I worry a lot about Mark, Liz and Julia. Mark was my flatmate in London in 1975, and we’ve kept in close touch ever since. Liz and Julia are my sisters-in-law. They all have diabetes. I already lost a dear friend to diabetes last year. I don’t want to lose another one.

All three are very diligent about keeping their sugar levels under control. But it’s a huge hassle — and it’s expensive. It costs $25 to $70 to take the standard complex glucose test plus a doctor’s office visit fee of $100 to $200. If you’re using strips, they cost $100 to $150 for a month’s supply. And it involves pricking your finger. Blood sugar testing pain is a daily drudgery for many diabetes patients.

Companies are aware of this problem. For decades, dozens of companies — including heavyweights like Abbott, Apple and Samsung as well as many smaller ones you’ve never heard of — have tried to develop a highly accurate non-invasive solution. None have succeeded. The accuracy eluded them.

The hurdles — both technological and financial — are daunting. JDRF CEO Dr. Aaron Kowalski has been knee-deep in the world of emerging diabetes technology for decades. “There are major technology challenges that are so big, you have to wonder if there is even a need anymore,” he said.

He’s not alone in that assessment. John L. Smith is one of the leading diabetes technology experts and author of the seminal paper “The Pursuit of Noninvasive Glucose: Hunting the Deceitful Turkey” article (first published in 2006 and last updated in a 2020 seventh edition). He says that it would take a minimum of five years and $25 million to $30 million to get a product to market.

Given the immense technological and financial challenges, I would have bet that the first company to crack this technology would be one of the bigger legacy companies. But I would have been wrong.

Instead, it is ViiT Health — a small startup that is tantalizingly close to finalizing a glucose monitoring device that’s commercial-ready, noninvasive, highly accurate, cheap, easy to use and quick (results in 15 seconds!). It’s flying through its clinical trials in Mexico, with just a couple of months to go. Then it will submit a request for clearance from the country’s FDA-equivalent government agency.

Like most other companies innovating in the noninvasive glucose monitoring field, ViiT Health uses spectroscopy as the basis of its technology.

Spectroscopy is the study of the absorption and emission of light and other radiation by matter. It involves the splitting of light (or more precisely, electromagnetic radiation) into its constituent wavelengths (which can be identified by different colors).

The majority of companies trying to develop a noninvasive solution (including ViiT Health’s potential competitors) are using reflected light. The problem? Reflected light doesn’t “see” the full spectrum of colors. It only sees one “analyte.” An analyte is simply a chemical substance that is the subject of a chemical analysis. So one analyte can be used to target glucose. But then it can’t target other chemicals.

ViiT Health’s technology uses direct transmittance of near-infrared light combined with its own proprietary computer vision algorithms. It’s harder to master this technology. It took ViiT Health five years. But now the company has the ability to “see” multiple analytes and the full spectrum of colors.

This is important. ViiT Health can use the same device that measures glucose to measure cholesterol, triglycerides and blood alcohol levels.

In fact, its next noninvasive monitoring product will be for cholesterol. That’s a huge market. Nearly 94 million people in this country aged 20 or older have cholesterol levels of over 200 (including me). Every damn time I see my doctor, I have to take a blood test to see my latest cholesterol levels. I would welcome a noninvasive device, especially one that could give me results right there and then in the doctor’s office instead of three to five days later.

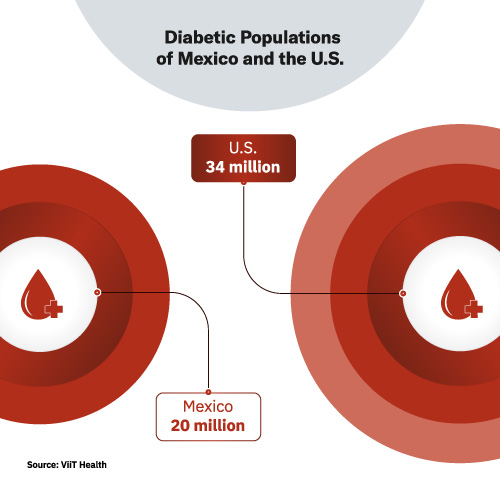

The glucose monitoring market is also big. Worldwide, 422 million people have been diagnosed with diabetes. 88 million Americans have pre-diabetes. And the scary part is that 86% of those 88 million have no idea they have it. 34 million Americans have diabetes. In Mexico, where ViiT Health’s two co-founders are from, 20 million live with diabetes. And the disease is the second-leading cause of death in the country.

This is a huge opportunity for the first company that gets noninvasive testing right. Getting it right means it must be affordable and provide highly accurate and fast results.

ViiT Health checks all three boxes. It’s five times cheaper than standard complex glucose tests and is 90% as accurate. It’s 5% to 10% more accurate than rapid tests. And you get results almost instantaneously. It takes an ultra-speedy 10 to 15 seconds (as opposed to 1.5 hours for the complex tests).

ViiT Health leads the pack by a significant margin. CEO Luis Fernando says the company is at least five years ahead of all the competition. Five years is in keeping with what John Smith says. But even if Luis is one to two years too optimistic, that’s still an enormous head start. The fact that this company has put considerable distance between itself and heavyweights like MIT (which is using laser pulses to monitor glucose) is an impressive technological achievement. And it gives ViiT Health solid defensibility.

