About

Early Investing’s mission is to help its readers find the most promising investment opportunities outside of the stock market.

Our research is focused on two areas in particular: private startups and cryptocurrencies.

Why are we looking outside of the stock market at startups and cryptocurrencies?

- Because every investor needs a diversified portfolio.

- And in today’s economy, you almost have to invest outside of the stock market to generate wealth.

For almost 70 years, the stock market and real estate were the largest wealth generators in the United States. But now, the real estate market is fundamentally broken. And the average annual return of the S&P 500 over the last 21 years has been 6.1%. But that’s not wealth. Or at least not the life-changing wealth previous generations have been able to enjoy.

But startups and crypto can provide returns that far exceed the stock markets. A 100% gain in the stock market is extraordinary and rare. But it’s achievable. But in startup investing, you shouldn’t even invest unless you see the potential for a 900% return.

Crypto also gives investors a chance at big gains. A 10% drop in the stock markets triggers alarm bells and circuit breakers. A 10% drop in the crypto markets is just another day in crypto. Big swings — both up and down — are the norm in crypto. And if you know how to navigate them, the returns can be incredible.

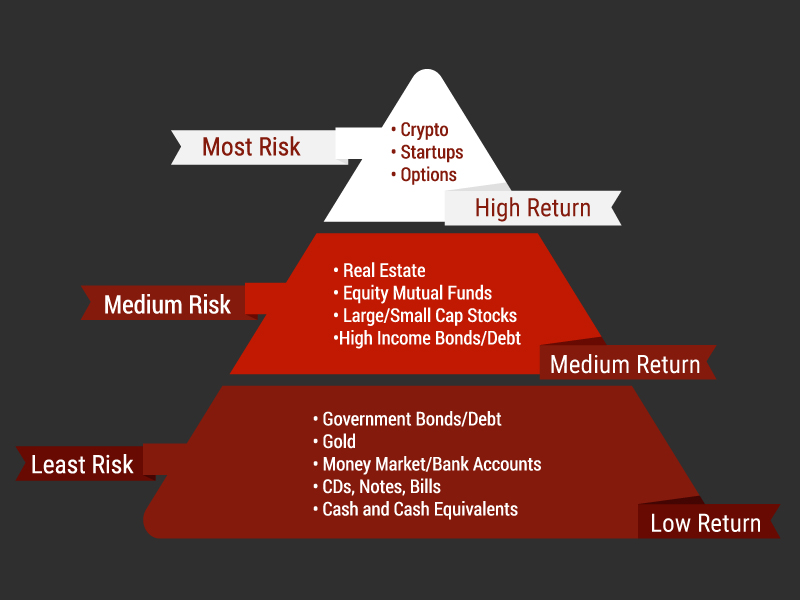

But investing in startups and crypto is inherently riskier than investing in stocks. That’s where the diversified portfolio comes in. Startup and crypto investments should fall in the risk asset section of your portfolio.

You can’t have a diversified portfolio if all you own is stocks. The low-risk investments in the portfolio are yielding virtually negative returns. Inflation is eating up any potential profits. And the medium-risk investments are generating small (but reliable) returns. So you have to look outside of the traditional investment markets for a diversified portfolio that generates wealth.

And that’s where Early Investing comes in. We want you to learn how to invest in startups and cryptocurrencies like a venture capitalist.

We provide both educational material and recommendations on specific investments. And with more than 200,000 readers, Early Investing is a leading destination for guidance in the alternative investment space.

Using our research and recommendations, readers have invested in some of the fastest-growing private companies in the world — including Spotify, Lyft, Dropbox, NowRx and many more. We recommend startups that range from early stage (initial funding rounds) to later stage (more mature, but still private companies).

We also make specific recommendations on cryptocurrencies that we believe have extreme upside potential, and we advise readers on how to buy, hold and safely store their coins. From blue chip “large cap” coins to smaller “altcoins,” we cover the entire market. Early Investing’s goal isn’t for investors to constantly trade in and out of positions. Instead, we want to help you build a portfolio with long-term potential that can handle crypto’s volatile nature.

Early Investing offers several distinctly different newsletters to help investors on their journey.

Early Investing is our free publication. (You will have to sign up for a free account once you hit your five-article limit.) Early Investing readers receive articles and videos that contain high level market analysis, the latest trends in the startup and crypto markets and educational material on how to become a savvy startup and crypto investor.

First Stage Investor is one of our premium publications. We recommend startup investment opportunities to our First Stage Investor members every other week. Anyone can invest in these startups. And the minimum investment typically ranges from $100 to $1,000. Crypto recommendations (mostly larger-cap coins) are dictated by market behavior. We also provide members detailed market and trend analysis, more advanced educational material, portfolio updates and our Startup Insider and Crypto Insider video podcasts.

Crypto Asset Strategies, another premium publication, focuses on small-cap and under-the-radar cryptocurrencies. At Crypto Asset Strategies, our goal is to give investors exposure to the breadth and depth of the crypto ecosystem, including DeFi, Web3, NFTs and much more. We also provide market news and thoughtful crypto analysis in our Crypto Monitor video podcast.