Everybody is worried about soaring oil prices. But I’ve been watching another resource that’s in high demand: lithium.

Its price has shot up 434% year over year, leaving oil in the dust. Users are beginning to panic. In April, Elon Musk tweeted that lithium prices were hitting “insane levels.”

“Tesla might actually have to get into the mining & refining directly at scale, unless costs improve,” he said.

But for costs to improve, one of two things needs to happen. Either supply needs to significantly increase or demand needs to flatten or decrease.

It’s hard to say which is more unlikely.

Lithium demand has been fueled by the increasing use of lithium-ion batteries in smartphones and all kinds of other consumer electronics.

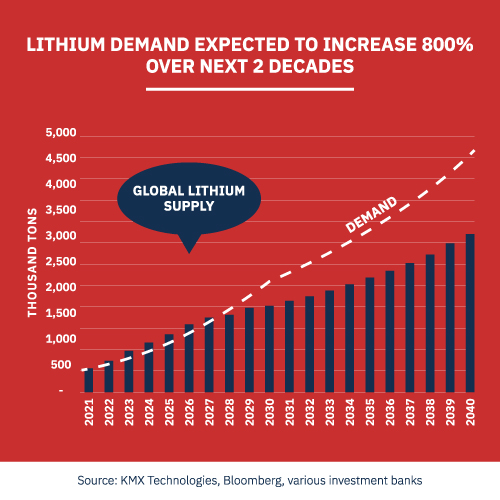

Electric vehicles (EVs) are also major lithium users. Credit Suisse says that EVs will account for 40% of passenger vehicles in the world by 2030. Today it’s 5%. And growth will continue to accelerate into the 2040s. In Europe alone, some prognosticators expect lithium demand to increase by a whopping 20-fold this decade. Worldwide, demand should increase by at least 800% over the next two decades.

As for supply, we shouldn’t expect any quick fixes. During the last decade, investment in new mining capacity became sluggish as lithium-ion battery prices fell. Even if investment picks up today, it’ll be years before we see the results.

Thank goodness we have good ol’ government to fall back on. This is exactly the kind of situation where we need governments to enact regulations that incentivize production, right?

If only it were that simple.

Instead, regulations are being issued that significantly raise compliance requirements for lithium production. The EU has taken the lead on this front. It’s recently announced strict carbon dioxide footprint limits on the lithium-ion battery supply chain — including lithium production.

The EU is not making lithium production more difficult for the fun of it. We need more production. But we also need cleaner lithium production. Traditional lithium production methods do serious damage to the environment.

There are two ways to look at this. You could argue that public policy is (needlessly and wrongly) hampering private sector efforts to raise lithium output. Or you could argue that the EU is doing the right thing in leaving it up to the private sector to develop a cleaner technology that also allows for more production.

As far as I’m concerned, that’s a no-brainer. In handing matters over to the private sector, the EU has turned a big problem into a big market opportunity. Not surprisingly — given the size and growth of the lithium market and Europe as its key driver — startups are on the case. Several are developing and testing new potentially disruptive technologies.

Here’s what the technology needs to accomplish:

- Lower carbon and environmental footprint by cutting down on CO2, other harmful emissions and water usage

- Deploy more rapidly than traditional methods (which typically involve waiting two years for a salt lake to evaporate or a mine to be developed)

- Save producers money in either the purchase of the equipment or its operation (or both)

- Dramatically improve productivity

- Prove product/market fit by being in the final stages of contract discussions with prospective users or — even better — already having signed contracts

- Provide superior performance and functionality that’s far ahead of the competition.

My search turned up a half-dozen companies. All of them were in various stages of developing direct lithium extraction (DLE) technologies. But only one checked off all the boxes: KMX Technologies.

Lithium Extraction Basics

DLE technologies use filters, membranes and other advanced materials incorporated into sophisticated systems that extract, separate or concentrate lithium from the brine found beneath salt flats.

KMX uses a DLE “amplifying” technology that works with all DLE technologies. KMX achieves a complete separation of particles (lithium and other material) and water. At that point, the raw lithium can be concentrated before being turned into battery-grade lithium.

To understand why startups have focused on DLE to disrupt lithium production, we need to take a step back and understand where lithium comes from.

Lithium is found in low concentrations in the hypersaline brine beneath salt flats, salt lakes or salt ponds and in “hard rocks” called pegmatites. Processing brine from large evaporation ponds (typically the size of several football fields) depletes the aquifers of salt lake basins and impacts the environment in predictable and unpredictable ways.

Both brine processing and hard rock lithium mining require large amounts of energy. It’s estimated that hard rock mines and evaporation ponds generate emissions of about 5 to 15 tons of CO2 per ton of lithium produced. And they also use prodigious amounts of water.

