In preparing this month’s issue, we came across an opportunity that just couldn’t wait. (We sent you that information in a special alert on April 3. If you haven’t acted already, we recommend taking a look immediately.) Be sure to watch your inbox for messages titled “New Recommendation.” Often these opportunities are time-sensitive, so don’t count on them being in the monthly issue.

The good news is… we have another exciting prospect for you today. Though it admittedly requires a little legwork on your part. Read on for details.

Get Paid $2,500 to Find Great Startups in Your City

There’s a brand-new and completely unique opportunity that First Stage Investor members can now take advantage of.

If you’re willing to put in a little time, you have a chance to…

- Make some cash

- Learn how to find promising startups on your own

- Give your local economy a boost

- And even earn stock options in the No. 1 U.S. equity crowdfunding portal.

The opportunity I’m describing is Wefunder’s “Scout” program.

Scouts can earn up to $2,500 per company they refer to Wefunder. Top scouts who refer 10 companies per month qualify for a $2,000 monthly stipend. The best are even rewarded with Wefunder stock options after three months of service.

Consider them Wefunder’s boots on the ground all across America. Their purpose is to drive quality companies looking to raise money to Wefunder.

Scouts are paid between $500 and $2,500 depending on how well Wefunder expects the company to do on its platform. It doesn’t matter whether the company ends up doing a successful raise or not. As long as Wefunder rates it as a good opportunity, you’ll get paid soon after the deal launches!

Wefunder is a top-tier equity crowdfunding portal. It’s far and away the leader when it comes to Regulation Crowdfunding deals, aka Reg CF. (These are the offerings where startups can raise up to $1 million per year.)

We’ve known the Wefunder team for more than three years now, and this company is one you can feel good about referring business to. In fact, I’ve referred a number of companies to Wefunder myself, including one of our recommendations, Barrow’s Intense Ginger Liqueur. (I didn’t take any reward, as that could be viewed as a conflict of interest.)

This is a fantastic opportunity for anyone looking to pick up some extra cash, expand their network and accelerate their knowledge of early-stage investing.

Getting Started

First, you’ll need a Wefunder account. If you haven’t signed up yet, you can do so here.

After you’re logged in, go to the Wefunder Scout Program page and click “Apply to Be a Scout.”

Be sure to fill out these fields thoughtfully:

- Why are you interested in being a Scout? Explain that you want to meet exciting startups near you and generate additional income.

- What kind of businesses would you like to focus on? How will you find them? For this question, the answer will depend on you and the area you live in. Are there a lot of tech startups in the area? If not, what industries are nearby that might use equity crowdfunding? Breweries, restaurants, theaters, retail shops? Whatever it is, explain how you plan to network with relevant companies.

My 10 Tips for Startup Scouts

Tip No. 1: Look for companies with growing and engaged customer bases.

Wefunder says around 70% of funds raised come from the startup’s own network (customers, friends, family, business partners). So when you’re talking with a startup, ask if it has an email list. Then ask how big it is and how many people open the emails. (The higher the percentage that open, the better.)

Check the company’s Facebook, Twitter and Instagram profiles. See if its customers/fans interact with its posts. In general, the more engagement a startup has with its customers, the more likely Wefunder will pay a hefty referral fee.

Finding companies that want to raise money will be easy. Finding companies that have what it takes to raise money online is a little trickier, but very doable. A big part of that is a base of fans/customers who would want to invest in the business.

Tip No. 2: Get involved in your local startup scene. Whether you’re in New York City or a small town in Oklahoma, there’s a startup scene where you live. It’s just a matter of finding it.

- Sign up for an account on meetup.com and search for “startup” in your area, then see what kinds of groups come up.

- Find local angel investor groups. Google “[your largest nearby city] angel investors.”

- Search the web for “pitch events” in your area. For example, I would Google “Baltimore startup pitch event” or “Baltimore pitch event.” These events bring rooms full of startups looking to raise money – perfect candidates for referrals.

- Search AngelList for promising startups in your area.

Getting involved with local startups and small businesses can be a very rewarding process in and of itself. You might find new business opportunities or partners, or you may even find a job. The Scouts program simply provides a nice monetary reason to explore your local scene.

Tip No. 3: Explain to startup founders how powerful it can be when a company’s customers turn into investors. Having hundreds, even thousands, of these individuals backing their company will drive word-of-mouth marketing, bring repeat customers and boost the business in countless other ways.

Investors can also help with introductions, further fundraising, etc. Having an army of “champions” with a vested interest in your business’s success is an almost unfair advantage.

