Table of Contents:

Structuring Your Portfolio

The Importance of Altcoins

Long-Term Strategy

Wall Street Boom Catalysts

Why Wall Street Needs Crypto

Why Wall Street Needs Crypto, Part 2 (The Tech)

Recommendations

– Long-Term Play No. 1 (Decred)

– Long-Term Play No. 2 (Nano)

– Long-Term Play No. 3 (OmiseGO)

– Short-Term Play No. 1 (Vertcoin)

– Short-Term Play No. 2 (Ark)

– Short-Term Play No. 3 (High Performance Blockchain)

–Bonus Pick (Draper Esprit)

Buy Bitcoin! How to Open a Coinbase Account

How to Open a Bittrex Account

How to Transfer Bitcoin From Coinbase to Bittrex

How to Buy Our Recommendations on Binance

10-Point Criteria for Selecting Altcoins and ICOs

Structuring Your Portfolio

I’m going to start out with a few notes about how to structure your portfolio to take advantage of the Wall Street Crypto Boom (more on that below). Here’s how I recommend setting up your portfolio:

- 50% bitcoin (BTC)

- 50% altcoins (the most promising competitors to bitcoin).

I’m sure many of you are wondering why I recommend holding such a large chunk of bitcoin. After all, I spend the majority of my time researching and writing about altcoins.

But the reason is simple. I believe that bitcoin is going to lead the charge in this Wall Street boom. Bitcoin is crypto’s first “killer application.” It has been around the longest, has the best security track record and will almost certainly be the first coin heavily targeted by institutional investors. It is an “uncorrelated asset,” meaning its performance isn’t tied to stock markets, foreign exchanges or commodities.

Bitcoin will have the first exchange-traded fund (ETF). And the first regulated custody solutions are being built around it. Bitcoin is “digital gold,” and it acts as a reserve currency for the crypto world. It’s a critical part of every crypto portfolio. Many new investors tend to skip over it in their eagerness to find the “next bitcoin,” and I want to help members avoid that mistake. Bitcoin is as close as we can get to a “sure thing” in the crypto world. I view bitcoin as a “set it and forget it” investment. Just buy it and check back in a few years.

The Importance of Altcoins

With that said, I am certain that bitcoin will eventually be surpassed by another crypto (an “altcoin”). There are hundreds of thousands of people working to make this happen. It’s very possible that the ultimate crypto winner has not even been created yet.

This is where our 50% portfolio allocation to altcoins comes into play. My goal is to help you find the next great cryptocurrencies – the ones with real-world use cases that will attract institutional investors and the ones that have the highest potential for price appreciation.

We target coins that are a tiny fraction of the size of bitcoin but could eventually surpass it. This is where we take our moonshots.

Holding 50% bitcoin gives us exposure to the top asset in this class, while our 50% altcoin allocation offers unparalleled upside. We will continually add promising new altcoins to our portfolio and, over time, I may recommend lowering exposure to bitcoin. But for now, I believe this is the ideal portfolio model.

I am also always on the lookout for publicly traded stocks that offer exposure to the crypto market. But I’m extremely selective with stock market plays, since most of the “crypto stocks” out there lack quality.

We have recommended only one of these so far – a publicly traded venture capital (VC) firm called Draper Esprit. It is a top-tier VC firm, and it has a large stake in Ledger, a leading crypto “cold wallet” company. This is the pick I refer to as a “modern-day Berkshire Hathaway” (with good reason!). You can read more about this pick later in this report.

Long-Term Strategy

The proven way to make money in cryptocurrency is by holding for the long term. As a young market, crypto is volatile. So you should mentally prepare yourself for the ups and downs. The market will become less volatile as it grows larger, but price stability is still a way off.

I have held bitcoin from $84. It went up to $1,200, down to $150, and trades around $6,200 today. As I said, it’s volatile. What we’re experiencing with this current correction is nothing out of the ordinary. The important thing to focus on is that despite these volatile cycles, crypto has always risen over the long term.

Legendary VC firm Andreessen Horowitz describes its crypto strategy (including a $300 million crypto fund it just launched) this way…

We are long-term, patient investors. We’ve been investing in crypto assets for five-plus years. We’ve never sold any of those investments and don’t plan to any time soon. We structured the a16z crypto fund to be able to hold investments for 10-plus years…

We have an “all-weather” fund. We plan to invest consistently over time, regardless of market conditions. If there is another “crypto winter,” we’ll keep investing aggressively.

