Investments always carry an element of risk. But of all the risks an investor faces, our own minds are the biggest risk of all.

By nature, humans aren’t well-suited for making investment decisions. If we let our instincts control us, we tend to trade based on two emotions – fear and greed.

Instinctually, we get scared when the price of a desirable asset drops and sell (or refuse to buy). When prices soar, we get greedy. That’s because of a different type of fear – the fear of missing out (FOMO).

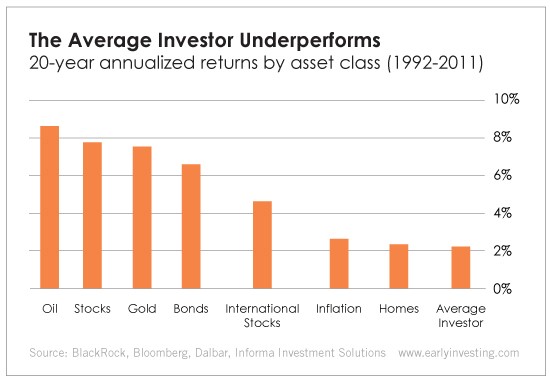

A 2012 study by BlackRock is the best evidence I’ve seen of the effects these emotions can have on investment returns. And the results ain’t pretty.

It shows that over a 20-year period, the average investor returned just 2.1% annually, while the overall stock market returned 7.8% annually.

Here’s an excerpt from the BlackRock report (emphasis mine):

Volatility is often the catalyst for poor decisions at inopportune times. Amidst difficult financial times, emotional instincts often drive investors to take actions that make no rational sense but make perfect emotional sense.

Psychological factors such as fear often translate into poor timing of buys and sells. Though portfolio managers expend enormous efforts making investment decisions, investors often give up these extra percentage points in poorly timed decisions. As a result, the average investor underperformed most asset classes over the past 20 years. Investors even underperformed inflation by 0.5%.

Let’s take a closer look at the first sentence. “Volatility is often the catalyst for poor decisions at inopportune times.”

Indeed it is. Dramatic price swings mess with our emotions and impair decision making. With cryptocurrency being far more volatile than the stock market, it’s even more important to be a disciplined investor.

I’ve cited this study before, because it’s a critical lesson. If we let our emotions control our trading, the results can be devastating.

Harnessing Fear

Instead of giving into fear, you can actually use it to drive better investment decisions.

Here’s what you do. Whenever you’re feeling fearful about the price of an asset you like, step back and evaluate the situation.

- Is the long-term fundamental bullish case still intact?

- Is progress still being made?

- Will the asset still be desirable in the future?

- Are there likely catalysts that should drive the price higher?

- Am I getting a good discount?

If we use bitcoin as an example, I would say yes to each of those questions. The technology is growing by leaps and bounds. Infrastructure is being built out across the world.

Trust in fiat money is dropping. Inflation is creeping up (soaring in some places). Debt continues to pile up.

In terms of bullish catalysts, we have at least four major ones I think are likely to occur:

- Booming institutional demand (we’re at the very beginning of a potential megatrend here)

- Possible reversal of China’s trading ban

- Eventual approval of crypto ETFs

- Looming financial/monetary crises.

Any one of these is enough to send bitcoin and the broader market far higher. If two happen? Three? All four? That would be quite the combination. And I view these events as nearly inevitable.

The bullish case for crypto assets is stronger than ever.

The fearful market is simply reacting to a correction after last year’s incredible bull run. It’s now down around 70%. But the fundamental case is still there – and improving. That’s a signal to step back and evaluate.

You have to learn to see times like these as opportunities to buy the dip. Average into positions (buy low over time). And if you’re bullish, resist the urge to sell when the price drops.

If you don’t trust yourself to judge when to buy the dips, you can use technical indicators, like RSI (relative strength index) to see when the market is oversold.

To learn more about using RSI to hit the dips, read my article “The Simple Technical Indicator for Crypto.”

Bottom line: Buy (and hold) the dips.