Back in October, Federal Reserve Chairman Jerome Powell made it sound like interest rate hikes would continue indefinitely. “We may go past neutral, but we’re a long way from neutral at this point, probably,” he said.

Translation: We need to take interest rates a lot higher. This “long way from neutral” wording spooked markets. Stocks pulled back sharply, and bonds did too.

However, after the recent market turmoil, Powell appears to be taking a more dovish approach, saying that rates are currently “just below neutral.” My take is that the Fed will probably hike rates in December and then pause at 2.5%.

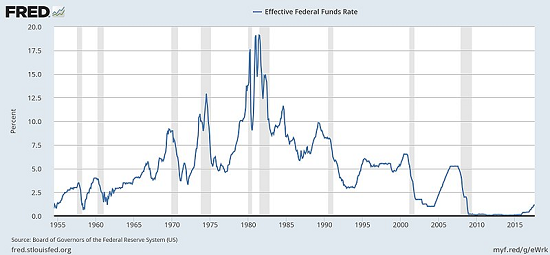

Let’s take a look at a historical chart of the Fed funds rate. Does 2.5% seem “neutral” to you? It sure doesn’t to me…

As you can see, since rates peaked in 1980, each credit cycle has resulted in lower lows and lower highs in interest rates. As we pile on more government debt, we become more dependent on lower rates to keep up with payments.

I don’t believe the Fed will return to a truly normal interest rate level anytime soon. The housing market is too fragile, and if the Fed hikes rates too much, it will be increasingly difficult to finance our massive deficits and pay interest on the debt.

In early November, I wrote an article that summed up my feelings on the matter.

The Fed’s admitted interest rate strategy has been to create a “wealth effect” by keeping rates low, which pushes stocks and other assets up. Everyone feels wealthier, so they spend more.

Will it abandon that strategy now and let the wealth effect fade and reverse? I don’t see it. The pressure on the Fed to loosen rates up again will be tremendous.

If equity and real estate markets get hit hard – which will probably happen if rates get back to 5% – everyone will be begging the Fed to lower rates and eventually restart quantitative easing. CNBC’s Jim Cramer is already screaming at the Fed to pause rate hikes so stocks don’t go down. So is President Trump.

This is the result of many decades of reckless Federal Reserve policy. The temptation to leave rates low and keep the boom going has proven too great time and time again.

I don’t think this time will be any different. The disturbing implication is that if the pattern continues, we may be in for negative interest rates in the near future. Who knows what lengths the Fed will go to to prevent a slowdown. Don’t underestimate it.

Interestingly, Powell’s newly dovish comments seemed to spur the recent rebound in crypto prices. It’s almost as if people are beginning to realize that the Fed’s going to print money to ease its way out of this mess, like it has many times before.

People are beginning to see the attraction of cryptocurrency (especially bitcoin) in such a chaotic financial world. But I do think it will take time to sink in. In the long run, I think everyone will want a way to hedge against such turmoil, and bitcoin is one of the best ways to do that, in my view.

While we wait for that to happen, now is a fine time to add to crypto positions.

Good investing,

Adam