Charts are a great way to dive into financial data. They give us an easy visual to help understand financial data and concepts. That’s why, each week, we’re going to send you a different chart about early-stage investing and cryptocurrencies. We hope you enjoy this new feature.

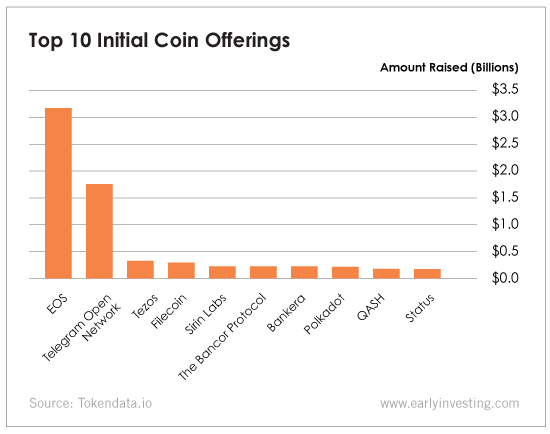

This week’s chart looks at initial coin offerings. An uncertain and unfriendly regulatory environment in the United States has driven most ICOs overseas. But that doesn’t mean American companies – or investors – should give up on them. As the chart above shows, ICOs can be a powerful tool to raise money.

EOS is easily the biggest ICO of all time. This is partly because the ICO is open for 350 days (it closes on June 1) while most ICOs happen over a shorter time frame. And it’s partly because people are excited about the potential of EOS, which is designed for commercially viable decentralized apps.

The second-largest ICO, Telegram Open Network, capitalized on Telegram’s massive user base. The popular messaging platform currently has 200 million monthly active users.

So if you’re looking to invest in ICOs, look carefully and choose wisely. There are good investments out there. But there are plenty of scams too. Act thoughtfully.

And if you’re looking to raise money, don’t rule out ICOs. Consult your attorney. There are ways to go the ICO route – even in the U.S. But you need an attorney who knows how to navigate those waters.