Tip No. 4: Don’t be discouraged if your first referrals are rejected. Wefunder’s staff knows what a promising startup looks like. If they don’t accept your first few, pay attention to the feedback they give you on why your submission wasn’t accepted. Then incorporate the feedback into the next referral you send their way.

Tip No. 5: Don’t submit poor candidates. Wefunder may fire scouts who continually refer poorly qualified startups. So try to find companies you want to invest in, and go for quality over quantity – companies with fans/customers, revenue and/or a real shot at making it big.

The companies you refer don’t have to be the next Facebook. They could be a popular local brewery or restaurant or a promising local tech company. All these kinds of companies have successfully raised on Wefunder. Try to pick companies that have customer/fan bases that will support them.

Tip No. 6: Become familiar with Wefunder from a company’s point of view. Read the FAQs and review the guides. Be sure to check out Wefunder’s “Raise Funding” page here. It’s full of useful information to use when talking with companies. Don’t forget to read the Q&A section near the bottom of the page. The small amount of time this takes will more than pay off when you’re talking with potential referrals.

Tip No. 7: Take advantage of the training that Wefunder offers. If you’re accepted into the Scout program, you’ll receive emails that contain valuable information and tips. You can even do a one-on-one Skype call with Wefunder staff.

Tip No. 8: Reassure companies that this method of fundraising is 100% legit. Some will find it hard to believe that you can raise money from anyone, not just accredited investors and venture capitalists. You can explain how the JOBS Act of 2012 is what enabled all this to happen, and that it finally got started last year.

Tip No. 9: Don’t be shy. These are entrepreneurs you’re dealing with. They want to find new ways to raise money. Most startups and small businesses today rely on credit cards and short-term loans at 40%-plus interest rates. Equity crowdfunding is a new, superior and exciting way to fundraise. You can be the one who introduces them to a new source of capital with the power to transform their business. And you can get paid handsomely in the process.

Tip No. 10: Be transparent about fees and costs. Wefunder’s fee structure is very reasonable. It charges 4% of money raised and takes 2% of shares sold.

The business will have to pay some legal and accounting fees to have its financials reviewed. However, most accounting and law firms provide significant discounts for new clients and first-time fundraisers. These fees will vary depending on how “messy” the company’s books are.

Total costs range anywhere from a few hundred dollars to raise $100K or less, to $3K to $10K to raise up to a million. Much depends on how much work the founder is willing to do and how expensive a lawyer they want to hire to do their equity contract. (Note that they would have to incur most of these costs anyway if they’re raising money.)

I truly hope some of you go out there and try this. It has the potential to be a great way to pull in some extra income, meet interesting people and expand your professional network.

Equity Crowdfunding Playbook

Part 5: How to Pick the Best Startups

Editor’s Note: This is Part 5 of a 12-part series called the First Stage Investor Equity Crowdfunding Playbook. If you missed the previous installments, you can find them here.

This is the lesson you absolutely can’t miss…

How to pick the best startups.

You need to do a lot of things well to become a successful startup investor. Evaluating a startup’s upside potential is certainly a big one (if not the biggest).

I’ve been vetting startups for years.

A major piece I always evaluate is leadership. (In a later lesson, I’ll discuss the qualities a “perfect” founder has.)

In this lesson, I want to give you early clues to later success outside of what a startup’s leadership brings to the table.

Like a lot of things, it’s often not black and white.

Nor is it always what you’d think.

For example, investing in the most advanced technology… or the product with the best or most features… or the company in the fastest-growing market…

Good things to look for, right? Well, not always.

Lots of things could still go wrong. For example…

Advanced technology doesn’t do you any good if you can’t monetize it. Or, put another way, if it doesn’t address a real need that people will pay for.

The feature-rich product? If a company keeps adding more features to a product, it could be a sign that the product is having trouble “connecting” with customers. Such products can end up being overcomplicated and overpriced while still failing to win over customers.

Hopping aboard a fast-growing market sounds exciting, and these markets draw a horde of opportunistic companies seeing big dollar signs. But are they really solving a problem? Is their solution unique? Are they passionate about what they’re doing?

As an investor, you have to be willing to dive below the surface to examine a company’s true strengths and weaknesses – the very opposite of formulaic investing. It’s not easy, and I can’t give you a single straightforward formula to follow.

But what I can give you are five metrics that will help you pick the best startups.

Product/Technology

I’m not looking for the “wow” factor. First thing’s first: I want to see if the product does what it’s supposed to.

The next level of questions: Does it address the problem effectively (if not addictively)? Does it bring real value to the customer (savings, convenience, pain point elimination, etc.)?

The founders will of course say “yes” to these questions. The more meaningful feedback comes from the customer. Testimonials are okay, but their behavior is the far better indicator.

