Crash Course: Online Startup Investing Explained

101 – What Is Online Startup Investing?

We hear a lot about “game changers” and “revolutionary changes.”

But most of these “breakthroughs” are marketing hype.

Not this one though.

Investing in private companies online is the most important new market we’ve seen in decades.

And to clarify, I’m speaking mostly about early-stage investments here. This is different than the pre-IPO fund you heard about in our past presentation on the subject. Those are already-established companies, and we cover them in-depth in the pre-IPO report.

What we’re talking about here is the ability to invest in companies when they’re valued from $1 million to $50 million.

It’s simply the most fun, exciting and profitable thing I’ve ever done. After just three years of online startup investing, I’ve personally made both a 12X gain and a 50X, not to mention multiple profits of 5X to 8s. Now, keep in mind that those are only “paper” gains for now. The cash isn’t in the bank yet, but the companies are still growing.

The potential returns from angel-style investing are tremendous. For example, one leading platform, AngelList, is averaging 46% per year across all investments on its platform.

This is an investment class driven by big wins. But you need a sufficient number of investments to have a good chance of hitting a big winner or two. At least 10 investments – preferably 20 or more – is what I recommend.

Now let’s get started.

Due Diligence

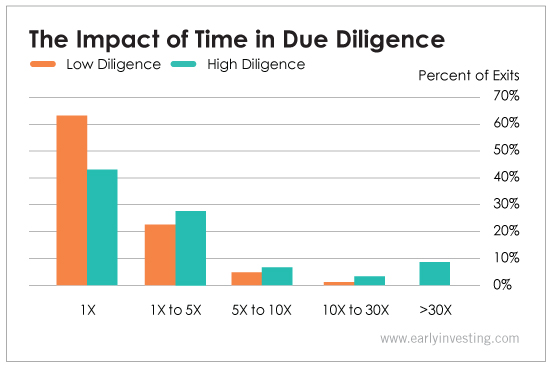

Research means a lot when investing in startups. A study by the respected Kauffman Foundation shows that the more time you spend on research, the better returns you get.

The vertical axis marking “Percent of Exits” above means successful “exit” events when a company is sold or IPOs. The companies that don’t exit typically end in a liquidation event, where investors lose some or all of their money.

The horizontal axis, meanwhile, represents returns. Note how all the gains of more than 30X are made by “high diligence” investors who did 40-plus hours of research per deal.

The lesson: You need to spend more time on research to make the really big gains.

But most people don’t have time to do research full time… which means the research you can do need to be highly efficient. Here are some tips…

Due Diligence Tips

- Don’t be afraid to pick up the phone. If the company has retailers or distributors, call them. Ask how the product is selling and whether customers like it.

- Use the product if possible. Did you yourself like it? If not, ask the company to address the problem or problems you found.

- Search for background details on the founders and investors. Check them out on Crunchbase. It has an easy-to-use database of information on startups, entrepreneurs, venture capitalist companies and all the big individual investors.

How Big?

One of your primary goals should be to estimate the size of the opportunity. How big could the company you’re researching get?

What problem does this company solve? Does the opportunity scale? What’s its unique selling proposition, or USP? How big is the market?

And most importantly: Does the product have value? This is a big one for us. If the product doesn’t satisfy the customer, I don’t like it. Even if the traction looks good.

Frédéric Bastiat said it best in his 1850’s masterpiece, The Law.

If you wish to prosper, let your customer prosper. When people have learned this lesson, everyone will seek his individual welfare in the general welfare. Then jealousies between man and man, city and city, province and province, nation and nation, will no longer trouble the world.

It may sound idealistic, but let’s frame Bastiat’s statement around Google, one of the best tech success stories of all time.

Google offers excellent value to its users. I’ve been using its advertising services since 2005. It’s simply too profitable to ignore. Google enables advertisers to target customers better than anyone else. It’s a beautiful model.