At times, it will seem like everything is going wrong and the market will never turn around. Pundits will say that crypto is dead. This is normal! It’s happened countless times before. Don’t get shaken out of your positions.

From the launch of this service, I have recommended a dollar-cost-averaging sitrategy. In simple terms, this means buying your crypto assets over time. Buy the same amount on a weekly or monthly basis for an extended period. For example, you could buy $1,000 of bitcoin every month or week for a year. This helps smooth out price volatility. For simplicity’s sake, we don’t use this method in our official portfolio pricing, but I recommend using this strategy if it appeals to you.

I strongly believe that approaching crypto from a long-term perspective is the proper way to invest in this market.

Ultimately, we’re making a bet on a monetary revolution. It won’t happen overnight, but with the institutional infrastructure going into place, I can’t imagine a better entry point. It’s an investment worth making because it could pay off like no other.

Wall Street Boom Catalysts

Today, institutional investors have essentially no exposure to cryptocurrency because, up until now, it has been impossible for the vast majority of these companies to enter the market.

There was simply no way for these companies to buy and store cryptocurrency in a legally compliant way.

Now, however, custody solutions are emerging that will allow institutional investors to buy and store cryptocurrency in a federally compliant manner. Leading the charge on this front are Coinbase, which recently launched its “Coinbase Custody” solution for institutional investors, and Bakkt, a new venture launched by the Intercontinental Exchange (ICE). (Read more about Bakkt here.)

Regulated custody solutions such as Coinbase Custody and Bakkt are a huge part of this building “Wall Street Boom.” Finally, big financial firms will have a secure way to buy and hold cryptocurrency.

The other catalyst we are closely watching is the launch of the first crypto ETF. There are currently 14 such funds awaiting approval from the Securities and Exchange Commission (SEC).

Of particular note is the Van Eck SolidX Bitcoin Trust. This ETF will offer institutional investors direct exposure to bitcoin. We are hopeful that the SEC could approve this offering by September 30. If the SEC continues to delay the launch of crypto ETFs, institutional pressure (big, reputable financial institutions like VanEck – with $50 billion in assets under management – want this) and competitive pressure (the SEC does not want its stakeholders fleeing to Bakkt, which will be regulated by the Commodity Futures Trading Commission) will continue to build on the SEC until it finally opens the floodgates.

And when the floodgates open, they’ll open in a big way. Right now, crypto investment funds have about $7.1 billion in assets under management (AUM), according to Crypto Fund Research. We estimate that 10% to 15% of that would be invested in crypto in the first month once institutional investors are given the green light. That’s at least $710 million of fresh capital that would be injected into the crypto markets.

For me, it is simply a matter of when, not if. The demand is clearly there for a publicly traded way to own crypto. Smart investors are placing their bets now, before the entire world is able to buy bitcoin (and eventually other cryptos) through their brokerage accounts.

Once Wall Street becomes comfortable with owning bitcoin, I believe it will quickly start moving into the altcoin market. And with most altcoins being a tiny fraction of bitcoin’s size (1/100th or even 1/1,000th), institutional money will create moves in them similar to the very early days of bitcoin.

Why Wall Street Needs Crypto

For the first time in history, large institutions will soon be able to easily enter the crypto market.

But astute observers may be asking, “But why will these firms buy crypto?”

First of all, the revolutionary nature of cryptocurrency is finally being realized by these large financial firms. It’s nothing less than a monetary revolution in the making.

At its core, crypto is a popular rejection of “fiat” money issued by central banks. Citizens around the world are getting fed up with inflationary, central-bank-printed money. That’s why bitcoin was created. Its inventor was fed up with the old system, so he created an alternative. Against all odds, the project is succeeding.

Even if institutional investors think there’s only a small chance of this revolution succeeding, they can’t simply ignore it. Right now they have all their eggs in one basket (fiat money). And that’s a problem if (when) there are future monetary crises. And I guarantee there will be no shortage of monetary crises in the fiat world going forward.

Lloyd Blankfein, CEO of Goldman Sachs, explained Wall Street’s conundrum well. Speaking about bitcoin, he said he was “uncomfortable” with it, but also said, “If it works, I say to myself, ‘Hmmm, maybe that was a natural progression from hard money to fiat money to consensus money.’”

