Note: This recommendation was co-authored by KingsCrowd Senior Investment Research Analyst Léa Bouhelier-Gautreau.

Moonshot companies are tricky to evaluate. By definition, moonshots are bold, audacious, innovative attempts to solve massive problems. And if the solution is successful, it can be immensely profitable for investors and beneficial for society.

Moonshots are also incredibly risky. Such innovative solutions are difficult to build. And it often takes a long time before society adopts a moonshot solution. It’s hard to overcome decades of doing something the same way.

That’s why timing is incredibly important when investing in moonshots. Investors know that many early stage moonshot companies are at least a decade away from succeeding. Investing in them often means waiting a long time before seeing any returns.

But every now and then, a moonshot company arrives on the scene at precisely the right moment — when a problem is so big and pressing that the world needs to adopt a working solution right away. And if a moonshot company has a working solution — and clear pathway to growth and monetization — that dramatically reduces the company’s risk profile and makes it extremely attractive to startup investors.

Léa and I believe Biodel AG is one of these special moonshot companies.

A Pressing Problem

The western part of the United States is going through a historic megadrought. The Colorado River is drying up. And the reservoirs that the Colorado River feeds are at dangerously low levels. Lake Powell has reached 24% capacity, and the three reservoirs above it range from 23% to 50% capacity. Lake Mead is only 29% full.

If you’re wondering how low 29% is, consider this: The water at Lake Mead has receded far enough that it’s created a new shoreline. And on that newly dried out shoreline, people have found wrecked boats, coffee machines, and the remains of five people so far.

If the water levels drop much lower, neither lake will be able to generate electricity, and utility companies will need to increase their use of fossil fuels to compensate for the loss.

Winter snow will help increase water levels. But Colorado is expected to have a mild winter this year. So while water levels will likely increase, it won’t be enough to get out of the danger zone next year.

Seven states (Colorado, New Mexico, Utah, Wyoming, California, Arizona and Nevada) and around 30 Native American tribes share water from the Colorado river. According to the century-old Colorado River Compact, the states in the upper basin — Colorado, New Mexico, Utah and Wyoming — are supposed to split Colorado River water equally. In practice, it hasn’t worked out that way. Last year, the lower basin states used 117% of their allotment. The year before, they used 113%.

But overuse by the lower basin isn’t even the biggest issue. When the treaty was written, the expected flow of the Colorado was 20 million acre-feet of water per year. The current flow is 12.5 million acre-feet. So not only is there excessive usage, but the amount of water allocated to the states far exceeds the amount of water actually in the system. Combine that with a historic megadrought and you have a recipe for disaster.

The states served by the Colorado River know they have to reduce their water usage. But they can’t agree on how to do that. They blew past an August deadline to reach a new agreement and haven’t reached one since.

Now the federal government is forcing their hand. Starting in January, the government will cut 21% of Arizona’s water supply from the Colorado River. And if the states and tribes involved fail to reach a permanent agreement that reduces water consumption, the federal government can unilaterally impose a solution that almost every state is certain to dislike.

So whether states agree to a reduction in water usage or the federal government imposes it, Colorado, New Mexico, Utah, Wyoming, California, Arizona, Nevada and about 30 Native American tribes will have to start using significantly less water than they do today. And that’s where Biodel AG comes in.

In the U.S., 45% of freshwater is used to generate electricity, 32% is used for irrigation, and 12% is used for the public supply. Biodel AG focuses on reducing the amount of water needed for irrigation. And it has an incredibly groundbreaking solution.

A Salty Threat

Farming is a massive business. American farms contributed about $134.7 billion directly to the U.S. gross domestic product (GDP) in 2020. Agriculture and sectors that rely on agricultural inputs contributed $1.1 trillion to the U.S. GDP the same year. That accounts for 5% of the GDP.

What most people don’t know is that most farmers don’t own their land. They have short-term leases on it instead. That means farmers are incentivized to increase short-term crop yields rather than worry about the long-term health of the land. Maximizing their crop yields is how they get paid. But the farming techniques that maximize crop yields over the short term are typically not good for the soil.