I bought Google’s stock once I realized how good its product was and how much it benefited the customer (me). A symbiotic relationship – where both seller and buyer benefit – is essential for any business that hopes to succeed.

Make sure the companies you invest in actually offer value to their clients – and that, like Google, they offer that value in a better way than potential competitors. (I should add that sometimes “better” simply means “cheaper.”) That’s the key to investing, whether it’s in early-stage or late-stage opportunities.

When possible, check a prospective investment’s online reviews. Beware of “astroturfing” or fabricated reviews. The latter are usually quite easy to spot, especially on sites like Amazon that verify when reviewers have purchased a product.

The due diligence process is powered by elbow grease; a lot of time spent on sites like Crunchbase, Google Trends, Quantcast and Compete; efforts to research the founders and the markets involved; and checking out who your fellow investors are and what their track records look like.

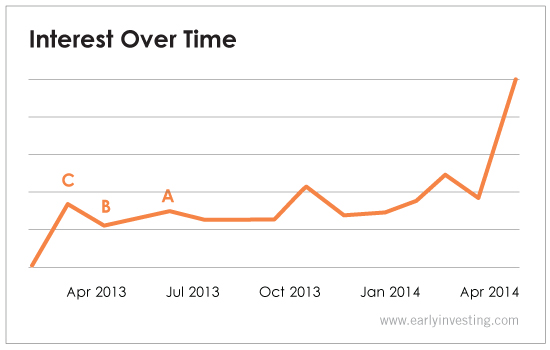

Google Trends, in particular, is invaluable

This chart shows how often people in the U.S. search Google for “SeedInvest,” a company we’ve recommended to subscribers.

As you can see, interest in the company was spiking when we recommended it back in March 2014, and we knew why: great deal flow and publicized recent successes.

By the way, we remain bullish going forward. Two points here: See the Google Trend and figure out why it’s happening.

You can learn a lot about some startups using Google Trends. But business-to-business or very early-stage companies may not have enough search volume to be listed there.

One important note: Trends is better for researching business-to-consumer startups as opposed to B2B ones. Since B2B startups get searched for less, the data Google reports is less reliable. So don’t always consider it a red flag if the startup you’re evaluating lacks traction on Google Trends. Depending on the company, it could be right around the corner or the sample size could be too small for Google to determine accurately.

Great Products Are Usually Affordable

Some investors look at profit margins and ignore everything else. They look at how expensive a product is and how much the company stands to make versus how much its products cost.

That’s an important detail, but only as long as the product is affordable to its customer base, since that’s what can build a big business. If it’s what a customer would consider “expensive,” it’s a bad sign. It’s very tough to get traction with a premium-priced product. And it’s even tougher to maintain that traction.

Not to mention… most companies with high-priced products usually don’t do well in recessions.

In the hospitality industry, for example, discount hotels prosper in tough times and five-star ones suffer.

Startups are even more vulnerable than luxury hotels in recessions thanks to low cash reserves, little revenue and not enough access to capital.

To guard against recessions, we recommend investing in companies that can do well in any environment… startups that can:

- Make their customers money and profit

- Sell consumers a sexy product

- Disrupt an existing industry or create a new one.

Young companies offering better services at lower prices do well in any environment, especially in the B2B world:

- Good economy? That’s good for companies that can increase profit.

- Bad economy? That’s great for companies that can cut costs.

Bottom line: We like companies that offer value to their customers, save or make them money, and offer them something the bigger companies would have difficulty duplicating

Let’s take a look at Wefunder, one of our Startup Investor recommendations, as an example.

It’s one of the leading portals that offer startup investments. And to show that its business model works, it periodically offers shares of its own company on its own site.

The great thing about Wefunder is that it gets 10% carry, or upside, on every investment made through its site.

Essentially, that means it keeps 10% of any profits made on all transactions that go through its site. It brings the deals to the table, screens them, makes sure they’re not selling Florida swampland, etc. I feel like 10% is a fair price to pay for that. Venture capital firms often charge 20% to 30%.

Test the Product!

