Seeing the Long Game in Crypto

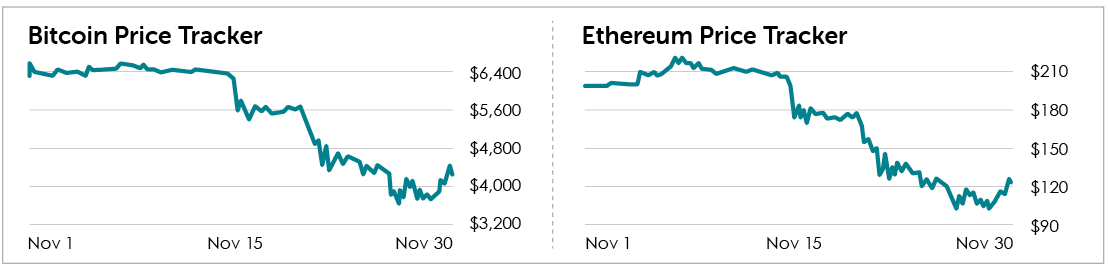

The ups and downs of crypto can be euphoric or nauseating, depending on whether we’re headed up or down. As you know, it’s been the latter this year.

About once a day lately, I get a text or email asking “What’s going on with bitcoin?”

My short answer is that crazy volatility like this is normal for crypto. And bitcoin, at least, has done this many times before. In fact, I’ve been around for most of bitcoin’s big swings since 2013.

My long answer? That’s what I’m giving you today. We’re going to dive deeper into what’s going on in the crypto markets and why I believe it’s

more important than ever to have exposure to them.

My goal is to reassure you that nothing fundamental has changed about crypto’s long-term outlook. I’m going long on crypto. Here’s why.

I believe the chaos we’re seeing in the traditional financial markets (which is likely just beginning) makes the fundamental case for crypto even stronger.

But right now, the turmoil over interest rates, debt and stock valuations is weighing heavily on just about every investor I know.

Usually there’s no correlation between the stock market and crypto market. In fact, my co-founder Andy Gordon has done some great research illustrating the noncorrelation.

But I believe that, right now, general market fears are spreading into bitcoin and the broader crypto market, which has exaggerated this downturn. Because in the crypto world, we have mostly great news.

The last time we had a sell-off this severe, in 2014, it was for a good reason. Mt. Gox, which for a time was the largest crypto exchange in the world, lost the majority of the coins it was holding for investors. It was a disaster.

There is nothing close to that level of severity happening today. The SEC has levied a couple of minor fines. And there’s some fear and doubt surrounding bitcoin cash’s hard fork. But there is no existential crisis like Mt. Gox in 2014.

Crypto exchanges today are large, secure, enterprise-grade operations. The SEC has said clearly that bitcoin and ethereum are not securities. Serious institutional custody solutions are launching soon (Intercontinental Exchange’s Bakkt in January and Fidelity’s Digital Asset Services early next year). Coinbase just completed a round of funding valuing it at $8.5 billion, from a group including some of the best investors in the world.

And we just learned that in Switzerland, a new exchange-traded product (much like an ETF) has launched. It’s the first multicoin asset you can buy through a regular stock account. It includes bitcoin, ethereum, litecoin, bitcoin cash and ripple. American investors can’t buy it yet. But this is a big deal. If it works – and we have no reason to believe it won’t – it should encourage other countries’ regulators to follow suit. That would instantly open up millions of 401(k)s, IRAs and regular investment accounts to crypto.

And the technology is growing by leaps and bounds. Bitcoin’s Lightning Network is up and running, successfully transferring coins in the blink of an eye. Hundreds of developers are building and testing the platform. It’s not ready for serious money yet, but applications to support it are currently being tested with small amounts of bitcoin.

Projects like bitcoin, litecoin, ethereum and cardano are all keeping their heads down and working hard on improvements.

The ethos within the crypto development community is that it’s even more important to make progress during a downturn.

The success of a project depends on how well it can weather storms. Crypto veterans know this rule well. And it creates an environment that values and supports long-term success.

Bitcoin, for example, is a passion project for the vast majority of its developers. Most of them are volunteers because they believe the world needs independent and decentralized money. They see far too much debt and far more wasted government spending than ever before. And they’re not happy about it. That’s what attracted them to bitcoin.

That’s exactly why bitcoin isn’t going anywhere. Its developers are true believers who will continue to improve the technology and product. I think bitcoin will continue to grow (in volatile cycles) until it’s widely accepted as a currency and a global store of value.