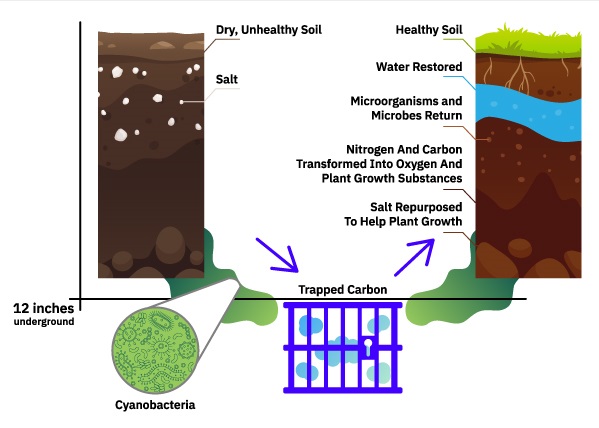

Healthy soil is full of life. It has worms, insects, bacteria, microbes, water, nitrogen, carbon dioxide, and other nutrients. This entire ecosystem is necessary for healthy plant growth. But drought, the use of chemicals (like fertilizer) and overcultivation destroys soil. It fills the soil with carbon and makes it too salty. Dying soil also loses microorganisms, which depend on organic matter to live. Then the soil becomes incapable of retaining water, and from this point, it’s unlikely that plants will ever grow again.

Salinity is one of the biggest threats to agriculture. It affects more than 10% of the total arable land in the U.S. And the saltier the soil, the more water it requires.

The typical solution to this problem is to coax more growing seasons out of depleted soil using chemicals. Unfortunately, that requires using even more water because the soil struggles to retain it. But that’s not an option anymore. The water supply is shrinking, and farmers have to change their farming methods.

A Multi-Purpose Product

Biodel AG’s Sequester product, made of cyanobacteria, brings soil back to life. Cyanobacteria use photosynthesis to live. They breathe nitrogen and carbon dioxide from the air and deliver beneficial substances (extracellular polymeric substances, or EPS) to the soil. Unlike regenerative products made out of simple microbes and bacteria, like Terreplenish or Wind River Microbes, cyanobacteria can revive soil with less than 1% of organic matter.

Once thriving, cyanobacteria attract other microorganisms to the soil. The healthier soil can retain significantly more water, thus reducing the need for irrigation. The healthier soil also makes it possible to grow crops without chemical fertilizers, which in turn makes the soil more robust and less thirsty.

The Secret Win for Farmers

Biodel AG’s cyanobacteria don’t only transform carbon. They also capture it and store it more than 12 inches underground. That way, the carbon is trapped and will not be released by agricultural activities, which reduces carbon emissions. And this carbon capture will be critical in driving adoption.

Let’s go back to the economics of farming. As I said earlier, most farmers hold short-term leases on their land. And they run medium-sized operations. So they are economically incentivized to increase short-term yields to maximize their profits even if it ruins the soil. But large farm operations — and the landowners of the medium-sized farms — operate under a different set of economic incentives at a different scale.

First, they’re worried about the long-term health of their soil. They need the land to be productive for decades, not just a few years. But more importantly for large farmers and landowners, the carbon capture element of Biodel AG’s product has the potential to unlock an incredibly lucrative revenue stream.

By sequestering carbon and reducing greenhouse gas emissions, landowners can get carbon credits. They can sell these credits to companies looking to reduce their own carbon footprint — like Amazon and Google. (Notably, only landowners directly benefit from carbon credits, not farmers renting the land.) The carbon credit or offset market is about a $50 billion sector in the U.S. and an $850 billion sector globally. And the buying and selling of these credits are largely driven by international organizations, governments and corporations’ commitments to reduce their carbon emissions.

