Most American investors can’t take advantage of some of the best markets and most explosive growth opportunities just because they’re happening outside the U.S.

So we’re forced to seek workarounds.

We can invest in shares of non-U.S. companies through American Depositary Receipts (ADR). I’ve done that countless times. They’re listed on American public stock markets. But the variety of companies is limited. Most of the overseas companies that do this are very large. The vast majority of my investing has been in overseas telecom, mining, big energy and only a scattering of companies in other industries.

Or we can invest in country-based ETFs. But those have the same problem. Many only follow large-cap companies. It’s much harder to find ETFs that follow mid-cap and smaller companies.

Or we can invest in a U.S. company whose sales are soaring in an overseas country or two. That’s why I invested in YUM Brands about a decade ago. It was killing it in China. Too bad that investment was also dependent on how YUM did in the dozens of other countries it was operating in.

For investors who like to go where the action is, this situation stinks. My frustration with this was one of the major reasons why I started my own company in southeast Asia. For 10 years, it scratched my itch to get in on great opportunities outside the U.S.

I did pretty well over there. I just wish I had had more money to invest in the opportunities I saw in Asia. I could have done so much better.

And that’s my message to you today…

You could be making so much more money if you had a safe and simple way to plug into fast-growing entrepreneurial opportunities overseas.

And now, you have that safe and simple solution thanks to a one-year-old company called Untapped Global. (By the way, Untapped Global and Untapped Invest are the same company. Untapped Invest is its legal name. And Untapped Global is its DBA [doing business as] name.)

Untapped Global “taps” into low-risk, healthy-growth entrepreneurial opportunities (in water pumps, solar panels, motorbikes and other sectors) in emerging economies. And it provides investor access to these exciting non-U.S. opportunities.

Untapped Global aggregates massive amounts of data in order to measure risk and accurately forecast revenue streams. Unlike banks, its due diligence is forward-looking. Rather than focusing on what the loan applicant has made in the past, Untapped Global is concerned only about what it can make in the future. Untapped Global reins in risk by tracking revenue as it’s occurring.

Mind you, this isn’t anything new. Uber does the same thing in tracking the revenue its drivers make. Square and Pipe do similar things in the U.S. But Untapped Global has turned this capability into an incredibly effective risk management tool in emerging markets. And that’s unique.

Untapped Global’s ability to collect and decipher data in real time played an instrumental role in signing up 20 overseas “operating partners.” Each partner had data from recent and current (at the time) operational activities, indicating positive and sustainable trends in sales. And Untapped Global uses that data to make investment decisions.

Untapped Global takes note if some of its operating partners are more established than others. If a company is well-established and growing — with lots of data validating its growth strategy — it will get a nice-sized check right away. If it’s a fairly new and small company with limited data that points to promising growth, it gets a smaller check. These checks vary in value, but they’re usually less than $100,000.

So let’s say a company receives $75,000. If it does well in the following month, its check size doubles to $150,000. If it continues to meet performance expectations, it gets another check a couple months later for $300,000. Six months in, if the data shows it has continued to thrive, it gets a check for $3 million.

What I’ve just described is a real example of how a motorcycle company proved to Untapped Global that it deserved a significant investment.

Now consider that for every $1 million, the company makes an average of $124,000. With a $10 million bankroll in hand this year, Untapped Global should make $1.24 million. If it disburses $20 million this year — a distinct possibility — it will earn $2.48 million. About 9% of that goes to the capital providers who buy Untapped Global’s promissory notes (to capture a 9% interest rate). The rest — or $115,000 for every $1 million of capital disbursed — flows into Untapped Global’s coffers.

So who benefits in this arrangement? Everybody. Here’s how.

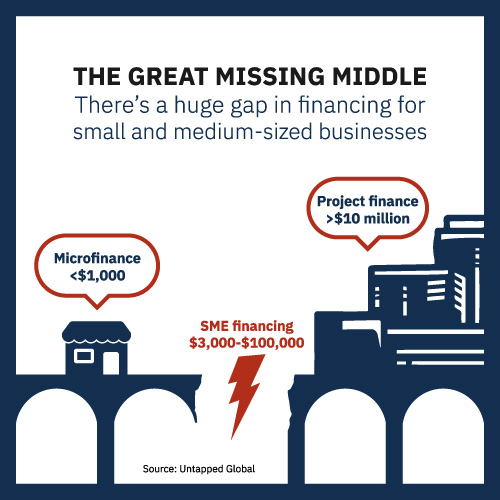

The operating partners: Untapped Global’s operating partners get access to growth capital that’s available nowhere else. It’s extremely rare in emerging economies to access business loans of more than $3,000 and less than $100,000. It’s the Great Missing Middle.