Seeing the Long Game

Many people who bought bitcoin during this last bull run probably only did so because it looked profitable in the short term.

They’re not looking at crypto as a potential monetary revolution. They’re looking at it as a trade.

As happened with the internet, investors who see the long game – those who view bitcoin as an asset that will benefit from the coming monetary storm – are the ones who are going to benefit. (Just ask the folks who sold Amazon when the dot-com bubble burst!)

And make no mistake, eventually the bill will come due for all this debt.

Money will be printed to pay it off, devaluing the dollar. This has already begun, as we’re currently borrowing to pay off old debt.

This is why bitcoin is so revolutionary. It’s a new form of sound money, with a hard cap on the number of coins. And each one can be divided into 100 million pieces (each piece being a satoshi, the smallest unit of bitcoin).

The logic of owning crypto is solid. It’s a new form of money, and there’s a very good chance it will eventually rival fiat currencies.

Even if there’s only a small chance of a fiat disaster, it makes sense to own crypto. Personally, I think there’s a strong likelihood of a global monetary disaster, one that will leave most of the world lacking a good way to store and transfer value (money).

So for me, it’s an easy decision.

But even if you believe there’s only an outside chance that fiat has major issues, it still makes sense to hedge a little. It doesn’t take much –

1% of your portfolio would do.

To buy a hedge against monetary disaster so cheaply is a no-brainer. It’s not a perfect hedge, but it’s as good as you’ll find, in my view. (Precious metals are also nice, and I do own some of those, along with stocks and startup equity.)

Most people believe a day of reckoning is still far off. I think it is too. Governments have become experts at kicking the can down the road with no plans to change their ways.

People are beginning to see that every credit cycle brings lower interest rates and more debt. That just increases crypto’s value.

It will take time for all of this to happen, thankfully. That’s why it’s important to try to ignore the short-term noise and price fluctuations. Crypto is a long game.

The foundation for an alternative monetary system is being built before our eyes. There’s a reason big institutions like Fidelity and Intercontinental Exchange are getting in the market. They see the need for an alternative system too, even though they may not admit it outright.

The world needs an alternative to fiat, and that need will only increase over time. That’s the long view on crypto, and I believe it’s the best way to approach this market.

It can be hard to hold this perspective during a bear market such as this. And that’s the inherent challenge of crypto. Holding sounds easy, but in practice… it’s another thing entirely. Adopting this long-term mindset is the way most of us stay focused. I suggest you do the same. ■

Lessons From Amazon

Fast, Faster, Fastest

Learning the Right Lessons From Amazon

In the late 1990s and early 2000s, I heard two common refrains…

The first one was “When are they going to win a damn World Series?”

You see, I grew up in Boston. It’s now the home of champions, but back then, the Red Sox annually broke our hearts and destroyed our souls.

I also heard this one a lot…

“When the heck are they going to earn a profit?”

That question referred to Amazon and its free-thinking founder and CEO, Jeff Bezos.

I’m not sure which refrain was voiced with more disappointment and disgust. It was pretty close.

Today those grievances seem pretty outdated. Nobody’s complaining now. Coming off their fourth World Series championship this century, the Red Sox are the toast of the town.

And Amazon has more than redeemed itself…

In 1997, it went public with a $382 million capitalization. Its market cap now hovers around $775 billion. That’s a gain of 202,780%. And that’s the least of it!

Amazon’s pre-IPO investors enjoyed a much higher return on their investment. In 1996, Kleiner Perkins Caufield & Byers (KPCB) bought a 13% stake at a $60 million valuation. Its profit? An eye-popping 787,000%. That wasn’t even the biggest winner.

In the two years before Kleiner’s big investment, around 20 local angel investors wrote Bezos checks ranging from $30,000 to $50,000. Amazon’s valuation at the time remains a secret. My guess

is that it was half of the $60 million valuation it got a year later, at most.

That translates into profits of at least 1.5 million percent. Not bad. And here’s the thing…

Until recently, Amazon made these supersized gains for its investors while either losing money or generating modest profits.

It’s grown into a gigantic company with a huge customer base. And it did so at a much faster pace than it would’ve had it required a big chunk of its revenue to fall to the bottom line as profits.

Instead, Bezos reinvested revenues into the company’s operations.

This isn’t really new or revolutionary for early-stage (seed, Series A, Series B) or even growth-stage companies (Series B, C or later). “Grow now and worry about profits later” is a conventional strategy that has netted startups prodigious amounts of venture capital.

