I never thought this day would come. I’m recommending a company that is replacing coffee with a hot beverage that is damn nearly as rich and roasty but a hundred times more healthy.

Listen, I love my coffee. I drink three to five cups a day. I find the whole package irresistible — the flavor, the boost it gives me. I love it with toast, eggs, cereal, cookies and cake.

And I love it strong. When ordering a cup from Starbucks, I ask for an extra shot of espresso.

I love it so much that when my doctor told me many years ago to quit drinking coffee if I wanted to get rid of my heart palpitations, I said no way, doc — I may not have my health, but I damn well have my principles.

But despite my strong predilection for coffee, I like Rasa‘s hot beverages… a lot. I’ve tried four of its 10 flavors: Rasa Original, Rasa Bold, Rasa Dirty and Rasa Calm. Admittedly, it wasn’t exactly love at first sight. It took me three mornings to acquire a taste for them. But once I did, I became a big fan. I not only liked the taste, but also liked the mental acuity and energy it gave me.

I deliberately ran out of my Rasa beverages a few days ago. I was curious — would I miss my new morning Rasa ritual? I drank coffee instead. And I still enjoyed my coffee. But something had changed. Damn it if I didn’t miss my Rasa.

So what makes Rasa different? It’s an adaptogen-rich brew made mostly from twigs and roots. That’s never been done before for the very good reason that the ingredients (by themselves) taste horrible. Rasa’s clinical herbalist had to go through hundreds of recipes to find science-based mixtures that also agree with our taste buds.

Rasa is not only a new drink. It’s a brand-new drink category. It tastes like nothing you’ve ever had before. And that sums up the risk, defensibility and huge opportunity that Rasa presents.

Let’s delve into them one by one.

The Risk: Will Rasa’s Taste Have Mass Appeal?

It’s too early to say for sure. But I’m not the only one who likes Rasa. It has a 4.7 star average customer rating (higher than its closest competitor MUD\WTR). Customers rave about the flavor. Here are just a few testimonials:

- I’m a former coffee addict. I love the earthy flavor. This stuff works better than coffee.

- It smells like chocolate-chip cookies.

- It’s so delicious with oat milk, served cold.

- I crave Cacao Rasa the way I crave a walk in the woods.

There are many more just as enthusiastic as these.

The last new beverage category to break into the big time was kombucha. It’s not like soda and not like juice but, like Rasa, it offers healthy benefits and an unusual flavor profile. It used to be on the expensive side (more so in the early years). A lot of people thought it would never catch on.

They were wrong. In 2021, Brew Dr. Kombucha reported revenue of $259 million. Health-Ade Kombucha boasted revenue of $150 million. And New Age Beverage Corporation, which makes Búcha, generated $52 million in revenue.

As with kombucha, users will want to like Rasa because they know it’s really good for them. Studies have shown that the adaptogens in Rasa help combat fatigue, improve focus, ease anxiety, and reduce short- and long-term physical and mental stress. They’ve been used for centuries in Chinese and Ayurvedic healing traditions. And now they’re finally gaining recognition in the West.

Adaptogen-based beverages could be the next big thing in healthy beverages. And that makes for a very interesting opportunity. So, can Rasa take advantage?

The Opportunity: “We Want to Be Everywhere Coffee Is.” – Founder and CEO Lopa Van Der Mersch

The kombucha market is projected to grow to $10.5 billion by 2027. The coffee market is currently worth $465 billion. If you could divert just 1% of that into a much healthier breakfast beverage, you’d be adding $4.6 billion to the already existing $4 billion adaptogen (food and beverage) market. The size of Rasa’s market is projected to be — at the very least — equal to the size of the kombucha market within the next few years.

Can Rasa become one of the two or three biggest winners — if not the biggest — in this market?

Rasa has given itself more than a fighting chance. It’s a bit early to handicap the field of competitors because we don’t know what companies will emerge as worthy rivals. MUD\WTR is the closest competitor I could find. It’s made with adaptogens, mushrooms and herbs but is more expensive than Rasa’s beverages. Unlike Rasa’s products, it contains caffeine, relies on mushroom ingredients and doesn’t have the variety of adaptogen-based ingredients that Rasa’s products have.

Another company, Four Sigmatic, offers a caffeine-free mushroom blended powder that’s added to coffee and tea. So you’re also sipping caffeine and other stimulants. It’s not the same as Rasa’s products, which rely on adaptogens to increase focus and energy.

The Defensibility: Does Rasa Face Dozens of Competitors?

Usually, food and beverage products come with little if any defensibility. If a new item catches on, you can be sure that a multitude of other companies will offer their version of the product. And why not? There are no patents to prevent other companies from jumping on board the gravy train.

