A few months ago, a founder pitched me on an interesting idea. It involved drinking and a form of bribery, so naturally I was interested. Her company increased attendance to a business event by sending a bottle of wine to invited participants. She claimed that attendance shot up 20% to 50% with her offerings in play.

I liked the idea… but only when applied to paid events. While effective, her idea isn’t exactly cheap. It works best when the price of the bottle can be offset by the price of the event. But for free events, the financial burden is pretty hard to ignore.

In the end, I passed. It was a nice little niche play but no more. Its potential impact was limited. It offered a narrow solution that took advantage of wine’s popularity but wasn’t particularly resonant to its time and place. I suspect the idea would have worked in much the same way 10 years ago.

My point isn’t to disparage this company, but to contrast it with a much more compelling idea from another founder. Both founders want the same thing: to help companies incentivize participatory behavior and increase positive responses. But Chad Hickey — the founder and CEO of Givsly — takes a different approach. His startup gives companies the tools to integrate “giving back” into their marketing and advertising campaigns.

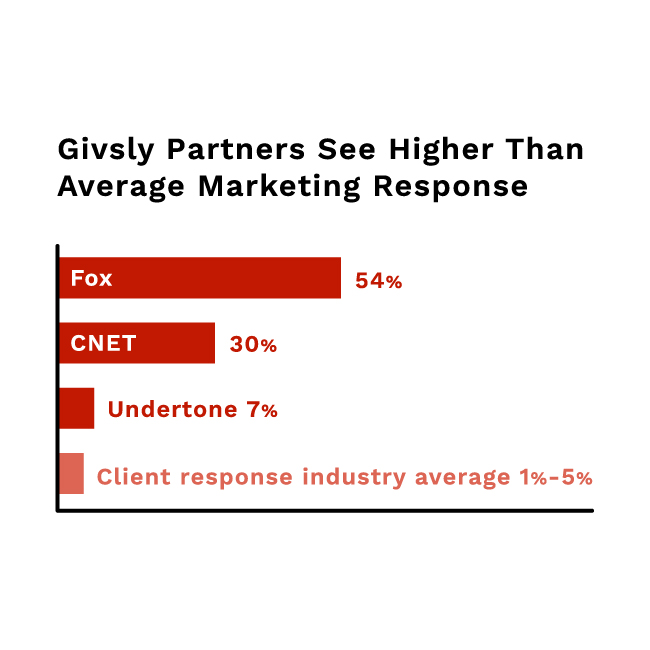

Early evidence indicates that it’s a remarkably effective strategy…

Beyond efficacy, the differences are stark. Givsly’s tech plugs into an impossible-to-ignore zeitgeist. Companies are paying increasing attention to broader issues of inclusivity and sustainability, in addition to ESG (environment, social and governance) criteria.

And, importantly, Givsly’s tech decreases the financial burden for companies. That’s really hard to do. Renting a celebrity is expensive. And unless you get an uber-celebrity, it’s often not worth the money. Giving away swag is old and tired. Who cares? Sharing a slick video is also expensive. And it’s only effective if your audience clicks a button to view it.

And that is the crux of the problem that marketers face. In the vast ocean of ads and notifications that everybody gets on a daily basis, how can companies grab someone’s attention?

Givsly’s answer is surprisingly simple and also very much of its time. When it’s hard not to feel helpless these days, Givsly gives customers a chance to feel good about themselves.

Nobody wants hunger and homelessness in their midst. More than ever, people want to be part of the solution. We hear it every day — in traditional and social media, on talk shows, at our own get-togethers with friends — that companies and individuals need to step up and do more.

Just last month my wife bought a silver necklace for $250. She said the company she bought it from pledged to give $100 to a nonprofit that was helping Ukrainian refugees resettle. As consumers, we want to help give back when we can. And, in doing so, we feel a little bit less helpless in a world that oftentimes feels like it’s under siege.

A Necessary Good

To be frank, I’m not neutral on this issue. I used to think ESG considerations were a luxury. Now I think they’re an absolute necessity. War, famine, plagues, and global warming are not only bad for the world, but they’re also very bad for business.

Practically speaking, for a long time, “giving back” was considered a financial burden. Companies did it for such intangibles as brand building or garnering positive press. Some did it — though reluctantly — out of a sense of “community” obligation.

But Givsly has turned “giving back” into a money-making marketing strategy. So even if you disagree with the growing role that ESG is playing, it should not take away from Givsly’s value proposition. It has created a suite of marketing tools that drive down costs while connecting with customers in new and meaningful ways.

Givsly’s clients have seen firsthand how effective this strategy is. Here are some comments from their customers.

- Thank you so much for making this donation on our behalf!!

- Happy holidays, it is great to be included in an effort to help others!

- Thank you for this opportunity to give!

