Crypto Market Musings

Bitcoin is soaring. It’s up more than 20% over the last 30 days and up about 5% over the last seven days. It’s trading at $27,928.74 as of this writing. Ethereum is up a more modest 10% over the last 30 days and about 1.5% over the last seven days. It’s trading at $1,771.63 as of this writing.

Unlike other big moves up by bitcoin, this one isn’t lifting the rest of the market with it. Polygon is down more than 19% over the last month and down 7% over the last seven days. Polkadot is down more than 13% over the last month and down about 5% over the last seven days. And Uniswap is down more than 14% over the last 30 days and down almost 4% over the last seven days.

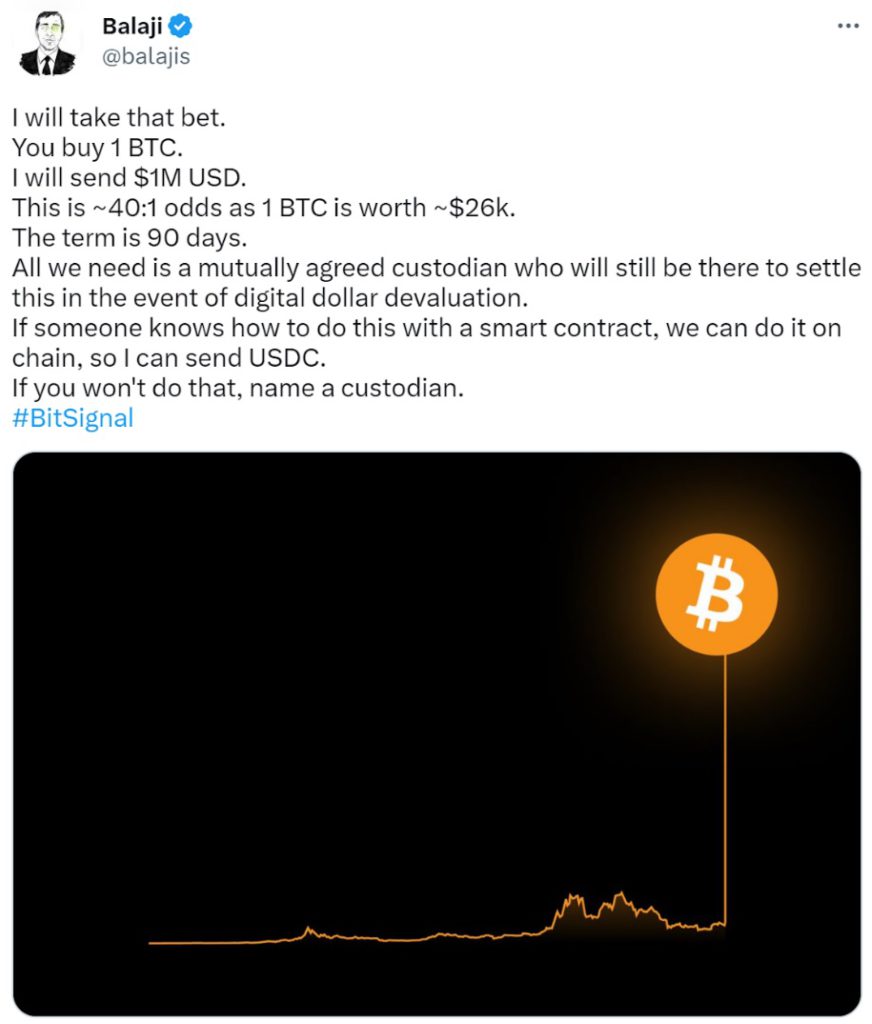

Two things are driving the market. First, people are remembering that crypto — and bitcoin in particular — was created as an alternative to the traditional banking system. And with the traditional banking system in crisis mode, investors are buying bitcoin. The other major factor in bitcoin’s surge is the extremely influential Balaji Srinivasan making a pair of $1 million bets that hyperinflation is on the way and (by extension) bitcoin would hold its value better than the dollar (more on that below).

Srinivasan is highly respected in the crypto space. And his willingness to bet against the dollar’s future is certainly a major factor in this surge.

What Vin Is Thinking About

The Srinivasan wagers are intriguing — and extremely scary. Srinivasan is the former chief technology officer of Coinbase. He was also a managing partner at Andreessen Horowitz and is an extremely successful angel and crypto investor as well as founder. He’s rich. He’s scary smart. And he does his homework. So if Srinivasan says something is going to happen, you need to pay attention.

But what Srinivasan is betting on is pretty scary. To be clear, Srinivasan didn’t propose these bets. He accepted them. Here’s how it went down.

So Srinivasan is betting that the U.S. will enter hyperinflation within 90 days because of a worsening banking crisis and money printing. (I know I’m oversimplifying his argument. If you want a more detailed explanation of his thoughts, you should follow Srinivasan on Twitter.)

Hyperinflation refers to rapidly rising inflation — typically more than 50% per month. If this happened, the dollar’s purchasing power would rapidly diminish. Massive economic upheaval would follow. And it would likely result in bitcoin becoming incredibly valuable extremely quickly.

This is objectively terrible for society. The amount of pain and suffering that hyperinflation would cause is hard to understate. According to Visual Capitalist, the countries with the worst inflation rates last year were Zimbabwe (269%), Lebanon (162%), Venezuela (156%), Syria (139%), Sudan (103%), Argentina (88%), Turkey (85.5%), Sri Lanka (66%), Iran (52.2%), and Suriname (41.4%).

This is a list no country wants to be on.

I don’t believe Srinivasan is rooting for hyperinflation. He’s also not trying to profit off of future misery or game any system or bet. Instead, he’s ringing the alarm bell and saying that this is a distinct possibility if the country continues on its current path. And he wants everyone to hear the bell.

Here’s how Srinivasan characterizes the bet on Twitter:

I believe Medlock will agree that this is an ideological bet… The hyperbitcoinization bet is obviously not a money making bet. It is purely informational…

To allay any question about my motivations, I publicly commit to never selling any Bitcoin for USD unless legally compelled to do so. While I still respect many individual Americans, I no longer have faith in the US currency or banking system.

And Finally…

If you really want to understand how fragile the semiconductor chip manufacturing industry is — and how the world might not be able to survive without Taiwanese plants producing chips — listen to this podcast. In it, the terrific John Dickerson interviews Chris Miller, author of Chip War: The Fight for the World’s Most Critical Technology. The two discuss just how complex chip manufacturing is, why so much of it happens in southeast Asia and how a war in Taiwan could disrupt chip manufacturing and bring down the global economy.