“Consensus money” is an interesting – and accurate – way of describing cryptocurrency. Lloyd Blankfein is acknowledging that people have the right to reject fiat and choose their own currency. So while JPMorgan Chase CEO Jamie Dimon and others are flat-out attacking crypto, the CEO of the world’s leading investment bank is taking a more nuanced approach.

Another telling moment came when SEC Commissioner Jay Clayton was discussing whether bitcoin is a security. He said the following about cryptocurrencies, “These are replacements for sovereign currencies – [they] replace the dollar, the yen, the euro with bitcoin. That type of currency is not a security.”

Note the wording. “Replace the dollar, replace the…” Mr. Clayton sees the big picture.

The potential size and scope of this budding revolution necessitate that today’s monetary establishment “hedges” its position with crypto.

These are the more controversial aspects of cryptocurrency. And like it or not, they play a very important role in this movement.

Why Wall Street Needs Crypto, Part 2 (The Tech)

Crypto will go down as one of the most important technological developments in history.

And this is another important side of crypto that institutional investors can’t afford to ignore.

You don’t need a middleman to send crypto. This alone removes a hugely inefficient part of the traditional financial system. In this respect, crypto is a direct threat to many financial institutions. So these financial institutions need to own some crypto as a hedge against their own business models in many cases.

Crypto and blockchain tech are not going away, so savvy firms are working on ways to incorporate them into their businesses. They’re building exchanges, custody solutions, financial products and more.

But cryptocurrency is more than that. It’s also “programmable money.” You can do so much more with it than you can do with traditional money.

Much of the focus here is on “smart contracts.” A smart contract is simply a piece of code used to execute a crypto-based financial transaction.

The largest use of smart contracts to date is in ICOs (initial coin offerings). And here we see the massive potential. I’m going to explain the process briefly so you know how it works and why it’s important. During an ICO, investors send cryptocurrency (usually bitcoin or ethereum) to a specific wallet controlled by the company conducting the offering.

Using smart contracts, investors are sent their newly minted ICO coins in exchange for their crypto. Ethereum was one of the first to complete this process, and it is now the leading platform for launching new ICOs.

This is a radically more efficient compared with a traditional IPO or another “fiat” financial transaction. It cuts out much of the manual labor and relies on tried and tested software to do the bulk of the legwork. Everything is recorded on a blockchain, which makes dispute resolution and accounting simple.

ICOs only hint at the potential of “programmable money” and “smart contracts.” The potential applications are endless, but a few notable ones are…

- Dividend payments

- Asset exchanges

- Immutable accounting

- Cross-border payments

- Insurance

- Settlement of securities

- Intellectual property management.

Now that we’ve got all the housekeeping out of the way, let’s get into our current recommendations. We have seven recommendations for you in this report. Three are long-term plays and three are shorter-term plays. And we have our bonus stock pick – Draper Esprit, which I mentioned earlier.

Recommendations

Long-Term Play No. 1

Coin: Decred

Ticker: DCR

Price: $39.3

Market cap: $326 million

Circulating coins: 8.2 million

Total coins: 21 million

Recommended exchange: Bittrex.com

Decred (DCR) is a pure cryptocurrency play, and I consider it one of the few legitimate bitcoin challengers.

The name decred stands for “decentralized credits.” And this coin’s focus from the beginning has been to fix what’s “broken” about bitcoin.

Decred was launched in 2016 and utilized bitcoin’s code as a base to build on. However, the founders added a number of important features and tools that I believe make it a better fundamental coin than bitcoin (and more are being added all the time).

The thing that truly sets decred apart is its proof-of-stake system (PoS). Decred combines the baseline security of bitcoin’s proof-of-work system with a functioning PoS to make a truly innovative hybrid coin.

What’s PoS? Essentially, if you’re willing to “lock up” your coins in a decred ticket, you’re rewarded with more decred. You can think of this “staking” system as a dividend reward for long-term holders who vote regularly and help validate transactions on the network.

This fixes one of bitcoin’s biggest issues: The fact that the network requires volunteered servers called “nodes” to help process transactions. You lose money running them, but a lot of people do anyway – for now, at least.

Here, decred adds an incentive where bitcoin has none, and adds a reward for long-term holders in the form of more coins.

This staking system also provides ongoing price support, as at any given time, more than half of all circulating decred is locked up in tickets.