The individual entrepreneurs: They’re the ones operating the digital assets and doing the actual work. They earn up to 150% of the capital coming from Untapped Global.

Institutional investors: These folks hate risk as much as they love upside. They also find interest rates of more than 5% irresistible. Untapped Global gives them everything they want and avoids everything they hate. It offers notes with rates of 6% to 10%. It uses data-driven risk management methodologies to avoid big losses while identifying assets with the highest probabilities of strong and sustainable growth.

Untapped Global: Its just-in-time live data feed on the assets it’s financed allows the company to make an average of $115,000 for every $1 million of capital invested. The monetization model works. It achieved an annual recurring revenue of $1.8 million in less than a year. And the company is already EBITDA-positive.

Untapped Global investors: You’d be investing in a company that’s investing in overseas companies (its operating partners) that are investing in entrepreneurs who are investing (their sweat capital) in revenue-growing digital assets. Each layer is incentivized to help the next layer perform at an optimal level. That’s a lot of protective layers to ensure your investment pays off.

And it only gets better when you think about all the ways Untapped Global reduces risk. Its data does a lot of the heavy lifting but not all. Untapped Global also keeps its powder as dry as possible — investing just a little at a time in its operating partners. And it writes the big checks only when operating partners definitively prove they deserve them.

While Untapped Global’s cautious disbursement of money effectively limits risk, it also perfectly complements the data the company gets from its digital assets. It knows early — as it’s happening — if and when an asset is experiencing a deterioration in revenue. At this point, it can simply delay future capital disbursement or pull the plug entirely. That’s what I call nimble risk management. Banks can only dream of doing something similar.

Everyone’s interests are aligned — from the bottom (where entrepreneurs have their livelihoods at stake) — to the top (where investors have their money at stake).

Masterminding this ingenious arrangement is founder and CEO Jim Chu. He’s backed more than 50 African investment opportunities from fintech to food tech. That may sound like a lot, but Jim will tell you that it barely scratches the surface of what could be achieved with smarter capital leading the way.

That’s what drives Untapped Global’s mission. And so far, it’s accomplished its mission. Jim has seen enough to know the combination of data working hand-in-hand with local expertise has made Untapped Global’s capital very smart indeed.

The next step is scaling that capital. That will have its own challenges, but the company doesn’t have to do anything essentially different. It just needs more money to grow the business.

That’s where you come in. In my humble opinion, choosing to invest is a no-brainer. You’d be getting a potentially great return from a growing valuation. And if all goes according to plan, you’d also be getting an annual income stream of around 3% to 4% in two to three years. But it doesn’t stop there. Jim plans on giving you a lump sum whenever a sector-specific portfolio is securitized and sold. He thinks the first one could be an e-mobility portfolio.

I’m beyond impressed with Untapped Global’s model. While I was running my business in Southeast Asia, getting my arms around risk was a constant struggle. I knew just enough to avoid a lot of risk and make money from the better opportunities. But I was lucky. Compared to Jim’s system, I was wielding a slingshot.

I don’t know of any other company that’s doing what Untapped Global is in emerging economies. It’s also the first time I’ve seen a company offer “3 in 1” returns: valuation appreciation, income (via dividends) and periodic lump sums.

Untapped Global has opened my eyes to what fintech can accomplish when it’s married to a brilliant concept. And at a $14 million valuation cap, this company has eye-catching upside.

I can’t wait to see what it accomplishes.

Deal Details

Startup: Untapped Global

Security type: SAFE

Valuation (cap): $14 million

Minimum investment: $100

Where to invest: Wefunder

Deadline: March 30, 2022

How to Invest

Untapped Global is raising up to $1 million in this round of funding on Wefunder. You’ll need to sign up for an account there if you haven’t yet.

Once you’re signed in to Wefunder, head over to the Untapped Global raise page. Now enter the amount you want to invest and click the red “Invest” button on the right-hand side of the screen. The minimum investment on this deal is $100.

Risks

This opportunity, like all early-stage investments, is risky. Early-stage investments often fail. Untapped Global may need to raise another round of funding in a year, if not sooner.

If it executes well, this shouldn’t be a problem. But that’s a risk worth considering when investing in early-stage companies. The investment you’re making is NOT liquid. Expect to hold your position for five to 10 years. An earlier exit is always possible but should not be expected.

All that said, I believe Untapped Global offers an attractive risk-reward ratio.