But Amazon was well beyond those stages. Bezos took a proven startup growth philosophy and made it part of the public company’s playbook.

When you look at the metrics of companies going public now, you’ll notice most aren’t profitable. This is happening despite companies waiting longer and longer to IPO. What these companies tend to have in common is impressive revenue growth and/or a rapidly growing customer base.

This Is Not Growth at All Costs

Bezos’ basic tenets about growing a company have been misunderstood by the vast majority of pundits and talking heads. He’s also misunderstood by founders.

I’ve listened to too many founders who purport to be the next Bezos and want to grow like Amazon. The problem is many of them don’t know what they’re talking about.

Here’s the key thing: Bezos does NOT believe in growth at all costs. He doesn’t ignore bottom-line metrics. And he’s never pursued such a strategy with Amazon.

Admittedly, he doesn’t like the profit metric. That’s fine by me. I don’t like it either. It’s too easy to manipulate.

Like Bezos, I’m a free cash flow guy. I was 20 years ago and still am. This is the cash a company pulls in, pure and simple. Taxes don’t enter into it. Nor do interest payments or many other things. So companies can’t really manipulate it by, for example, paying more or less on taxes or loans.

Not too much to ask, is it? Bezos likes cash flow for another reason that he spelled out in his 2001 letter to investors…

Why focus on cash flows? Because a share of stock is a share of a company’s future cash flows, and, as a result, cash flows, more than any other single variable, seem to do the best job of explaining a company’s stock price over the long term.

Free cash flow is also easy to look up. Yahoo’s finance pages list free cash flow for the past 12 months.

So here’s a rule from my personal investing playbook: Free cash flow shouldn’t be less than one-tenth of the company’s price. It’s one of the most important metrics I use to determine whether a public stock is worth investing in.

Far from growth at all costs, Bezos believes that growth is only meaningful (and investment-worthy) if a company meets these four criteria…

- Customers love the company’s product.

- The company has the potential to grow to a very large size.

- It has or is expected to show strong returns on capital.

- It has a good chance of growing for decades.

If a company has these four features, Bezos says it qualifies as a “dreamy business.”

Notably, Amazon eats its own dog food. The company lives up to Bezos’ definition in all four areas. It’s also worth noting what’s not in Bezos’ definition: a track record of turning a profit; consistent profit growth from year to year over an extended period; low capital costs; and a predictable business.

These are all conventional measures that Wall Street brokers use to determine if stocks are buys or sells. If Bezos gives these traditional metrics short shrift, he does the same in regard to so-called startup metrics. Bezos doesn’t talk about hypergrowth or viral growth or breakthrough technology. At Amazon, he believes that to fight off startups, you need to act like one. And that means, in his words, “It’s always day 1.”

Day 1 embodies everything that gives startups (and startup investing) their big upside. It represents enthusiasm, fast decision making, a willingness to take chances and an eagerness to delight customers. This is a far cry from growth at all costs. Nor should it be grouped with two very different growth approaches. The first is weaponizing costs.

Far from costs being avoided or grudgingly tolerated, in this strategy they are embraced. This is the thinking behind SoftBank’s $100 billion Vision Fund, which writes ginormous checks to companies so they can grow at the speed of light and overwhelm their competitors.

The other alternative approach belongs to Reid Hoffman, the PayPal executive who co-founded LinkedIn and has since joined venture capital firm Greylock Partners. To outgrow and outmaneuver competitors, he advocates that founders under the “right” circumstances should adopt a “blitzscaling” strategy that prioritizes speed over efficiency.

The goal? To be the first to market and the first to scale. But, again, it’s incredibly expensive, wasteful and inefficient. And it’s not for everybody.

The thing these strategies do have in common with Bezos’ strategy is that they all de-emphasize profits. So in a way, and quite inadvertently, Amazon has opened the doors to growth strategies where profit is less important.

As a successful startup entrepreneur (who now runs a corporate empire), Bezos ranks higher than Zuckerberg, Gates and Musk.

If founders say they’re following the path blazed by Amazon, I’m OK with the broad strategy, and I begin with questions about Bezos’ four criteria of a “dreamy business.” The founders better have good answers.

But companies that accept $100 million checks or pursue a blitzscaling strategy? They make me awfully nervous.

Fast is good. Faster is better. But fastest? It gives me whiplash. No thanks. ■

IBM’S BLOCKCHAIN PROBLEM

IBM Has a Centralized Blockchain Problem

IBM believes in the blockchain.