If at all possible, test the product. Many startups have free trials or samples. If the company has a $5 app, buy it. The experience, whether positive or negative, will tell you a lot about the company’s potential.

If it’s a tech company and you’re not a tech person, ask someone you know to try it out. Or ask someone online. There are discussion forums based around every niche you can imagine.

For example, if you’re considering investing in an online tax-preparation startup, Google “tax preparation forum,” “tax forum” or something similar, then search the posts for your startup’s name.

Convertible Debt

Convertible debt is a common way to invest in startups. The main reason it’s used is because the contract is simple. A convertible debt deal may be five to 10 pages, whereas a preferred equity contract could be 60.

During the convertible stage, companies are typically very young. They may have “seed money” or “friends and family” capital to the tune of $100,000 to $300,000.

Gauging how much a company is worth at this stage is hard. It’s difficult to predict how much traction a company will get over the next year. So some decide to use convertible debt in the hope that their traction gets going by the time they decide to raise again. If that happens, they can sell shares at a higher price. So the second key is that debt financing doesn’t require a valuation of the company.

Here are the main points on convertible deals:

- No hard valuation of the company is set.

- The note will be converted into shares based on the terms of the next fundraising round.

- In return for your early investment, you usually get a 10% or 20% “discount” on the next round’s valuation.

- Convertibles usually pay interest on their notes until they’re converted. Two percent to 8% is typical, while some deals offer no interest.

- If there is a “cap,” that’s the maximum valuation your shares will be converted at. For example, if the cap is $5 million and the round values the company at $10 million, your shares are converted at the $5 million valuation. This essentially gives you twice as many shares as the investors in the next round.

You can learn a lot about a company from its terms. Consider the following:

- “Raising $1.5 million to $2 million”: The company’s goal is to raise at least $1.5 million and up to $2 million.

- “Ten percent discount on next round valuation”: You get a 10% discount on the next round’s valuation or your shares are converted at a “capped” $15 million valuation – whichever is more in your favor.

- “Two percent interest on note”: You get 2% interest on your money until the note is converted.

- “$15 million valuation cap”: This is the valuation “cap,” or max, on the next round of funding. It’s the highest valuation your shares will be priced at.

Fraud Watch – Avoiding Shady Deals

To be clear, I don’t expect much equity crowdfunding fraud. There are plenty of other easier ways to commit securities fraud.

Like it or not, ECF will be a heavily regulated space. A primer on its regulations is necessary to understand why:

- The SEC has a team of eight lawyers, each with teams of staffers, to police ECF deals.

- Every deal has to go through a FINRA and SEC-regulated portal or site.

The primary built-in defense in equity crowdfunding is the crowd itself. The investors and prospective investors will serve as the primary “check” on bad actors.

When you have thousands of investors evaluating a deal, cracks will be exposed. All statements on the deals we recommend are on record and under constant evaluation. And the portals where these startups publicize their fundraisers are another line of defense. The better ones won’t list startups without either well-known entrepreneurs heading them or well-known investors investing in them.

Still, it’s important to be vigilant. I’ve seen a few shady deals listed on ECF portals. Most were removed shortly after posting – but it’s something to be aware of. Here are some other tips:

- Good startups are upfront about their progress; watch out for overly promotional or generic statements.

- Be wary if a company doesn’t say much about its early traction.

- As stated before, research the founders and lead investors, check out their profiles on Crunchbase and AngelList’s sites, and Google them. Search SEC.gov if you’re really suspicious.

The Portals – Where to Invest

There are dozens of portals competing for “deal flow” in the equity crowdfunding space. But only a handful of them consistently offer high-quality investments. Here’s a list of the ones to watch:

#1 – AngelList

One of the original equity crowdfunding sites, it’s widely considered to be the cream of the crop. It’s backed by investors such as Google Ventures, Kleiner Perkins Caufield & Byers, Marc Andreessen and many other notable names.

