Deal Details

Minimum investment: $100

Raising up to: $1 million

Valuation: $10 million cap (the max your investment will convert into shares at a future equity fundraise)

Industry: Blockchain

Investment portal: Wefunder

Dear First Stage Investor,

Balance, the company we’re recommending to you today, sees clearly the future of cryptocurrencies and the blockchain…

Even though it seems far off.

“Today,” Balance says, “blockchains are incredibly hard to use.”

I couldn’t agree more.

You need a great deal of patience and forbearance in buying and exchanging cryptocurrencies. There are a lot of steps involved.

It’s far from quick or intuitive.

But Balance is making stunning progress toward an ease of use we can barely imagine…

Like seeing all our balances – whether they’re in bitcoins or Litecoins or euros or rubles – all in one place, with their dollar values listed alongside in real time… That would be its free service.

And like converting some of those euros or bitcoins into dollars… That would be its paid service.

Balance calls it “see it for free, convert for a fee.” Catchy, no?

But there’s a lot more to Balance than a clever slogan. A lot of thought, not to mention advanced technology, has gone into its business model.

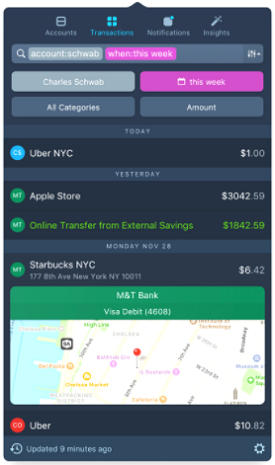

All your balances are constantly updated. You can view your latest transactions and choose a filter – like credit card charges – to view selected transactions.

Here’s how Balance envisions this blockchain future…

I have no doubt that future is coming our way. The only question is…

Will it happen sooner or later?

And what small innovative company (believe me, it won’t be a legacy bank) will bring it to us?

Waiting for the Blockchain to Be Unleashed

Cryptocurrencies and the blockchain are technologies just waiting to be unleashed.

But two things need to happen first.

First, costs must go down.

Think of the first websites. They were really expensive to build. As costs dropped, websites proliferated.

Second, users need to find and access blockchains with the same degree of convenience they navigate the internet with. Remember, only when the Mosaic browser came along did the internet take off.

Balance wants to be the key enabler for the billion blockchains that will be created.

It’s an audaciously ambitious off-the-charts idea.

The kind of idea that could make early investors a ton of money.

CEO and co-founder Richard Burton understands that what Balance is trying to do is pretty big. In fact, he can pinpoint the moment he had his epiphany. He recalls working on the interface design for Ethereum at the time when…

One of the team [members] said to me, “Richard, you do realize you can redesign the internet, right?” At the time, I thought he was absolutely nuts.

Not anymore.

Burton wants Balance to be like Mosaic, an interface design for the interchain that makes blockchains easy to use.

He wants Balance to be like Mint, an app that keeps track of your cryptocurrency and other balances.

And he wants Balance to be like Chrome, a browser that helps you navigate blockchains.

First in Line

First up is the Mint-like product: a wallet for multiple tokens.

Balance has already created an app that works with more than 15,000 U.S. banks.

In a very short time, it has attracted more than 400 paying customers.

Balance is now finishing a major potential breakthrough upgrade, which will give users the ability to buy and exchange digital currencies within the app.

If it doesn’t work as advertised, it could spell the beginning of the end for Balance.

On the other hand, if it works…

The Start of Something Very Big

The market opportunity is huge. There are roughly 9,000 financial institutions that could be part of the app – banks, credit cards, investment accounts and online wallets.

Balance’s brief but impressive track record makes this more than just a roll of the dice.

Customers loved its first app that let users check their balances from their menu bar. They gave it five stars.

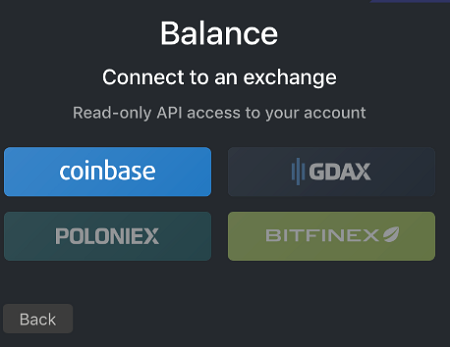

Its latest iteration lets users check out Coinbase. Next up: cryptocurrency exchanges GDAX, Poloniex and BTCC.

And this is just the beginning!

Balance plans to include as many cryptocurrency exchanges as it can. It will also be integrating with several upcoming initial coin offerings.

Who Are These Guys?

The founders have no trouble thinking big. But can they pull this thing off?

Burton designed interfaces for the Ethereum Foundation. It changed his life. He not only made a ton of money (when the ether coins took off)…

But also became a true believer in the transformative power of the blockchain.

Co-founder and Chief Technology Officer Ben Baron worked on the largest music streaming service in the Middle East before joining Apple as a software engineer to work on Apple’s “Photos for Mac.”