500,000 gallons of water are required to produce just 1 ton of lithium using these standard extraction methods. DLE technologies offer a much smaller footprint with clear environmental advantages. The potential is there for the technology to become a game changer. But it first has to solve its own water problem. Current DLE technologies also need lots of potable water.

Checking All the Boxes

So — with this background in mind — let’s go through the checklist again and focus just on KMX.

- Environmental Impact: Unlike conventional processes used in mechanical evaporator and mechanical crystallizer technologies, KMX’s thermal osmosis technology (using hydrophobic membranes) doesn’t require water to boil. So it’s less energy- and carbon-intensive. That was a critical factor for the two companies KMX is closest to landing contracts with. One, Cornish Lithium, seeks “environmentally sustainable extraction of lithium” as the country where it operates (the UK) “moves towards a zero-carbon future.” The other company, CleanTech Lithium, aims to “produce material quantities of battery-grade lithium by 2024, with near zero carbon emissions and low environmental impact.”As for needing ample amounts of local freshwater, KMX’s technology creates distilled quality water as part of its lithium concentration process. Lithium mining companies benefit from the water KMX recovers. The company has, in effect, conquered the water problem. And that gives it a key advantage over other lithium concentration companies. To my knowledge, no other companies have figured out the water problem.

- Rapid Deployment: KMX’s technology can be rapidly deployed by setting up small decentralized systems as well as trailer-like systems. Its modular design allows systems to easily scale from 10 gallons per minute to several hundred gallons per minute.

- Cost Savings: According to the company, its technology saves around 30% of capital and operations expenditure.

- Better Productivity: KMX says its technology results in a 500% increase in productivity over traditional mining methods.

- The Right Product at the Right Price: This is not always clear at a pre-revenue stage. KMX plans to offer long-term leases of 10 years paired with structure fees that should provide its users with a roughly 30% rate of return. This approach should prove enticing to prospective users such as Cornish Lithium and CleanTech Lithium. Both could be signing long-term leases following upcoming demonstrations.

- A Better Solution: KMX offers lithium producers a way to comply with stricter environmental regulations while also providing cost and productivity advantages. There’s an awful lot for producers to like here.

This is one of the more long-lasting market opportunities I’ve come across. A supply shortage is just around the corner. And like the price of oil in the 20th century, the price of lithium is likely to keep rising relentlessly over the coming decades.

KMX Chairman and CEO Zachary Sadow rightly views lithium as a multi-decade market opportunity. KMX is primed to take advantage. It has effectively separated itself from a group of young companies hoping to leverage this opportunity into several decades of increasing revenue streams.

P.S. I’ve uncovered an “insider trading”-like clue you shouldn’t ignore. In March, KMX reduced the number of shares offered for the current round. It’s perfectly legal but a curious move nonetheless. It’s not often done. Usually, the more you raise, the better.

So why did KMX do it? I have no insider information to share. But this is my educated guess. A good reason for KMX to limit shares now is if it thinks it can sell more shares later at a much higher price. In its announcement, KMX cites “unfolding market and commercial developments” and “potential upcoming company catalysts.” There’s no other explanation from the company except that it “would be positive for the company’s long-term outlook.”

So all we know for sure is that something positive is afoot. And the company feels so good about it that it’s limiting how much it can raise. More tailwinds blowing KMX’s way? Or a significant deal about to go down? Again, I have no way of knowing. But I know a positive signal when I see it. To this investor’s ears, it’s ringing loud and clear. And it’s yet another reason to invest.

Deal Details

Startup: KMX Technologies

Security type: Common stock

Offering maximum: $1,069,999

Share price: $1.49

Valuation: $40,086,294

Minimum investment: $99.83

Investment portal: Netcapital

Deadline: August 5, 2022

How to Invest

Go to the KMX investment page on Netcapital. Be sure to review the KMX raise page and offering circular thoroughly before making an investment. If you don’t have an account on Netcapital, you’ll be prompted to create one. Then follow the steps and fill out the required information. It shouldn’t take more than a few minutes. Then click on the yellow “Invest” button. The minimum investment for this deal is $99.83.

Now choose the payment method that works best for you to transfer the funds. Your money will be held by an escrow agent until the deal closes, when it will be transferred to KMX, and you will officially own a piece of this exciting, innovative company.

Risks

This opportunity, like all early-stage investments, is risky. Early-stage investments often fail. KMX might need to raise another round of funding in a year or two, if not sooner.

If it executes well, this shouldn’t be a problem. But that’s a risk worth considering when investing in early-stage companies. The investment you’re making is NOT liquid. However, Netcapital does allow secondary trading on its portal after a holding period of one year for retail investors. It might be less for accredited investors. Expect to hold your position for five to 10 years. An earlier exit is always possible but should not be expected.

All that said, I believe KMX offers an attractive risk-reward ratio.