But Rasa is different. It has taken difficult ingredients and developed recipes that make the drinks appealing while giving them specific health benefits, such as energy boosting or calming effects.

It wouldn’t be easy for other companies to replicate Rasa’s formulas. Nor would it be easy to create the breadth of Rasa’s supply chain. Rasa has scoured the world to find its 48 botanicals sourced from 12 to 15 countries. Several of the herbs are very specialized and hard to get. “Grown in the USA” sounds nice. But I prefer Rasa’s commitment to finding the best herbs and mushrooms wherever they are found in order to make the best adaptogen-based beverages.

Rasa Is Winning This Tug of War

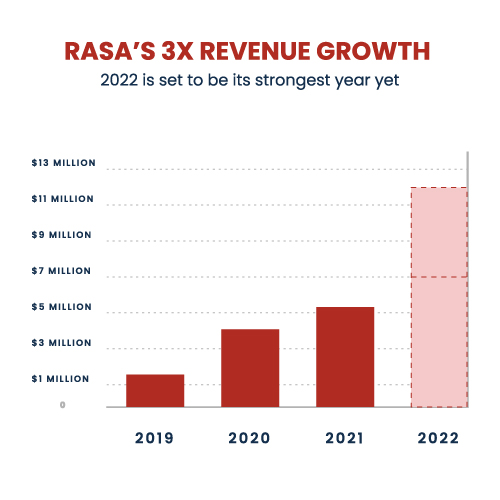

There are early clues that Rasa is winning the tug of war between risk and opportunity. With a tiny marketing budget the size of my thumb, revenue has nearly tripled from $1.9 million in 2019 (its first profitable year) to $5.1 million in 2021. The company has clearly struck a chord in the healthy (sometimes called “functional”) beverage market.

Revenue is expected to reach at least $7 million this year. But Rasa thinks revenue should at least double from 2021’s $5.1 million. If it hires a decent sales and marketing team (that’s what the majority of this raise will be used for) and the economy doesn’t go south, Rasa will more likely generate $8 million to $10 million in revenue. And if all goes according to plan, it’ll push revenue up to $12 million.

Because that plan is about to get far more aggressive. The company is already making a serious push to add customers to its subscription rolls. A new marketing campaign recently generated 14% subscriber growth in its inaugural month — a very nice start.

Rasa is stepping up its activities on several fronts. It’ll be expanding its product offerings with jazzy new flavors similar to its popular Peppermint Cacao beverage. It’s making a serious move into more grocery outlets. It’s laying the groundwork for selling products in several countries, including England, Australia and Canada. And it plans to add a new funnel to its marketing arsenal every three weeks.

Orchestrating all this is Lenny Chase, Rasa’s new head of sales. In his last job, he grew Halo Top’s sales to $350 million in just two years. Lenny has a lot on this plate. Fortunately, he’ll have Lopa, the founder of Rasa, at his side providing guidance and direction. Lopa is an experienced entrepreneur and two-time co-founder. All told, the company has nearly 20 full-time and part-time employees.

Sales to date have been impressive. But the fun has just begun. With most of the hard work on product development behind them, new hires will join Rasa’s sales and marketing unit. Lopa plans on increasing Rasa’s team by around 25% with the funds from this raise. She said that should result in a 500% boost in revenue over the next two to three years. From some founders, that would sound like wishful thinking. But in Rasa’s case, it sounds entirely doable.

The opportunity is real. Rasa’s revenue track record, as brief as it is, also argues that demand is real. And the risk is more than manageable, helped by surprisingly strong defensibility that should keep new competitors at bay.

It’s no sure thing that adaptogen-fueled beverages will be the next big thing. But if they are, Rasa has put itself in a position to capture a big piece of the market… if not the biggest piece.

For this company, opportunity easily trumps risk.

Deal Details

Startup: Rasa

Security type: Preferred Shares

Valuation: $25 million

Share price: $4.49

Minimum investment: $100

Where to invest: Wefunder

Deadline: March 31, 2022

How to Invest

Rasa is raising up to $5 million in this round of funding on Wefunder. You’ll need to sign up for an account there if you haven’t yet.

Once you’re signed in to Wefunder, head over to the Rasa raise page. Now enter the amount you want to invest and click the red “Invest” button on the right-hand side of the screen. The minimum investment on this deal is $100.

Risks

This opportunity, like all early-stage investments, is risky. Early-stage investments often fail. Rasa may need to raise another round of funding in a year, if not sooner.

If it executes well, this shouldn’t be a problem. But that’s a risk worth considering when investing in early-stage companies. The investment you’re making is NOT liquid. Expect to hold your position for five to 10 years. An earlier exit is always possible but should not be expected.

All that said, I believe Rasa offers an attractive risk-reward ratio.