Co-founder and Chief Design Officer Christian Baroni worked with Microsoft on “Office for Mac” and iOS and designed user interfaces and icons for Stripe and Clearbit.

So, can this team pull it off?

Its short history is impressive. The group has done a lot with a little to get this far. Burton’s father was a big early investor. And Burton himself has given the company a series of loans (thanks to the wealth-conferring ether coins he got for his work on Ethereum).

By the way, we think it’s a nice signal when the founder has his own skin in the game.

But can they really pull it off?

There’s competition.

ConsenSys, which has attached itself to Ethereum’s smart contract technology, is developing decentralized applications and end-user tools for the blockchain.

Coinbase is also getting into the space. It now offers Token, which serves as a “private and secure” app for messaging, an Ethereum wallet and a browser for Ethereum apps.

Balance’s approach is more inclusive. It uses open-sourced technology and is not just focused on technology built on top of the Ethereum blockchain.

I liken it to Keen Home, a company we recommended to our members (see our recommendation here) partly because it integrates its Internet of Things products with as many IoT protocols as possible.

Balance’s original app was built on top of Plaid, a nice choice. Plaid aggregates all of the U.S. banks into a single application programming interface (API).

It will also be integrating with APIs like TransferWise and ShapeShift, more smart choices. I believe this is a far better approach than those of ConsenSys and Coinbase.

Critical Pieces in Place

Balance’s partnerships – particularly the one with Plaid – shows that it can make key alliances within the industry.

And it’s getting ready to offer an upgraded app that I believe will showcase Balance’s huge upside more than any words or deck could.

If all goes as planned, the app will put the company on the map. It will give Balance the cred it needs to hire top-end talent.

And, no small thing, it should also provide a nice revenue stream early on in the company’s development.

Yes, we’d be investing before this happens.

But this is right around the corner. It’s not quite a done deal, but after this happens, the company will be worth a lot more than it is now (a reasonable $10 million).

In other words, we believe it’s the perfect time to invest. Balance is a company that is positioning itself to grow right along with the blockchain, giving itself unprecedented upside.

It’s early in the game. But what’s not open to debate is the huge market that is sure to develop for blockchain-related services.

Balance is putting its hat into the ring at the right time with the right app.

As I said, it could be the start of something very big.

How to Invest

Editor’s Note: If you’re new to First Stage Investor, or if you just need a refresher on how to invest in startups through portals like SeedInvest, check out our video tutorial.

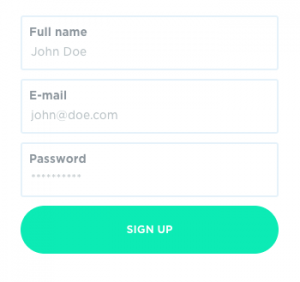

Create an account on Wefunder.com if you haven’t yet. Filling in these three boxes is all you have to do. Then click the green “Sign Up” box.

After you’ve signed up and logged in, click here to go to Balance’s investment page.

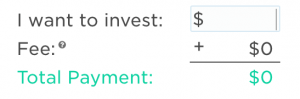

Click on the green “Invest” button on the right side of the screen. This is what you’ll see.

Enter the amount you want to invest. The minimum is $100, but you can invest more if you like.

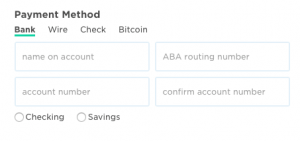

Scroll down a bit and you’ll see “Payment Method.” You can select “Bank” (a debit payment), “Wire” (a credit payment), “Check” (for which you’ll get instructions on who to assign the check to) and “Bitcoin” (for which you’ll get instructions).

If you’re using the first option – a bank transfer – please remember that the ABA routing number appears on the bottom left of your check and the account number appears next to it.

Also note that the second option – sending a wire – doesn’t require you to give Wefunder your banking information. It remains in-house with your bank, if that matters to you.

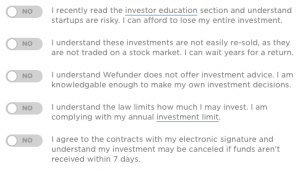

Okay, ready to scroll down a little more? You’ll see this…

Please click on each one to turn the “No” into “Yes.” Once you do that, you can click “Invest.” You will now be guided through the remainder of the funds transfer process.

Note: There are limits on the amount that individuals can invest per year. (Full details on that here.)

So, if you’re new to this, consider investing the minimum amount. There will be many more opportunities to come. Remember, it is ideal to spread your investments across 15 to 20-plus startups.

If you’re sending money from your account for the first time, it’s pretty easy. But the first time doing anything can be challenging. So be patient, and do not hesitate to call your bank if you have any questions.

Risks

Like all early-stage companies, there is a risk that the business won’t succeed. It could run out of money or fail to attract enough customers. While we’re confident in the company’s ability to execute, we don’t want you to invest any money (in this or any other startup) you can’t afford to lose or will need in the near future.

Invest early and well,

Andy