One of the other unique features of decred is its self-funding mechanism. Every block that is mined sets aside 10% of the reward for a development pool. In this way, “contractors” are paid in decred for their contributions to the project.

It’s a simple but elegant solution to one of the oldest problems in crypto: how to attract and incentivize coders. You can read more about the contractor hiring process here.

Other projects, such as bitcoin, rely on volunteer developers. Such systems have unintended consequences. For example, critics of bitcoin say the coin has been “taken over” by a powerful company called Blockstream, which has consistently pushed for an approach that favors its business model (off-blockchain scaling). That’s a separate (and long) discussion, but the point is that decred avoids these issues altogether by automatically setting aside funds for developers.

Upcoming decred features include…

- Improved privacy

- Lightning network support

- Increased scalability

- Atomic swaps with more cryptocurrencies.

The tagline on decred’s website is “an autonomous digital currency.” Autonomous means self-ruling, and it’s a fitting slogan. Decred is self-funded and has a decentralized governance system that’s working.

How to Buy

I strongly recommend using Bittrex to buy decred.

If you don’t already have bitcoin, you’ll need to buy some on Coinbase, Gemini or a local exchange if you’re outside the U.S.

Then you’ll need to transfer it from Coinbase to Bittrex, as I’ll describe later in this report.

Once you’re logged in to Bittrex, under “bitcoin markets,” search for decred or the symbol DCR.

You can also use ethereum to purchase decred, but I recommend bitcoin since the market is larger and more liquid.

The Bittrex buying process is described in-depth later in this report…

Long-Term Play No. 2

Coin: Nano

Ticker: NANO

Price: $1.08

Market cap: $143 million

Circulating coins: 133.25 million

Total coins: 133.25 million

Recommended exchange: Binance.com

Nano (NANO), previously known as raiBlocks (XRB), is a potentially revolutionary cryptocurrency. And now, in this dippy market, is the perfect time to open a position.

Nano doesn’t operate on a traditional blockchain infrastructure. It operates using what it calls a “directed acyclic graph.” Think of it like a network of blockchains, with each user having its own “mini-chain.”

There are no “miners” with nano. All of the nano coins that will ever exist already do (133,248,290, with each being divisible into billions of subunits).

Nano is very fast, with transactions taking 10 seconds or less. And it has no transaction fees at all.

Now, considering the fact that bitcoin’s average transaction fees have crept up to $30 or so, this is… big.

How are “fast, free” transactions possible?

Most of the processing power used in a nano transaction is provided by the sender and receiver. Since they are both running their own private blockchains, it doesn’t take much. And the system is extremely efficient.

Additional assistance is provided by what are called “nodes” – dedicated servers that help support the network.

So who runs these nodes (since there are no fees to be collected)?

Right now, nano nodes are run by…

- Cryptocurrency exchanges

- Nano wallet providers

- Nano holders and enthusiasts

- Nano developers

- The nano team.

Exchanges, for example, must run nodes in order to interact with nano. By doing so, they help the entire network.

It doesn’t cost much to run a node. For around $50, you could run a node on a major hosting service like Amazon or DigitalOcean for a year.

If nano takes off and becomes the cryptocurrency of the future, plenty of businesses, banks, exchanges and more will need to run nano nodes to transact with the network.

I’m not worried about a lack of nodes slowing this project down. If it keeps growing, the number of businesses running nodes will scale in a similar way. Plus, there are always members of the development community who will run their own nodes simply because it gives them more control.

The amazing thing about this crypto is how it’s efficient enough to run with very minimal outside support. It’s practically a peer-to-peer cryptocurrency.

If you want more details on the technical aspects of nano, read this piece that compares nano to IOTA, a competing coin. It’s technical, but a very good read.

The Team

The lead developer and founder of nano is Colin LeMahieu. He’s an extremely talented coder.

Colin worked at Qualcomm, the giant chipmaker, before leaving to work on nano full time.

He was also a software engineer at AMD and Dell.

Colin seems to also be an excellent communicator, which is rare among coding geniuses. You should read this article Colin wrote on Medium.

Colin appears to be building a top-class team of developers. (This is good because great crypto developers are hard to find these days. They want to work on only the coolest projects with the most potential, or the ones that pay them the most.)

Nano is now (rightfully) considered one of the coolest and most potentially game-changing crypto projects in the world. So it should have no problem attracting top talent, and it shouldn’t have to overpay for it.