The company is forging ahead at full speed, determined to leverage its first-to-market advantage. Its clever go-to-market strategy targets Mexico as the first country it will begin selling in. If Mexican government clearance goes according to plan, it’ll happen before the end of the year with sales to clinics, private companies and hospitals immediately gearing up. The company projects it will gain a little more than $8 million in gross profit next year in Mexico.

Then ViiT Health plans to pursue U.S. FDA clearance. Before submitting an application, the company will need more clinical trials to demonstrate that it meets American safety standards and that its effectiveness is equal or better than currently available products. That said, it usually takes three to six months to obtain 510(k) approval.

It’s not a high bar, but we need to be aware there is risk here. I’d characterize FDA approval as a “high probability,” not a given. U.S. FDA protocols aren’t much different from Mexico’s. What’s more, the information and data that the company collected and submitted to the Mexican government for certification should facilitate the approval process in the U.S.

Given the company’s initial U.S./Mexico focus, Canada and Latin America are logical countries for ViiT Health to target two to three years down the road. And remember, it would be doing so with no effective competition. Even its entry into Europe in 2026 should be without serious competition. By the time it hits Asia in 2027, it will have established itself as a globally trusted brand. It’s possible that companies might develop comparable technology by that time. Even so, they would be at a distinct disadvantage.

While ViiT Health’s investment profile is compelling, in its broad strokes it’s not that unusual. Along with other innovative medtech companies, it offers promising but not quite fully proven technology. New solutions to large, decades-old and intractable problems usually create instant interest in the marketplace, especially when — as in ViiT Health’s case — they’re 80% cheaper than existing solutions.

ViiT Health also has the wind at its back, as it’s selling into a fast-growing market. The blood glucose monitoring market is forecast to grow 9.6% annually until 2026. And as the sole beneficiary of potential widespread adoption, ViiT Health should experience rapid revenue growth.

The investing opportunity is outstanding as is. But there’s even more to like. ViiT Health is throwing into the mix an additional two big bonuses. ViiT Health will be restructured into a holding company in order to absorb two other similar technologies that have shown great promise.

One uses computer vision to detect breast cancer. The other uses computer vision to detect skin cancer. Validation of these two technologies is at a much earlier stage than ViiT’s glucose monitoring technology. Mexican and U.S. government clearance is a couple of years down the road. Following the playbook used for its glucose monitoring technology, ViiT Health would pursue government approval from Mexico first, then the U.S.

The additional cost to develop these products shouldn’t be a problem. While it’s not quite a done deal yet, a fund has soft pledged to invest $2 million into the new holding company. It’s a sweet deal for investors. You’re getting three highly promising monitoring/detection technologies for the price of one.

The upside is extremely compelling. Of course, there are always risks we must consider. So let’s look at each risk individually…

- Technology/Regulatory Risk Part 1. It doesn’t matter if you or I think the technology works great. It has to work well enough to get government clearance. The risk is low for Mexico and higher for the U.S. But clearance in Mexico would give ViiT Health a high floor, which nicely complements its high ceiling.

- Technology/Regulatory Risk Part 2. Three technologies housed in one company diversifies risk. That’s a good thing.

- Manufacturing Risk. Manufacturing can be hard. ViiT Health has identified sites in Mexico City and New Mexico and will begin production later this year. 3D printing will play a big role. The team does not have a high-ranking manufacturing specialist, so it’ll have to hire one soon. There’s risk here that shouldn’t be ignored.

- Competition Risk. ViiT Health has no serious competition. Risk is minimal. This is a huge plus.

- Marketing Risk. Badly needed health solutions that save lives and money eventually catch on and become widely adopted. Still, ViiT Health has to competently market its product. Mexico doesn’t worry me. Both founders are Mexican-born and CEO Luis has a long entrepreneurial track record there. The U.S. worries me a little bit. But the company will be able to apply many of the lessons learned in Mexico to its U.S. marketing efforts. And that should help immensely.

U.S FDA approval looms as the biggest hurdle and risk. But keep in mind that FDA clearance is also the gateway to a much higher valuation. Nailing manufacturing is a close second. Risk overall grades out as extremely reasonable. And the upside is very high. Luis deserves kudos for getting the company to the cusp of clearance, commercialization and serious revenue generation.

And the cusp is what you want. A year ago would have been too early to assess risk. Post-cusp and the company’s price will have sky-rocketed. The timing is just about perfect.

Deal Details

Startup: ViiT Health

Security type: SAFE

Valuation (cap): $15 million

Minimum investment: $100

Where to invest: Wefunder

Deadline: February 28, 2022

How to Invest

ViiT Health is raising up to $2 million in this round of funding on Wefunder. You’ll need to sign up for an account there if you haven’t yet.

Once you’re signed in to Wefunder, head over to the ViiT Health raise page. Now enter the amount you want to invest and click the red “Invest” button on the right-hand side of the screen. The minimum investment on this deal is $100.

Risks

This opportunity, like all early-stage investments, is risky. Early-stage investments often fail. ViiT Health may need to raise another round of funding in a year, if not sooner.

If it executes well, this shouldn’t be a problem. But that’s a risk worth considering when investing in early-stage companies. The investment you’re making is NOT liquid. Expect to hold your position for five to 10 years. An earlier exit is always possible but should not be expected.

All that said, I believe ViiT Health offers an attractive risk-reward ratio.