Note from Early Investing’s editors: There’s been a lot of buzz about how Silicon Valley may be losing its throne as a startup hub. Factors such as sky-high living expenses in California, the rise of remote work and online startup investing are changing the entrepreneurial and venture capital landscape.

But where will the “next” Silicon Valley be?

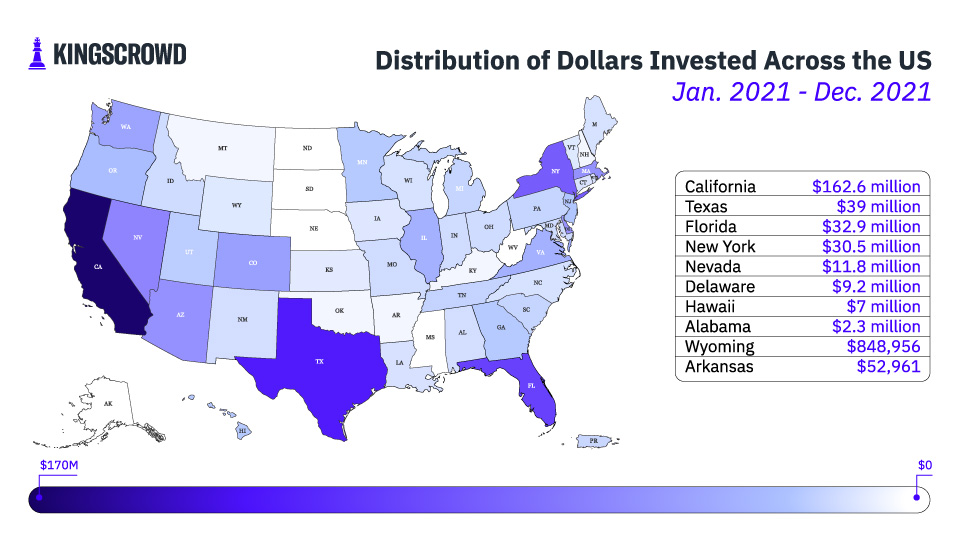

Our friends at KingsCrowd recently examined how online crowdfunding broke down across state lines in 2021. And they found something that might point to where future founders will base their operations. Spoiler alert: it isn’t New York or Florida.

In our last Chart of the Week, we discovered that the home state of startups raising capital via Regulation Crowdfunding in 2021 did not correlate much with the population. Other factors such as laws and taxes attract founders. While the number of online startup deals tells us about the investment opportunities in a state, the amount of capital invested in startups tells us about their quality and appeal to investors.

In this Chart of the Week, we are looking at the amount of capital invested in each state via Regulation Crowdfunding in 2021.

But is there any correlation between a state’s population, the number of startups that come from it, and the amount of capital these startups raise?