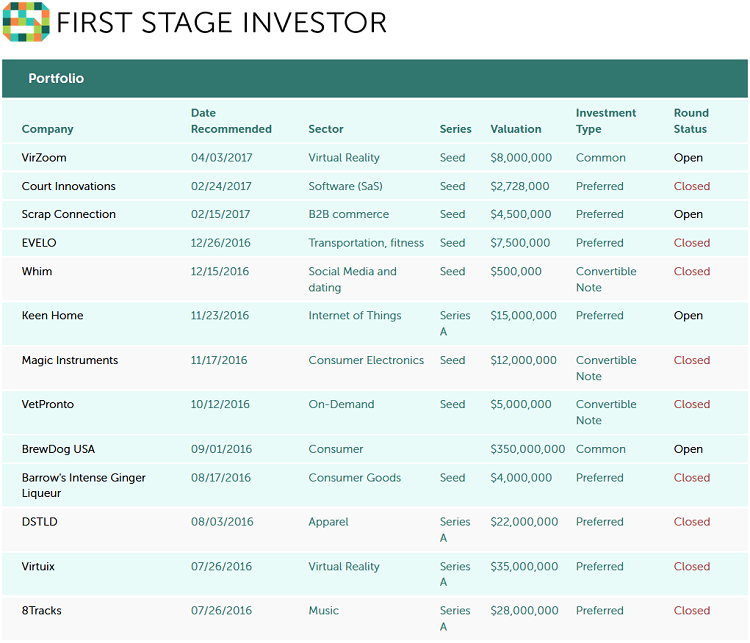

I also look at the return rate. It should be under 2%. For example, Keen Home, a recent First Stage Investor recommendation, boasts a return rate of less than 1%.

Churn rate (or dropouts) should in general be a 5% to 7% annual rate. And the Net Promoter Score (NPS) should be 25 or higher, but varies widely based on market. (NPS is calculated based on responses to a single question: How likely is it that you would recommend our company/product/service to a friend or colleague?)

Defensibility

Keeping encroaching companies and future competitors at bay is key. How long did it take the founders to go from concept to finished product? The longer, the better (unless we conclude that the company is moving too slowly).

Then there are other factors. Patents, for one. How many are filed? Are they approved or pending?

How many iterations did the product go through? Is it still being iterated? How often? The more obsessively a company tweaks its product (and listens to its customers), the better.

Is the skill set of the company’s engineers and developers hard to replicate? You should hope so. One person, chief technology officer of VirZOOM and creator of Guitar Hero, exemplifies this.

Your ideal conclusion? The competition will be limited or disadvantaged by the head start and technical expertise of your company.

A startup ratcheting up sales in the absence of meaningful competition has a far greater chance of success than a company fighting tooth and nail with other startups for a piece of the action.

Scalability

Scaling doesn’t mean hypergrowth. It speaks to a company’s ability to increase sales without increasing costs. Scaling also assumes a big market to grow sales into.

We look at market size and growth as well as global prospects. We like companies that have developed a solution for important, massive and growing problems.

What’s most scalable? SaaS (software as service) and online marketplace companies. The number of people using the software does not affect cost. It can all flow to the bottom line. It’s why portfolio holdings Court Innovations and Scrap Connection were so appealing to us.

Companies that license their technology are also scalable. They get some combination of flat fees plus commission without having to ramp up to meet growing demand. VirZOOM, for example, is determined to license its technology at the earliest opportunity.

Traction

Very rarely do we recommend companies with no sales. All the research in the world does not prevent companies from making a product that nobody wants. (Think Google Glass or Coca Cola’s New Coke.)

I want to see traction. A year’s worth is good enough. But even a few months of rising sales is better than nothing. With typically low numbers starting out, growth should be rapid. It’s a red flag if it’s less than 30%… a yellow flag if it’s less than 100%. Whim, another portfolio holding, had only three months of traction. But it was impressive and a big reason why we developed strong faith in the company.

But the numbers at such an early stage can be deceiving. Companies may be targeting their most promising demographics. Or they may be only selling into the local market, like San Francisco, where so many new products and services get their first test run. But San Francisco is not always typical of the rest of the country.

And models that give stuff away for free can be problematic. How do these companies plan to monetize? Even if it sounds good, it’s all theoretical until the company puts its plans into effect.

In the absence of a track record, any clues you can garner are critical to your evaluation. Pre-orders, pipeline projects and the interest of large clients are some things to look for.

A founder may not have the answers you’re looking for, but a pathway to further revenue growth has to be part of the business plan, even at an early stage.

