DEAL DETAILS

Startup: Digital Brands Group

Security type: Preferred equity

Valuation cap: $35 million

Share price: $0.53

Minimum investment: $500

Investment portal: StartEngine

Raise: Series A

Digital Brands Group is an online direct-to-consumer company specializing in lifestyle brands.

Its first product was high-end jeans made from quality denim that were designed and stitched in-house. Since those early days, it’s expanded into leather jackets and leggings, suede jackets, trench coats, technical outerwear, hoodies, tees, button-downs, and terry cloth. It will introduce cashmere sweaters and pants in fall 2019.

I’ve been following DBG’s remarkable progress since mid-2016 when it went under the name of DSTLD and was primarily a jeans company. It offered jeans at half the price and twice the convenience of its competition. That’s a winning formula. (And the jeans were truly terrific. I still wear mine!)

DBG knew it was sitting on a winning formula too. That’s why it expanded beyond jeans.

Fast forward to today and the DBG team has learned a lot. The majority of its products have sold well. But that’s not why its current growth expectations are so high.

To better take advantage of the world’s fast-growing $3 trillion apparel market, DBG has adopted a holding group growth model. So it will grow via acquisitions. It plans on buying one or two companies a year and five to 10 in all. Each company must generate at least $5 million in revenue ($10 million is preferable). (Note: This acquisition strategy was implemented after DBG brought on its second brand, ACE Studios.)

DBG intends to grow each of the companies it acquires into $100 million to $250 million businesses within five years.

Prior to acquisition, these companies should already be profitable or on the verge of it. Management, metrics and margins should also be well above average (for the retail sector).

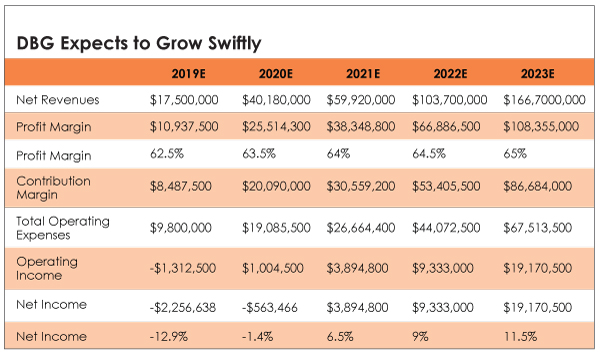

A look at the chart below suggests DBG plans to rapidly expand using the growth-by-acquisition strategy.

The holding group model allows DBG to cut costs and deploy a marketing strategy across all brands that focuses on targeted content.

And it allows DBG to grow quickly. There are a plethora of online retail companies on the cusp of scaling that DBG can target. And the top 200 digital brands represent around $2 billion worth of sales.

Notably, past sales growth isn’t one of DBG’s primary criteria. It’s looking for quality, value, a minimum revenue base and the potential to scale big-time.

Its acquisitions must also contribute to its mission of “luxury performance at exceptional value.”

If a company meets those requirements, DBG CEO Hil Davis told me, “We’ll be able to grow the brand.”

A potentially explosive growth strategy is just one factor in DBG’s favor. There are a few dozen more! I can’t list them all, but here are the big ones…

1. Customer Metrics.

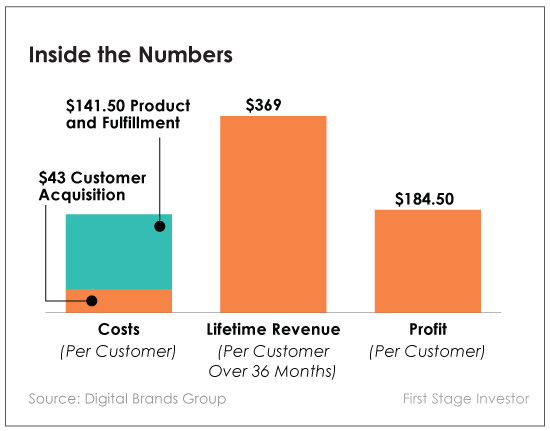

A company needs to make more off a customer than what it pays to acquire that customer. Hil says that, 36 months down the road, the gross profit from those customers acquired in the fourth quarter of this year will be 4.3 times the cost of getting them on board. This is known as the Customer Acquisition Cost (CAC) payback multiple.

