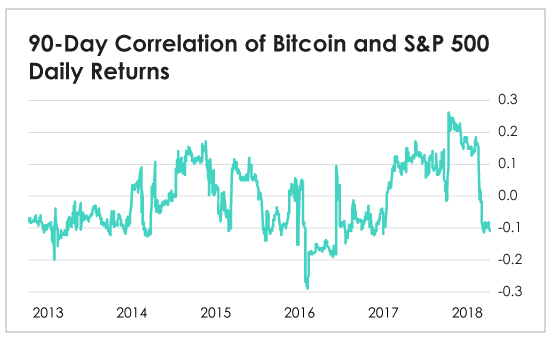

This chart begins to explain why…

This chart is about correlation… how much (or how little) bitcoin reacts to the S&P’s movements – both up and down.

How Correlation Works

If bitcoin mostly tags along with the S&P, rising and falling with the stock index, it’s “highly correlated.” Highly correlated assets are those with a correlation score between 70% [correlated] and 100% [correlated]. Strong correlations begin at 50%.

That’s one scenario. Another scenario is that bitcoin follows the S&P up but rarely down. In that case, it would earn something near a 50% correlation. You apply the same calculation if bitcoin follows the S&P down but seldom up.

OK, hope you’re still with us! We’ve just explained positive correlation. Now it’s time for negative (or inverse) correlation.

Negative (or inverse) correlation is when bitcoin does the opposite of the S&P. When the S&P goes up, bitcoin reliably goes down. When the S&P goes down, bitcoin goes up. If it happens more often than not, then the negative correlation will be 50% or more.

Since this is negative correlation we’re talking about, it’s expressed as a negative number of -50% or more. The stronger the negative correlation, the bigger the negative number (a -90%, for example, means the correlated assets are moving almost in unison in opposite directions).

Many assets are highly correlated. Some examples of positive correlation are S&P stocks to Nasdaq stocks, forestry products to real estate prices, and domestic stocks to international stocks (which wasn’t the case 10 years ago).

Examples of high negative correlation are harder to find, but here are a few: dollar to gold, big oil companies (like Exxon) to airline companies, and bonds to money. (Think of interest rates as the price of money. As interest rates rise, the prices of bonds fall.)

So now that you understand the basics of correlation, you’ll appreciate what we’re about to tell you…

Assets have become remarkably correlated, especially following the financial crisis of 2008.

The positive correlation to stocks of everything but U.S. Treasurys increased sharply in 2008 to 2009, according to Fidelity. And now?

Treasurys have also become positively correlated, when they once were negatively correlated.

And noncorrelated assets?

Well, they’ve become a rarity. And that’s not a good thing.

It has made a diversified portfolio – where the losses of some assets are cushioned by the gains of other assets – very hard to construct.

And very expensive.

Investors must pay big bucks to participate in hedge funds and private equity, which are considered noncorrelated investments.

Bitcoin to the Rescue

Now, with bitcoin, that’s no longer the case.

Remember, strong correlation is anything 50% or higher. Bitcoin’s correlation to U.S. stocks hovers just above 30% at its highest. Negative correlation doesn’t even reach 20%.

Correlation is negligible in both directions.

And anybody can buy bitcoin. You don’t have to be wealthy. You don’t have to write a $250,000 check to a hedge fund.

That makes bitcoin a highly attractive asset class – one of the few that facilitates diversification.

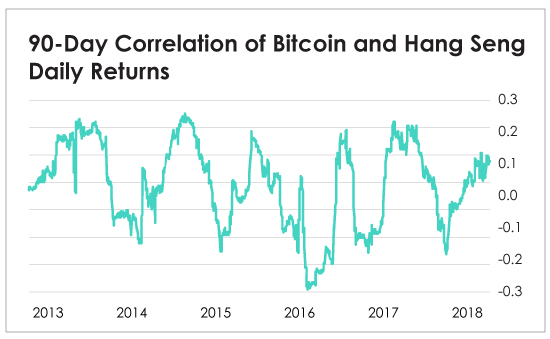

It’s even more attractive when you consider this chart…

The Hang Seng is the index used to measure movement in Hong Kong’s stock exchange. Bitcoin shows little correlation to Chinese stocks. The positive correlation peaks at just over 20%, and the negative correlation almost reaches -40% at one point. We also ran similar charts comparing bitcoin with the stock markets of England, Japan, India and Germany.

They all showed the same or even lower correlation than the Hang Seng Index.

The data generated by the Early Investing team shows bitcoin to truly be an asset noncorrelated to many stocks all over the world. What makes this such a big deal is that you don’t have to be wealthy to own bitcoin.

But here’s the thing (and it’s pretty ironic)…

Wealthy investors may be big players in institutional funds…

BUT THESE FUNDS DO NOT BUY BITCOIN… at least not yet.

Many of the issues preventing them from buying bitcoin will be going away soon, including regulatory clarity, custodial security and insurance coverage.

It’s just a matter of time before these institutional players become big buyers of bitcoin and other cryptocurrencies that offer the twin benefits of upside and noncorrelation.

And that time is coming soon.

Crypto Is Built to Last – And Win

People new to crypto often look at it as a speculator’s bonanza. But crypto isn’t based on blind speculation.

What we see in crypto is a new financial system being born – one based on currencies that can’t be devalued by a central bank and one that is not controlled by corruptible centralized parties.

We see vast potential in the “internet of money” aspects of cryptocurrency. Everything is handled by decentralized networks of computers. It’s based on math and computers, not bank executives and central bankers.

Crypto is programmable money, and it’s set to revolutionize financial transactions in much the same way the internet did for information.

At its essence, crypto is a bet on financial revolution. Many of us believe that a new financial system will be necessary in the near future. The current one is slowly melting down. And this alternative financial system is under construction as we speak! It’s being built by some of the smartest entrepreneurs, coders and investors in the world.

If this revolution succeeds, anyone who doesn’t own crypto will be left out.

Why wouldn’t every money manager allocate 1% of their risk portfolio to crypto? The possible downside is fixed at the level of investment. But the upside is 50 to 100 times, and eventually more.

In short, we’ve reached the point where the risks of not owning cryptocurrency are far greater than those of owning it.