Valuation

There are two schools of thought here.

- If you really think a company is going to grow into a $1 billion price tag, do you care whether you bought in at $20 million or $10 million?You’re still making mind-blowing profits at the higher valuation, right?

- Valuation matters, no matter how exciting the startup’s upside. Best-case scenarios don’t always occur.What happens if this same startup (above) only grows into a $30 million valuation? At the lower valuation, you’ve tripled your money (or a little less, taking dilution into account). At the higher valuation, you’ve made 50%. Quite a difference.Furthermore, if a company is overvalued, it could have trouble raising money at a higher valuation in the next round. That’s something founders want to avoid because it sends a bad signal to investors and could prevent the company from accessing the funding it needs to grow.

We’re wary of high valuations. It’s one of the big reasons why we recently passed on a robotics company that we liked.

On the other hand, some companies were simply too good to pass up, like BrewDog. It had the recourses and marketing experience of an established and highly successful company and the strategic mindset of a startup. A very unusual company offering a one-of-a-kind opportunity.

A single lesson on how to evaluate startups can serve only as a jumping-off point to a pretty complicated issue. You haven’t heard the last on this topic. We’ll return to it time and again.

(In fact, Adam will be sharing his favorite investing tips with you as soon as next month.)

This lesson gives you a foundation and a framework for exploring a company’s potential on your own.

As I hope you’ve surmised, it’s not a two-minute exercise. It will take time, and it requires insight. The startups you’re evaluating are new, different and relatively untried. They’re also hard, if not impossible, to quantify. There just aren’t enough numbers to crunch.

But it’s not accurate to say these young companies don’t have fundamentals you can measure and assess. There’s plenty to evaluate.

And now you have some of the tools you need to rate a startup’s potential and come to your own conclusions.

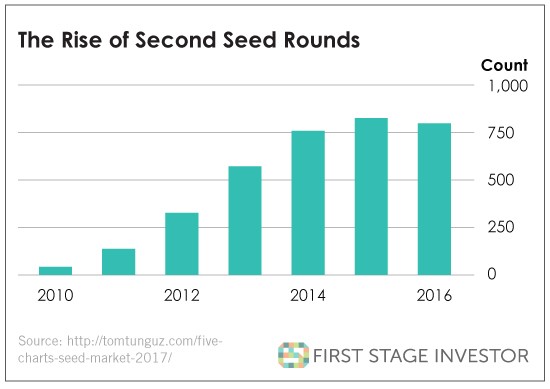

Chart of the Month

Second Seeds Offer Investors More Choice

For the past few years, second seed rounds have been growing in popularity.

As an early-stage investor, you should know what a second seed is… and why you should care. Let me explain…

After a startup has done its first seed raise, it’s usually only a matter of time before cash reserves get low and it needs to raise more money again.

Up until 2010, companies had only one choice: to raise in a Series A round.

Series A companies typically found a market fit and rapidly grew revenue, but it was a problem for startups that hadn’t reached that stage yet.

Potential late bloomers faced a harsh fate. Raising more money from venture capitalists was very difficult, if not impossible. Cut off from their only source of funds, many went under.

A second seed round filled this funding gap. By demanding less of startups, it gave slower-developing companies a much-needed other option.

So when more venture capital began migrating down the funnel from the late stages to the early stages, second seed rounds started taking off around 2011-2012.

Nowadays, about one in three seed rounds is a second seed fundraise.

It’s a win for startups. But how about investors?

I like these rounds. There’s more track record to dissect than is typically available in first seed rounds, yet valuations remain extremely reasonable.

The fact is some startups gear up faster than others. This is where your judgment comes into play.

Is the slow start indicative of poor leadership, a non-receptive market or something more benign?

For example, sometimes it simply takes more time to get a product exactly how you want it.

Given that a growing amount of capital is flowing into these second seed companies, there seems to be little stigma attached to these companies.

In other words, the market understands the role these rounds play.

The rise of second seed rounds is a positive development for both startups and investors.

Portfolio Updates: Three Startups Launch Ambitious Initiatives as Their Fundraising Rounds Close

BrewDog

“We will be opening a brewpub in any U.S. city that reaches 500 equity punk investors or more.”

– One of BrewDog’s many promises

The beer company from across the Atlantic said it would close its round on March 31. But it also said that’s subject to change.

Sure enough, it’s April, and we see the round is still open. We suspect it won’t be for much longer. Then again, the lads from England who head BrewDog – James Watt and Martin Dickie – love to flout convention and tradition. As for rules? They’re made to be broken. So we’ll just have to wait and see what the new fundraising deadline is.