Mathematically, the CAC payback multiple is the gross profit divided by the CAC. Gross profit, in turn, is derived from revenues minus costs. You improve the CAC payback multiple by either increasing revenue or reducing costs.

Any CAC bigger than a 3 or 4 is excellent. I need to see that to consider investing in a consumer-facing company. Just as important is whether that number is improving. And DBG is lowering acquisition costs while also raising lifetime value and the cart value of average orders. Here’s a chart that puts that 4.3 CAC payback multiple in context…

Two years ago, DBG’s lifetime revenue was $100. In early 2017, it was $180. By the fall of 2017, it was $360. It’s on track to be higher in 2019. And its costs per customer has dropped by more than 20%.

2. Sales Growth.

Revenue didn’t really get going until 2015, when sales doubled in the following two years to nearly $4 million.

In 2018, sales were flat as the company prepared for its new acquisition strategy. The strategy is expected to begin paying off in 2019, when revenues should reach anywhere from $17.5 million to $22.5 million, depending on whether one or two acquisitions are made.

And sales from ACE Studios will begin kicking in around mid-2020. DBG is projecting $2 million in ACE sales next year. That revenue is expected to double the following year and double again the year after that.

DBG expects to break into the black by 2021 (and become self-sustaining) with $59 million in revenue.

By 2023, DBG says it will be generating $166 million of revenue based on six new acquisitions. It’s a high bar but doable based on one to two acquisitions per year. Whether or not DBG meets it, I do expect rapid growth… in the 50% to 100% range at minimum.

3. The Market Opportunity.

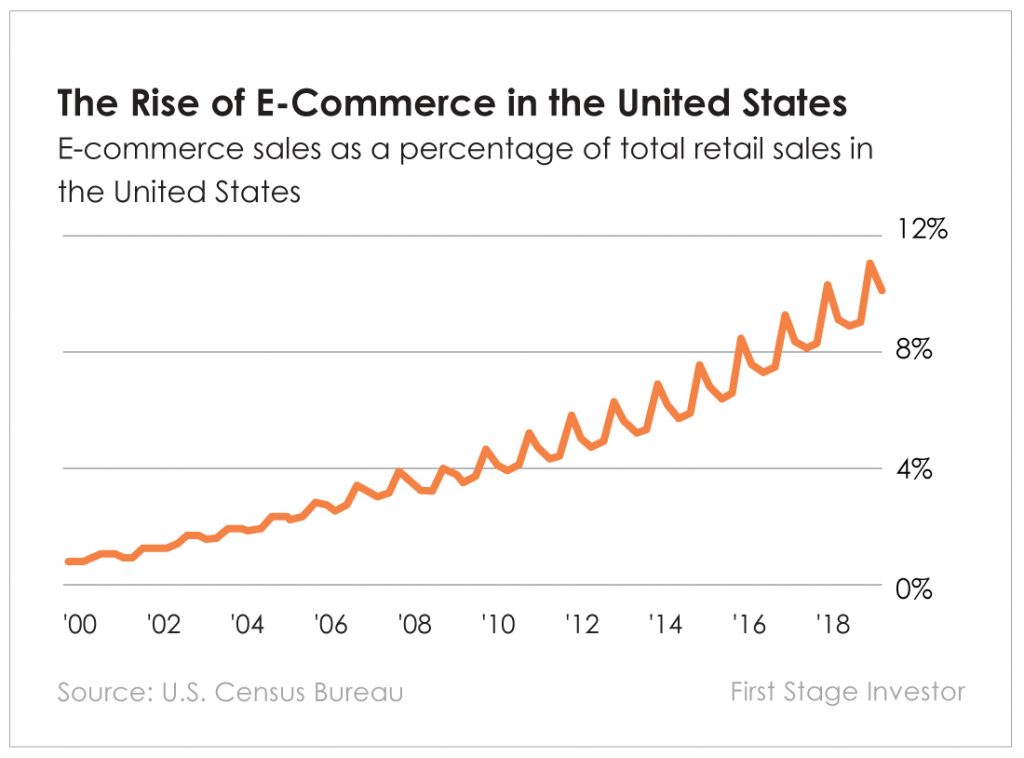

In 2015, online retail sales totaled $335 billion. By 2020, they’re expected to reach $523 billion – a 56% increase.