Question is… who believes in IBM?

Blockchains were built as a decentralized alternative to centralized control, be it big government, big banks or big global corporations.

IBM ignored the memo. So did dozens of other big companies. They’re betting on big centralized versions of the blockchain – permissioned blockchain-as-a-service (BaaS) platforms – to carve out a place in the next huge industry.

Software Giant SAP launched its BaaS platform earlier this year, as did Oracle, JD.com and Huawei.

IBM and Microsoft are much further along the curve, though.

IBM launched its blockchain platform in 2017. Microsoft began adding blockchain modules in 2015 and launched its service in 2016.

The initiatives – particularly IBM’s – are breathtaking in terms of audacity and scale.

But the centralized control of at least one of them is scaring partners.

IBM, the acknowledged BaaS leader, recently introduced TradeLens – a supply chain, shipping and logistics platform – in partnership with global shipping and logistics giant Maersk.

Much like IBM, Maersk is a legacy behemoth

in its own right. It’s the world’s largest shipping company. It generated $30.95 billion in revenue in 2017.

Here’s the problem, though. Not everybody trusts Maersk to be an owner/operator/chief decision maker of a shipping platform for everyone – even one governed by the blockchain.

IBM, for the shipping companies, is the more trustworthy partner. And it’s working to become even more so.

Big Blue recently made TradeLens open-source, welcoming everybody to leverage a technology that excels in managing and tracking goods from the time they leave the factory and farm… are transferred to vessels bound for near and distant destinations… and are loaded onto trucks and trains on the last leg of a long journey… to when they finally arrive at the warehouse, factory or retail facility.

Back in the day, when I was a global trader and financier, I had to make sure that all kinds of products – from barrels to containers to heavy equipment that required customized boxing – arrived safely and intact.

Every so often, however, I got that dreaded call from a customer…

“Where is my product?”

That’s when the fun would begin.

I’d call my freight forwarder. And even though I’d used him a couple hundred times before, he would still tell me it would take 24 to 68 hours to get an answer. I’d tell him it’s urgent. He would promise to do his best.

After two or three days, I usually found out what happened. Sometimes, the product got lost… Other times it was damaged. I’ve also had products stuck in customs.

TradeLens turns those days into minutes.

I can appreciate that. It’s a major upgrade that’s long overdue.

Yet it hasn’t exactly been welcomed with open arms. Both CMA CGM (the third-largest shipping company by ship fleets and containers) and Hapag-Lloyd (the fifth-largest) said the Maersk-IBM blockchain solution is unusable.

Reading between the lines? For shipping lines, Maersk is the fox guarding the henhouse.

Cable television has been dealing with this problem for decades, and the results are often not pretty.

In Los Angeles, more than half of the market can’t watch Dodger (baseball) games on TV. Why? Charter Communications, a giant cable system in its own right, owns SportsNet LA, which broadcasts the games. Charter hasn’t been able to convince any other cable operators or DirecTV to carry the games.

Cable disputes aren’t limited to sports. In 2013, 11.9 million Time Warner cable subscribers lost access to CBS in a dispute. And right now, Dish TV subscribers can’t watch HBO.

The point is cable companies are supposed to be “neutral” utilities. But these “neutral” utilities can do enormous damage to competitors by shutting off access. And these “neutral” utilities are more than willing to wield that power.

And that’s now the fear in the shipping industry.

Maersk is the cable company other shippers can’t trust. They need a global shipping and logistics platform the same way TV stations need cable systems to air on. But they don’t trust a fellow shipping company to be neutral in terms of access and pricing.

TradeLens is no DirecTV or AT&T-Time Warner – at least not yet. But it has 100 members and it’s growing.

Participants include port operators, customs authorities, logistics companies and carriers.

They’ll be operating at higher efficiencies and lower costs than their peers – enabling them to offer their customers more bang for their buck and fatter operating margins. IBM has launched other big blockchain initiatives that are doing well – so it’s possible that centralized blockchain solutions can work.

But TradeLens shows BaaS platforms need to tread lightly. The blockchain wasn’t meant to be centralized. And that can sink a lot of projects.

The push and pull of the free market will decide how this competition plays out. ■

GRADING ANDY’S 2018 PREDICTIONS

Andy (“I’m Not an Oracle”) Gordon Grades His Fearless Predictions

I may not be a seer or an oracle. But I am in the predictions business. I need to have a good idea of not just where prices are heading, but also where technology, user and macroeconomic trends are heading. It’s fun. But only if you can accept the fact that you can’t be right all the time.

