Bitcoin is the original cryptocurrency. It was created in 2009 and its price has soared from less than $0.10 to more than $19,000 at its high.

Today, digital currencies are growing faster than anything else is. And many believe bitcoin could be one of the most important inventions ever.

Bitcoin is a unique form of money and store of value, primarily because it is not controlled by governments or banks. It has been referred to as “digital gold” due to its scarce nature. There will only ever be 21 million bitcoins.

Only a few million people own any bitcoin today.

Bitcoin is still in the very early adopter phase, which means it still has quite a ways to go, assuming we’re headed for mainstream adoption.

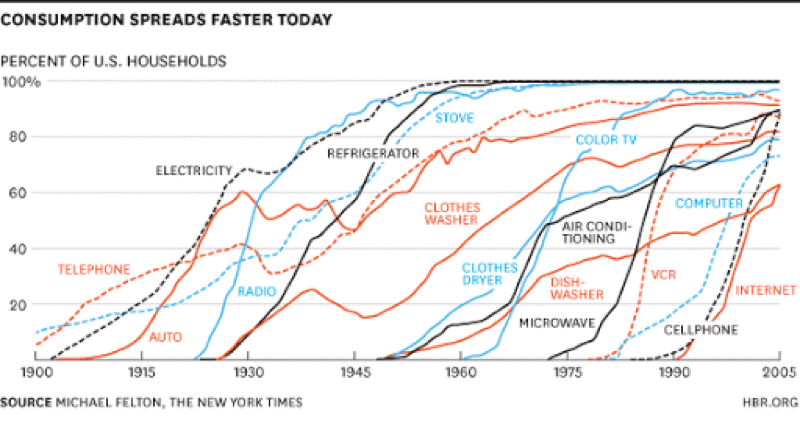

To get an idea of what “going mainstream” looks like, here’s a chart showing the rate at which consumers adopted other various new technologies…

You’ll notice that each curve is roughly S-shaped. And over that time, adoption grew faster. For example, it took around 35 years for the refrigerator to complete adoption… and only around 15 years for cellphones.

With bitcoin and cryptocurrencies, we’re in the first inning. Perhaps 1% of Americans own any at all. Crypto today is 1992 for cellphones.

But adoption is growing fast. Here’s how bitcoin has grown exponentially: As more people make money off bitcoin, they tell more of their friends about it. They talk about it on TV. It makes the news.

More people get interested and eventually become comfortable enough to invest. The cycle repeats again and again.

This is bitcoin’s secret to viral, organic adoption. And unless a black swan event (something unpredictable and bad) happens, it will continue doing its thing.

Importantly, you can’t counterfeit bitcoin because everyone in the network runs a copy of the “ledger” that records all transactions (the bitcoin blockchain).

Bitcoin can be used as both a currency and a store of value. As mentioned earlier, since it launched in 2009, the price of bitcoin, even at its current price (which is well below its high), has grown exponentially.

No other asset class in the world has the potential to rise in price as much as cryptocurrencies, and bitcoin is still king of that world for now. I believe the price could eventually surpass $1 million per coin.

It is important to realize that you have not “missed the boat” if you don’t own any yet. The only limit on bitcoin’s potential is the number of people who believe it has value.

Today, only a few million people own any cryptocurrency at all. If it becomes widely adopted as a store of value and/or currency, today’s prices will look dirt-cheap in comparison.

You can send bitcoin across the world in a few minutes, with extremely low fees compared with traditional options.

It has the potential to disrupt our current monetary systems like nothing seen before.

That’s why I love bitcoin.

How to Set Up Your Bitcoin Wallet and Purchase Your FIRST Coin

I recommend purchasing bitcoin through Coinbase.com. It is the most secure and trusted cryptocurrency exchange in the U.S.

Coinbase has more than 13 million active accounts and is backed by two of the best venture capital firms in the world (Union Square Ventures and Andreessen Horowitz).

To get started, create a Coinbase account here.

Use that link to sign up to receive $10 in free bitcoin in your account. Coinbase will also donate $10 in bitcoin to a non-profit organization near and dear to my heart, The Roberto Clemente Health Clinic. This model health clinic is an impoverished region in Nicaragua provides access to high-quality health care and wellness programs. To learn more about this charity, click here.

Be sure to choose a very strong password. It should be at least 18 (randomly chosen) characters long and should not contain any words that could be guessed by a hacker.

One easy way to generate a truly random password is by using Scrabble. Put the game pieces upside down, and choose 18-plus letters at random. Then be sure to add in some numbers and special characters.

Write down your password (or print it out), and store multiple copies of it somewhere safe.

Once you’re logged in to Coinbase.com, click on the “Buy/Sell” tab on the top menu. You can now purchase bitcoin using your bank account or credit card.

Coinbase has an excellent reputation in the industry and uses top-of-the-line security protocols. I feel very comfortable trusting them with my information.

Keeping Your Account Secure

I strongly recommend taking the additional security step of using “two-factor authentication” on your account. This makes it nearly impossible for thieves to access your account. Every time you log in to Coinbase, you will be asked for your password and a verification code.

The best option for two-factor authentication is using a phone app called “Google Authenticator.” You can download Google Authenticator on both Android phones and iPhones. Here are the links you’ll need for Android phones and for iPhones.

Once you are logged in to your new Coinbase account, to activate two-factor authentication, click on “Settings,” then click on “Security.”

Under “Two-Factor Authentication,” choose “Google Authenticator” as your method. Then follow the directions as provided by Coinbase here.

Also, in your Coinbase account, I recommend moving your bitcoins to the “Vault.” This is an additional security measure and makes it much harder for anyone to steal your bitcoins. You will need to move your bitcoins from your main “Wallet” to the “Vault.” More information on Coinbase “Vaults” can be found here.

Disclosure: I own bitcoins and have since 2013. I have no plans to sell and do so only occasionally to diversify into other coins.

Everything Worth Doing Has Some Risks

Bitcoin is a highly speculative, volatile investment. There are regulatory risks involved. There are possible technological problems involved. Invest only as much as you could stand to lose, because that is one possible outcome.

I recommend investing no more than 3% or so of your portfolio in bitcoin and other cryptocurrencies. If you have a longer time horizon, a heavier allocation could be justified. However, a large investment is not necessary to give yourself significant upside. Start with small investments, and spread your bets out over time if you’re willing to be patient.