Biodel AG will help landowners access the carbon credit market to sell carbon credits. They’re doing this by signing large farmers to five-year regenerative contracts. That locks the landowners into using Biodel AG’s product for five years. As Biodel AG’s product works, the soil will get healthier each successive year, helping it retain more water, sequestering more carbon and reducing greenhouse gas emissions. And each year, Biodel AG will work with farmers and landowners to get certified soil samples that establish carbon “savings.” Then they’ll help the farmers and landowners access the carbon credit market to sell carbon credits. This unlocks a significant revenue stream farmers previously didn’t have access to.

Carbon credits are not regulated yet. But the voluntary markets are quite efficient, with big corporations such as Delta Airlines, Alphabet and Walmart trying to become carbon neutral by buying carbon credits to offset their own carbon emissions.

That’s a powerful incentive to adopt Biodel AG’s product. And right now, Biodel AG has this space mostly to itself. One other company, agribusiness giant Monsanto Company, has a working cyanobacteria product on the market. But it’s being used mostly to increase yields.

The fact that Monsanto Company is in the market with a cyanobacteria product is actually a good thing for Biodel AG. It provides some validation for the approach it’s taking. And more importantly, Biodel AG’s product is better. It’s built for the future. And Biodel AG has protected its intellectual property well with three U.S. patents and two international patents.

The Path to Growth

Biodel AG is already gaining traction thanks to a mix of direct sales and licensing. It is building its website to increase direct-to-consumer sales. But it will mostly focus on closing multi-year contracts with large landowners to use any of the five products Biodel AG offers.

From our discussions with the founder, Léa and I learned that Biodel AG negotiated a three-year trial and supply agreement with the Navajo Agricultural Products Industry (NAPI) in New Mexico. NAPI is one of the largest farming enterprises in the U.S. with more than 100,000 acres of irrigated farmland. This is both a stunning and impressive achievement.

I’ve done a lot of business with Native American tribes. It can take years to gain the trust of a tribe to do business with them. And for good reason. Native American tribes have been burned so often in the past that they’re extremely cautious about entering an agreement with anyone. Additionally, Native American tribes think long term, not short term. They know that every decision they make impacts whether their tribe, people, and culture will still exist 50 or 100 years from now. So every decision a tribe makes is viewed through this long-term lens. Decisions are made carefully and deliberately.

The fact that Biodel AG was able to land a NAPI contract is a significant indicator that both the team and the product are ready to succeed.

The company’s collaboration with Melanie Venter, owner of a public relations firm, and Kent Adams, a consultant for Biodel AG with marketing experience, will also help educate landowners on carbon sequestration.

Targeting large farms and farm landowners is a smart go-to-market strategy. They are ultimately the decision makers in the use of their lands. And the top of the market is where the money is. Biodel AG is providing large farmers and landowners with powerful and revenue-based decisions to adopt Biodel AG products. The company will gain some traction with sales to small farmers and gardening hobbyists. But its path to exponential growth is tied to penetrating the big operations. And Biodel AG has the goods to make it happen.

Disrupting Multiple Large Markets

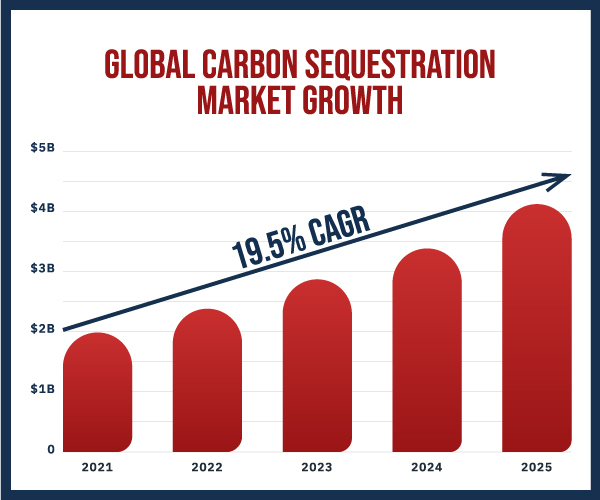

Carbon sequestration is a $2 billion global market growing at a rapid annual rate of 19.5%. There is a pressing demand for carbon sequestration solutions, which opens up revenue opportunities for Biodel AG.