Needless to say, these guys are extremely well-connected in the startup community. Co-founder Naval Ravikant was an early investor in Twitter, Uber and many other wildly profitable angel investments.

AngelList has the best volume of all the crowdfunding portals at this time. And it arguably has the best quality, too. It should be your first stop.

One of the unique features AngelList has is a place to search for syndicates. A syndicate allows a well-known investor to list a deal on AngelList. In return, he or she gets to collect anywhere from 5% to 30% of the carry.

Key takeaways:

- It involves 5% to 30% carry (i.e., percentage of profits that the syndicate lead takes).

- To get started, you need to back at least one “syndicate.”

- All deals are invite-only now.

- There are 15 deals per week.

- Features extremely well-connected founders.

- It’s used by major angel investors.

As for which syndicate or syndicates to back specifically, most of those featured leads on AngelList are high-quality. You can see the full list here.

The important thing is to just start backing a few of them. You’ll need to apply to each one individually. Make sure you set up a respectable-looking AngelList profile first.

Once you’ve got a few investments under your belt, you’ll start to be invited to more deals. You can pick and choose as you like at that point. Even when you’re backing a syndicate, you always have the option to opt out of the deal.

#2 – Wefunder

Wefunder may not have the volume AngelList does, but the deals it does get are high-quality. It has a close relationship with the well-known startup “accelerator” program, Y Combinator. As a result, it frequently offers YC deals. In fact, it graduated from the prestigious program itself.

But a word of advice: When YC deals go up on Wefunder, the good ones fill up fast. So bookmark the site and check it regularly.

We’ve spoken with Wefunder’s founder, Mike Norman, many times. We recommended the company’s last investment round to Startup Investor subscribers.

Wefunder is now pushing hard into non-accredited deals (accessible to anyone, not just the wealthy). So if you don’t meet the “accredited investor” definition, you’ll definitely want to bookmark this site.

It’s already had a big success story. Zenefits was listed on Wefunder in early 2013 with a valuation of around $7 million. Less than a year later, it had raised money at a valuation of $70 million. And just a few months after that, it raised $44 million at a $500 million valuation.

Today, it’s valued at more than $2 billion.

Investors in Zenefits’ round on Wefunder made 2,000% in a little more than a year.

Key takeaways:

- 10% carried interest

- One to two deals per week

- High-quality startups

- Good team

- Offers multi-company funds around certain themes.

#3 – FundersClub

FundersClub is another portal with extremely high-quality deal flow. It has an impressive track record, boasting a 47% internal rate of return over the first two years of operation (including fees).

The caveat is that it’s rather expensive compared to AngelList and Wefunder. It charges a 10% fee for administrative costs, plus a 20% carry on the deal. If not all the administrative fees are used, the remainder is returned to investors.

FundersClub is a textbook case of getting what you pay for. Its deals are extremely high-quality. And there’s no annual fee on most offerings, unlike with a typical VC.

One thing that’s different about FundersClub is that it refers to each company as a “fund.” Don’t let that confuse you. It only calls them funds because each investment is structured as a separate LLC.

Key takeaways:

- High-quality offerings

- High fees (25% to 30%)

- Great management

- Excellent fund options (you can invest in 10 to 15 startups with a single investment).

#4 – CircleUp

CircleUp is different. It only lists consumer-product companies, such as edibles, electronics, tools, toys and gadgets.

It has very high-quality deal flow. And it’s already had some major success stories, such as SmartyPants, a children’s gummy vitamin. SmartyPants has now completed two raises on CircleUp for a total of $4.7 million. And sales are booming (exact numbers are confidential for now).

The minimums on CircleUp are high – often as high as $20,000.

About Early Investing and Startup Investor

- We are a 100% independent financial research firm.

- We don’t accept compensation in any form from any of the companies or portals we mention.

- We pay our own travel expenses, meals, etc.

- We work only with reputable, well-regarded startup portals,

- We are not brokers, and we do not perform brokerage services.

- We make all our money from the fees we charge for our financial research.