How to Buy Nano

Nano trades on Binance. If you don’t already have an account there, you’ll need to open one.

If you don’t already have bitcoin, you’ll need to buy some on Coinbase, Gemini or a local exchange if you’re outside the U.S.

Then you’ll need to transfer it from Coinbase to Binance. (We’ve outlined this process later in the report.)

Once you’re logged in to Binance, under “bitcoin markets,” search for nano.

Long-Term Play No. 3

Coin: OmiseGO

Ticker: OMG

Price: $9

Market cap: $535 million

Circulating coins: 140 million

Total coins: 140 million

Recommended exchange: Bittrex.com

The nature of money is changing rapidly. Cash and cards are out; mobile wallets are in.

OmiseGO (OMG) is set to capitalize on this shift. This remarkable team is building an international financial platform to rival existing bank infrastructure.

Its slogan is, fittingly, “Unbank the Banked.” It’s meant to be ironic, seeing as many cryptocurrencies plan to “bank the unbanked” with new tech. But omiseGO is attempting to upset the existing system and build a better one.

OmiseGO’s goal is to be an international and decentralized exchange, a clearinghouse and a payment platform – a virtual JPMorgan of crypto, if you will. It will allow cryptocurrencies, fiat money and other financial assets to be transferred in a fast, secure and transparent manner.

In essence, omiseGO is using blockchain technology to facilitate trade and commerce on a global level. Unlike existing bank systems, omiseGO transactions will settle in seconds instead of days. And unlike bitcoin, omiseGO is built to be energy-efficient. This is critical for such a large-scale project.

OmiseGO is the cryptocurrency that powers this network. It is used to validate transactions and will reward owners with “dividends” from transaction fees. (This feature is still in development, so stay tuned for updates.)

Here’s a summary of why I believe in omiseGO.

- It has an all-star team of blockchain developers (including genius and ethereum founder Vitalik Buterin – this is one of only two other crypto projects he works with).

- It has an energy-efficient “proof-of-stake” system that rewards owners with “dividends.”

- It’s going after the biggest market in the world (money).

- It has a strong community of users, developers and holders.

- OmiseGO’s timing is perfect – as debt piles up and the world loses faith in fiat currencies.

Here are just three of the massive markets omiseGO is targeting…

- Remittances – when foreign workers send money back home (a $462 billion-per-year market in Southeast Asia)

- B2B commerce – facilitating payment in multiple crypto and fiat currencies for merchants (a market worth trillions)

- FOREX – foreign exchange is a tremendously large market, and omiseGO aims to be a next-generation crypto and fiat exchange.

All-Star Team

Omise, the company behind omiseGO, already has thousands of merchants signed up for its payment processing services. Omise is backed by top Asian VC firms Golden Gate Ventures and SBI.

Omise is based in Asia, with offices in Thailand, Japan and Singapore. This is where most of the technological innovation in crypto is taking place today, so it’s perfectly positioned geographically. These countries are also among the most progressive in terms of supporting blockchain technology, with Japan going so far as to make bitcoin official legal tender (money).

OmiseGO is the cryptocurrency that powers this international network. It will be used to validate transactions on the omiseGO blockchain, and it is already emerging as a useful cryptocurrency by itself.

In the near future, owners of omiseGO will be able to “stake” their coins in a wallet. This system allows ordinary owners to process and verify transactions, and collect transaction fees in the process. This system is still in development and should be released in the near future. Some of the best blockchain developers in the world are currently working on it.

Partnerships With McDonald’s and Others

Omise recently announced a partnership with McDonald’s of Thailand. Under the deal, Omise’s suite of tools will power orders on the corporate site and through its official delivery app, McDelivery Thailand.

To be clear, this doesn’t mean McDonald’s is buying a bunch of omiseGO (yet). But it shows that the team has serious chops when it comes to business development. It knows how to make deals with big players, which will be critical to the success of omiseGO.

The underlying business of Omise is thriving, and this will drive demand for omiseGO down the road. The goal is to build an international payment network and platform – a next-generation payment company with its own decentralized currency.

OmiseGO has a strong partnership with the ethereum network and hosts some of its services on the ethereum blockchain. As stated earlier, one of omiseGO’s lead advisors is Vitalik Buterin, the 25-year-old genius and creator of ethereum.

OmiseGO developers are hard at work building their own blockchain network infrastructure, which should be released in 2019. Until then, it will be primarily based on the ethereum blockchain.