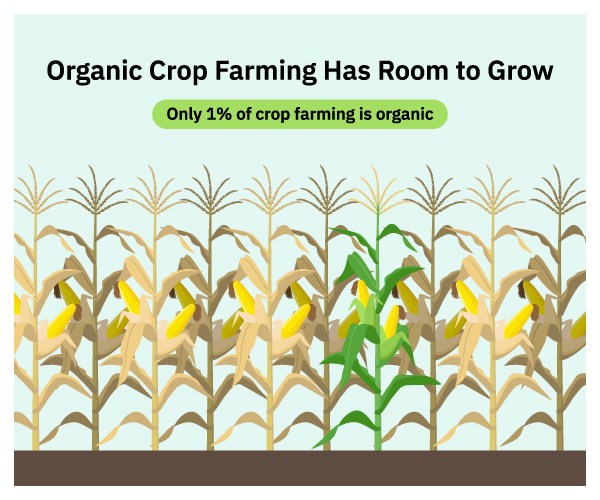

Cyanobacteria’s EPS transforms the salt in soil into biofilms that retain water and promote plant growth. Solving salinity issues allows Biodel AG to enter the $38.5 billion global soil treatment market that’s growing by 6.3% every year. It can also help farmers transition to organic crops. In 2019, more than 300,000 acres of crops across the U.S. transitioned to organic farming. The opportunity is driven by the government. The USDA’s Organic Transition Initiative is investing $300 million to support the transition to organic farming. But only 1% of U.S. land dedicated to crop farming is organic. Biodel AG has a huge opportunity to position itself as a support mechanism in the transition to organic farming.

A Cream of the Crop Team

A product that can serve different markets is good. An experienced team that can execute in these markets is even better. Ben Cloud, founder and CEO of Biodel AG, led a farming enterprise of 250 employees in the production of crops like dates, cotton and grain for 17 years. He also managed the production of rubber in Arizona before starting Biodel AG. His extensive industry experience is crucial to understanding market needs and connecting with potential clients.

Léa and I were also impressed with the company’s chief financial officer, Michael Kirksey, and the detailed financial projections for the next five years that he showed us. The Biodel AG team is supported by an exciting set of board members. Some are executive managers in the agricultural industry, while others are making introductions to help Biodel AG get business opportunities. In fact, our last Zoom call with Ben and Michael happened right before Ben hopped on a plane to visit a potential customer. The meeting was facilitated by a board member. And the board member was joining Ben for the visit.

In multiple conversations with Biodel AG, Léa and I were impressed by both the team and its vision. Biodel AG is following a set growth strategy that will hopefully turn into significant revenue.

Let’s be clear. There are significant risks here. Biodel AG is trying to convince an established industry to change its ways. Since farmers will be forced to adopt new farming practices because their water supply will be dramatically reduced, Biodel AG is perfectly positioned to bring its product to market. But that doesn’t mean large farmers and landowners are happy about the situation. They’ve been doing business a certain way for decades. And it takes time for change — even forced change — to take hold.

That said, Léa and I believe the risk-reward profile justifies investing in Biodel AG. Its products promote plant growth, retain water and remove salt from soils — all while sequestering carbon and giving farmers and large landowners access to the carbon credit market. It is a complete solution to solve today’s most pressing agricultural problems. And we believe the timing is right for adoption.

Deal Details

Startup: Biodel AG

Security type: Convertible Note

Valuation cap: $25 million

Minimum investment: $250

Where to invest: Wefunder

Deadline: January 20, 2023

How to Invest

Biodel AG is raising capital on Wefunder. If you don’t already have an account with Wefunder, you can sign up here.

Once you’re logged in, visit the Biodel AG raise page. Be sure to review the deal page and offering documents thoroughly before making an investment. When you’re ready, click the red “invest” button. Enter in the amount you want to invest, starting as low as $250, and then move through the required steps. Make sure that your investment is confirmed, and then you’re good to go.

Risk

Startup investing is inherently risky, and startup investors should expect to hold their investments without liquidity for five to 10 years. Never invest more money than you can afford to lose.