So how often am I right (according to me, not my wife)? Most of the time? Some of the time? Hardly ever? Gee, I hope not.

To find out, I’m doing things a little differently this year. I’m reviewing my predictions from last year and giving myself a grade. And for those who care about such things, you’ll also find out whether I’m a tough grader.

And in our next issue, I’m going to go back out on that limb with a new set of predictions. A good oracle is like a good battery – always charged up and ready to go.

Let’s get this party started…

Prediction 1: Venture Capital Investments Will Continue to Crash

What I said: The shift to mobile, cloud and software attracted billions of dollars these past few years, but… suddenly new ideas aren’t as plentiful or fresh.

Was I right or wrong? Mostly right. A few mega-deals from mega-funds (hello, SoftBank) have kept the overall funding amount at a pretty high level. But the volume of VC deals is down dramatically. At its current rate, we’ll see a little less than 9,000 VC deals by the end of the year – a level we haven’t seen since 2013.

Score: A-

What I should have said: It’s more of a “downturn” than a “crash.” But, directionally, I was all over this trend.

2018 Corollary Prediction: Fewer and Bigger Deals Will Dominate Venture Funding

What I said: SoftBank’s Vision Fund is leading the charge, investing huge sums in large established unicorn startups like WeWork, DoorDash and Uber.

Was I right or wrong? Mostly right. SoftBank – which hands startups checks for at least $100 million and often more – has been very busy this year. Its latest investments? How about a combined $1.5 billion in Zuma (whose robots make pizzas) and View Inc. (which makes light-adjustable glass). But it’s not just the $100 million and up category that’s increasing. Rounds totaling more than $50 million now comprise more than half of all U.S. VC deals made so far this year.

The overall trend is bigger companies needing and raising more money.

Unicorns have raised $7.96 billion so far this year via 39 fundraising campaigns. At that pace, they’ll set a record by the end of the year.

Score: B+

What I should have said: I should have dropped the “fewer.” There have been plenty of big investments. But in our early-stage space,

the number of deals has gone down this year.

Prediction 2: The Next Hot Technologies Will Finally Meet Expectations

What I said: I’m keeping an especially close eye on robotics, wearables, digital health, genomics and artificial intelligence.

Was I right or wrong? I was more right than wrong. I got wearables, AI and genomics right. But digital health and robotics failed to break out in 2018. A few more details…

Wearables have come on strong, driven by Apple’s success with its watch and the high levels of engagement we’re seeing among smartwatch owners.

AI is all the rage. Companies are adopting AI whether it fits their business models or not.

As for genomics, rapid growth has finally arrived. Advances in the technology, combined with lower prices, are driving a compound annual growth rate of 11% from 2018 through 2022, when the market is projected to reach $23 billion.

Robotics hasn’t broken out yet with a killer product. There’s a reason Google sold Boston Dynamics to SoftBank for around $100 million.

Digital health has shown steady progress. But it needs more investments to reach its potaential.

Score: B

What I should have said: Never before have so many strategic future industries been in the hands of a single duopoly.

I’m keeping a close eye on Apple and Google. They have too much market power.

Prediction 3: Fintech 2.0 Will Continue to Make Inroads

What I said: The new fintech technology is centered on the blockchain. We think it has immense upside.

Was I right or wrong? On the mark.

We’ve written a ton on this. Adam Sharp and I have an abiding belief in the power of blockchain technology to reinvent the global financial system.

We see important progress being made behind the scenes.

Just one example as to why we continue to believe blockchain is a game-changing technology: JPMorgan Chase recently disclosed its plan to use Quorum (its enterprise version of the Ethereum blockchain) to tokenize gold bars.

Score: A

What I should have said: Fintech 2.0 will continue to make inroads but will fail to meet overhyped expectations.

Prediction 4: Big Data and Analytics Will Emerge

What I said: Big data, analytics and AI will have all kinds of uses – from healthcare to industry to advertising – in the years ahead.

Was I right or wrong? It sounds so obvious now, right? But I’m not apologizing. This was actually a debate last year in many circles.

Score: A

What I should have said: The emergence of big data will create a huge backlash over who owns the data and who should benefit from it. ■

BUILDING YOUR CANNABIS PORTFOLIO

Cannabis Investing 101

We’re at the very beginning of a tremendous cannabis boom. Legal recreational cannabis sales in Canada, which began on October 17, are expected to reach between $5 billion and $7 billion in the next 12 months. Markets don’t often go from $0 to $10 billion in a year. These types of events are incredibly rare. Yet this situation is set to repeat itself around the world as many other nations see the benefits of legalizing cannabis.