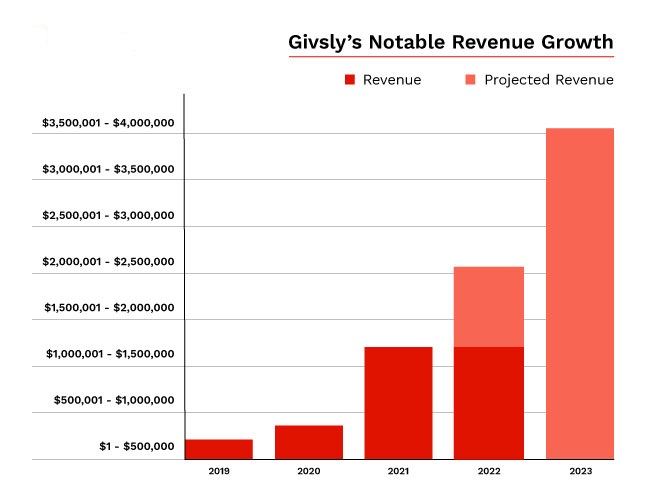

Givsly is nearly doubling revenue every year. It has already reached last year’s revenue total and projects at least $2.1 million in revenue by the end of the year. It has launched its subscription business, charging $7,500 a year. It projects 33 clients will sign up this year, with 69 subscription clients expected to contribute $1.26 million of revenue to a total of $3.55 million in 2023.

Givsly also plans to launch a cool advertising product this July. When the user engages with an ad, it triggers a donation to a nonprofit. Maybelline, 1800Flowers and other companies have already lined up to launch campaigns using this technology. By 2024, Givsly expects around 75% of revenues totaling $10.7 million will be generated from a combination of recurring income (subscriptions) and application programming interfaces (APIs)/advertising. APIs will enable Givsly’s 330 signed-up nonprofits to appear on clients’ own websites and platforms, in addition to marketing and advertising content.

Givsly plans on taking a small advertising tech fee (around $0.35 CPM, or costs per thousand ad impressions) that should quickly add up and become the main driver of revenue growth in the coming years.

Achievable Aspirations

Givsly operates in a huge digital market. Just how big it is varies from data source to data source. If we take the lower end — $20 billion to $30 billion — capturing just 1% translates into annual revenue of $200 million to $300 million. But these top-down analyses can be misleading. If there were 100 companies operating in the space, perhaps capturing one-hundredth of the market would be a reasonable goal. But there are more than 6,000 digital advertising agencies in the U.S. in 2022.

So let’s do some quick back-of-the-envelope math. For the sake of convenience, let’s apply the 20-80 rule and assume that 20% of 6,000 companies capture 80% of a market worth $20 billion. So 1,200 companies are capturing $16 billion in revenue. That’s an average of $13 million in revenue for each company. But let’s assume that Givsly’s aspirations are much greater than being a top 1,200 company in its space. So let’s apply the 20-80 rule one more time, whereby 240 companies are able to capture $12.8 billion. That’s $53 million a year. A buyout multiple of 15X (based on some research I’ve done) would give these companies an $800 million valuation.

Using a bottom-up analysis of its revenue growth trajectory, Givsly is aiming for revenue generation of $32 million by 2025. By 2026, it’s projecting revenue of $70 million. By the way, I got a peek at the numbers that went into that projection. The assumptions — such as rather low conversion rates along with a 65% margin — struck me as very conservative. It’s not a given. But it does seem well within the company’s reach.

Leading Givsly’s charge is Chad Hickey, a proud and experienced founder with an extensive network in the space. He has more than 17 years of experience contributing to the growth of several adtech companies — most notably at Groundtruth (formerly xAd). As chief revenue officer, he helped the company attain yearly revenue of more than $100 million. Chad really impressed me with his knowledge of his industry. His idea would not have worked 10 years ago. But it’s needed now. A handful of companies are employing “giving back” elements in their offerings to clients, but none are doing it quite like Givsly.

Companies are looking for opportunities to implement and display their newly acquired social awareness. With its lineup of fully vetted nonprofits, Givsly makes it painless and operationally beneficial for companies to step up to the plate.

Deal Details

Startup: Givsly

Security type: SAFE Note

Valuation: $10 million

Conversion discount: 20%

Minimum investment: $1,000

Where to invest: SeedInvest

Deadline to invest: July 8, 2022

How to Invest

Givly is raising up to $750,000 in this round. You can invest through SeedInvest. If you don’t already have a SeedInvest account, you’ll need to sign up for one. Once you verify your account and are logged in to SeedInvest, visit the Givsly deal page.

Then click the button to invest. Enter the amount you want to invest, starting as low as $1,000, and proceed through the required steps. Be sure your investment is confirmed, and then you’re good to go.

Risks

This opportunity, like all early-stage investments, is risky. Early-stage investments often fail. The investment you’re making is NOT liquid. Expect to hold your position for five to 10 years. An earlier exit is always possible but should not be expected.

All that said, I believe Givsly offers an attractive risk-reward ratio.