Now they’re directing their considerable amount of energy toward their latest projects. They sure don’t lack for ambition or originality.

That’s what we’ve come to expect from James and Martin. It’s a big reason why we recommended BrewDog. These guys could give a master class to America’s top 50 CEOs on how to think big, take a different approach and capture the imagination of their customers.

And what’s more different than… in their own words… are you ready for this…

“Waking up inside a brewery?”

BrewDog is launching The DogHouse, which they say is the world’s first craft beer hotel and sour brewery. I didn’t bother checking out their claim. I’m trusting my instincts on this one.

I mean, who else would be crazy enough to build a beer hotel? That is, besides the guys at BrewDog, who specialize in crazy?

I’m not at all surprised that it has sparked a huge amount of interest. Nearly 1,500 backers on Indiegogo have contributed $225K to the enterprise, tripling the company’s $75K target. Take a look…

They plan to adapt their beer to serve multiple purposes to please their customers. Beer spa treatments? In combination with hop oils, there’s nothing else like them. IPA on tap in your room? Hey, no room should be without its own keg of freshly brewed beer. Beer-themed meals? Yep, take your pick: breakfast, lunch or dinner. Food pairings with beer? Sure, I’d be real curious about trying this.

Who knew beer was so versatile?

With a bird’s-eye view of the distillery and a minibar stocked with craft beer, I could easily see myself spending a couple of weeks in a room like this…

BrewDog is putting the finishing touches on the hotel’s design. “The features of the hotel and rooms are being dialed in as we speak,” reports the company.

While we wait for the hotel to open, BrewDog is inviting customers to visit its taproom in Columbus, Ohio. Launched in late February, it’s hosted more than double the number of customers the company had anticipated. So BrewDog is busy adding more bars and seating capacity to accommodate the bigger-than-expected crowds.

The company is also reporting progress on the brewing front. Last month, it conducted its first batch tests of Punk IPA. When the company tells us how they went, we’ll be sure to let you know.

If you’re interested in investing, click here to reach the company’s investment page on bankroll.com.

Keen Home

“Having one thermostat is like having one light switch – not enough for one home.”

– From the company’s files

Keen Home still has a few months to go in its fundraise. It has collected more than $2 million so far. We expect it to shut down its fundraising activities sometime in late June.

What made Keen so appealing to us was not only an outstanding product – its Smart Vent – but also the business model it adopted to market it.

Instead of making its Smart Vent compatible with just one major platform – let’s say the Nest Thermostat – founders Nayeem Hussain and Ryan Fant decided to make their product compatible with as many smart product makers and platforms as possible.

The vents work with a number of them already, including Nest, Apple’s HomeKit, Wink’s Connected Home Hub and Lowe’s Iris. Samsung’s SmartThings users can also integrate Echo (the Alexa voice) with Keen’s Smart Vents.

As of late February 2017, Keen also works with ecobee and its smart thermostats. Keen’s new partnership with ecobee helps homeowners automate room-by-room temperature.

Keen is busy shipping another run of pre-ordered Smart Vents to homeowners. It anticipates that all pre-orders will be fulfilled this month (April).

Our investment thesis in Keen Home is playing out as expected. It’s operating in a vibrant, explosively growing market with no competitive products in sight. And its superbly designed “smart” products are making customers very happy, resulting in a return rate of less than 1%.

Keen’s latest numbers: 35,800 vents sold. Dollar amount: $2.6 million. The product is sold at more than 500 Lowe’s stores and 95 Best Buy stores.

For those of you interested in investing, go to its SeedInvest investment page right here and click on “Invest in Keen Home.”

DSTLD

“We’ve always been about working directly with our customers to disrupt the $200 billion fashion industry.”

– From the company’s files

Retail is a notoriously fickle business. But DSTLD is already making its mark with more than $3.3 million worth of merchandise sold last year alone. The company has 39,000 customers and counting.

The company ended its fundraise on February 28. The week before, I had the pleasure of hosting a webinar with DSTLD’s two impressive founders, Mark Lynn and Corey Epstein…

You can check out the webinar here.

DSTLD continues to roll out new products to complement the sales of its popular “three in one” jeans that feature high quality, affordability and enduring fashion.

From T-shirts to belts to purses to hats, it’s building up an impressive array of high-end, low-cost product lines.

This is critical. While the jeans market is large at $15 billion, the $3 trillion global apparel market dwarfs that. Just capturing a fractional part of the market – say, 0.0033% – would give DSTLD annual revenues of $100 million.

Going by my talks with both Corey and Mark, I know that’s the vision they’re pursuing for the company. They’re thinking big. And, so far, they’re executing their vision quite nicely.