Among these benefits are…

- Less crime and fewer prisoners

- Less opioid abuse

- More economic growth

- Better medical outcomes for many patients.

In terms of the global cannabis market, I’ve seen credible estimates of $200 billion in annual sales worldwide by 2030. I believe this market will eventually surpass alcohol, which is a $1.35 trillion-per-year global business today. Alcohol and cannabis are both recreational drugs with wide appeal. But over the long run, I suspect the extremely promising medical applications of cannabis will give it the edge over booze.

Canadian Giants

Canadian companies are set to lead the global cannabis market. Their government moved first, and they will reap tremendous rewards. In the U.S., marijuana is still illegal at the federal level. So companies can operate only in states that have specifically legalized it. That’s dramatically hindering access to banking, transportation and other key services that fuel industry growth.

We should call our elected representatives and demand action. The federal government needs to legalize at the national level, or else we’ll fall even further behind.

As it is, Canada is set to take the lead over the U.S. in cannabis production. Because of this, I believe everyone should own at least a few Canadian pot stocks.

Canopy Growth Corporation (NYSE: CGC) looks like the early market leader. It’s raised $4 billion from major conglomerate Constellation Brands, a huge global distributor of alcohol products. Canopy’s stock is currently valued at $11.43 billion, and the company has locked up about a third of Canada’s recreational supply contracts so far.

Canopy also controls a large portion of the Canadian medical market. And that segment continues to grow at a healthy rate, with the number of people signing up for Canadian medical marijuana services increasing by at least 10% every quarter since April 2014. Canopy is now expanding internationally, with operations in 11 countries so far and more on the way. The international opportunity is huge for large producers like Canopy.

Canopy’s partnership with Constellation Brands should help immensely here. Having access to an experienced and expansive distribution team is really going to come in handy.

Other big players in Canada to watch include Aurora Cannabis, MariMed and Tilray. Be cautious with Tilray. It has already had an incredible run-up since its recent IPO. If you’re looking for diversified exposure through an ETF, the big fund is the Horizons Marijuana Life Sciences Index ETF (HMLSF in the U.S., HMMJ in Canada). The expense ratio is a little high at 0.94%, but this is a solid way to buy a diverse basket of pot stocks.

High Valuations

Based on traditional metrics like price-to-sales and price-to-earnings ratios, nearly all cannabis stocks look expensive today. But there’s a good reason for this premium: Investors are clearly pricing in major growth for the foreseeable future.

This is normal for markets undergoing sustained hypergrowth. Look at Amazon, which has always seemed expensive, but continued its amazing growth trajectory nevertheless. Savvy investors were confident it was a good bet, even though it may have seemed too expensive to many.

Cannabis companies will always seem expensive if you look at the last 12 months of earnings. But if you expand your horizon out to five years, you’ll start to see why people are willing to pay such a premium.

Play the Long Game

For most people, I don’t recommend trading in and out of cannabis stocks. The volatility is going to be quite high. Unless you excel at timing the market, just buy and hold. If you want to take some profits along the way, that’s fine. But I would hold on to the majority of your positions.

Holding great stocks is how investors made a fortune on the internet. I believe the same will be true for cannabis. You’re a lot more likely to hold your way to serious profits than trade your way there.

What to Look For

Since the recreational market is just now opening up, we can’t look at past earnings to judge these stocks. Here are some factors I look at when evaluating cannabis stocks:

- Production capacity

- High-margin products (oils, edibles, beverages)

- Strong partnerships

- Cost efficiency

- Access to capital

- Overhead costs.

Of course, leadership is critically important as well. I’m particularly interested in companies run by the founders (as Canopy is). You want to pick companies with charismatic leaders who can attract large investments and partnerships.

I’m extremely bullish on cannabis, and we’ll be providing much more coverage of this space going forward.

Disclosure: I do not own any of the stocks mentioned here. ■

portfolio update

“It might be the most underreported wave of new millionaires in history.”

– Adam Sharp, Angel Investor

A high school kid starts off with a few dollars and is now worth $1.09 million… A former U.S. Marine is now worth at least $30 million… A lifelong libertarian is now worth an estimated $52 million… And (if you’re bold) you could be next…

To learn more, go to www.cryptoassetstrategies9.com. Or call 800.514.5876 or 443.353.4335 and mention priority code GSUIUC00 to take advantage of this special offer.