Clearly, the future of retail is online.

Venerable retailers – including Macy’s, J.C. Penney, The Limited, Best Buy and Sears – are shutting down stores by the hundreds. And Toys R Us is gone completely.

But here’s the thing…

Retail, overall, is thriving. Americans are spending record amounts, more than $5.31 trillion in 2018. They’re just doing more of it online, approximately $514 billion.

DBG has already proven adept at riding this wave of online-savvy shoppers. It was able to establish a growing denim brand in addition to products such as outerwear, T-shirts and accessories.

And now it’s adopted an aggressive “build and buy” strategy. It’s a bold, all-in move. You have to trust Davis and the company’s founders to execute this move. Which I do. And here’s why.

4. Management Is Steeped in Entrepreneurial Success.

Davis previously scaled custom-tailored clothing brand J. Hilburn to $55 million in revenue in just six years. He used that expertise to launch ACE Studios. The ACE Studios team scaled a men’s clothing company in 2007 from a raw concept to $55 million in annual revenue… in just six years.

So when he says DBG is on schedule to meet its revenue goals, it carries weight in my book.

DBG’s chief marketing officer, Laura Dowling, comes from similarly structured holding group companies: Tapestry (holdings include Coach, Kate Spade and Stuart Weitzman) and the Swatch Group (Harry Winston, Omega and Breguet).

A lot of her initiatives have already seen positive results. She’s using targeted texts to help trigger conversions. Conversion rates are up more than 19X – from 3% to 58%. And click-through rates are up 12X – from 6% to 72%.

Laura’s other initiatives are paying off, too, with a 66% increase in new customer growth and an increase in average order value from $129 to $149. Laura told me she thinks this boost in growth is sustainable far beyond this year.

5. The Price Is Right.

DBG is raising at a $35 million valuation. The valuation is based in part on continued rapid expansion and growing brand recognition.

The impressive size of the market opportunity and DBG’s aggressive growth plan also plays into its valuation.

The opportunity is very large and extremely attractive. But there are risks, as there are to all startup opportunities.

The DBG team has to continue to execute at a high level. But at this moment in time, a $35 million valuation seems more than fair.

We look for at least 10X gains. If things go according to plan, it could be much more.

An Exciting Endgame

As for the endgame, a buyout from one of several giant merchandisers is possible. Amazon is used to dominating everything it touches, but it’s off to a slow start in the retail lifestyle space. Walmart and Target loom as possible interested parties too.

DBG is also exploring following up its current raise on StartEngine with a listing on London’s junior stock market, AIM. Davis said British investors are eager to fund high-growth retail opportunities. They’re much rarer in Europe than in the U.S.

DBG is also weighing the option of going public via an OTC listing in the U.S. The company wants to not only let its past and current investors buy and sell shares more easily but also give its founders and early employees of its acquired companies a shorter pathway to liquidity.

Most exciting of all, DBG plans to trade up to the Nasdaq sometime in the second half of 2020.

How to Invest

Go to the DBG investment page on StartEngine here. Shares are priced at $0.53. And the minimum investment is only $500. Though you can invest more if you like.

If you don’t already have a StartEngine account, you can sign up for one here. Once you’re logged in to StartEngine, go to the DBG deal page. Now click the green “Invest Now” button. Enter the amount you want to invest and proceed through the required steps. Be sure your investment is confirmed, and then you’re good to go.

Risks

This opportunity, like all early-stage investments, is risky. Early-stage investments often fail. DBG might need to raise another round of funding in a year or two, if not sooner. If it executes well, this shouldn’t be a problem. But that’s a risk worth considering when investing in early-stage companies.

The investment you’re making is NOT liquid. Expect to hold your position for five to 10 years. An earlier exit (even within the next year or two) is quite possible but should not be counted on. All that said, I believe DBG offers an attractive risk-reward ratio. ■