The omiseGO proof-of-stake (dividend and verification system) system should be live within a few months. We don’t have an exact deadline as of yet. Once that’s live, we can all begin “staking” our omiseGO and receiving a bit of reward in the form of more omiseGO.

Disclosure: I am long on omiseGO. I have no plans to sell and will only do so after I have told members to sell.

As I mentioned earlier, I believe in buying and holding crypto for the long term. However, the recommendations below are short-term plays. These are coins with strong fundamentals. But they’re much smaller (in terms of market cap) in nature. So we have to monitor them more closely to make sure we’re entering and exiting the market at the right time.

Short-Term Play No. 1

Coin: Vertcoin

Ticker: VTC

Price: $4.90

Market cap: $32.9 million

Circulating coins: 45.5 million

Total coins: 84 million

Recommended exchange: Bittrex.com

Vertcoin (VTC) is often called the “people’s coin” because of its fair and decentralized nature. Created in 2014, it has a track record of delivering on its promises.

This coin is still under the radar of most investors. With a market cap (total value of all coins) of less than $100 million, it’s still very small – a tiny fraction of bitcoin’s $108 billion market cap.

One reason vertcoin is under the radar is because it didn’t have a big flashy ICO. It started before that trend got going. The coin began with a fair distribution, and, unlike many other coins, vertcoin was not “pre-mined” by the founding team. This is a huge positive for vertcoin because there aren’t a ton of insiders with free coins to dump.

Vertcoin is quietly building momentum and delivering high-quality upgrades. It’s been implementing upgrades at a faster pace than bitcoin while maintaining code integrity and security. For example, it launched Segregated Witness (SegWit) technology – an important security upgrade – months before bitcoin did.

Vertcoin was originally based on bitcoin’s code, but it has made many notable improvements to the original system.

The most important difference is that anyone can “mine” vertcoin. This gives it a huge advantage in terms of decentralization (a critical feature for successful, secure cryptocurrencies).

For the uninitiated, here’s a quick cryptocurrency mining primer…

Mining is the process of creating new coins. “Miners” use computers to solve complex cryptographic problems as part of securing the network. Miners are rewarded with a few coins for their effort.

In the early days, anyone could mine bitcoin with just about any computer. This was ideal because the entire purpose of a decentralized network is that it’s widely distributed and cannot be shut down or censored.

But today’s bitcoin miners are large corporations with multimillion-dollar data centers. They use specialized computer chips (ASICs), which are significantly more efficient than retail ones. This has allowed mining to become somewhat centralized between a few major players.

Miners can mine whatever cryptocurrency they choose to. And sometimes they decide to create their own versions of bitcoin, like bitcoin cash, which was “forked” off of bitcoin into its own blockchain ticker symbol.

Many argue this position gives bitcoin miners too much influence over the coin. For example, the largest mining group just tried to make some major changes to the coin through a “hard fork,” which could have been disastrous. (SegWit2x would have shifted power away from bitcoin’s core development team.) It showed that bitcoin’s mining system can be vulnerable to outside influence.

Vertcoin is built so that anyone can mine it. You don’t need a million-dollar data center to do so.

Its main goal is wide distribution and community involvement. That’s why it’s known as the “people’s coin.”

The algorithms are also uniquely built to prevent attempts to gain an unfair advantage over other miners. So the playing field for mining is leveled.

The team recently launched Atomic Swaps, which allow users to exchange their vertcoin with litecoin and other cryptocurrencies seamlessly from within their own wallets. This means that one day, exchanges like Bittrex may not even be necessary.

Along with litecoin, vertcoin is leading the charge on Atomic Swaps – one of the most promising upcoming crypto breakthroughs.

I believe this coin has a bright future, and it could easily be the size of litecoin in a few years or so.

Vertcoin is one of the few coins that can legitimately compete with bitcoin. And many argue that its system is better due to its more decentralized nature. (Remember, the more decentralized a coin is, the more secure it is.)

And because more people can mine it, it should continue to grow organically as word spreads among miners, investors and their friends.

Disclosure: I own vertcoin. And even though I’m recommending this as a short-term play, I currently have no plans to sell and will only do so after I have told members to sell.

Short-Term Play No. 2

Coin: Ark

Ticker: ARK

Price: $0.68

Market cap: $265 million

Circulating coins: 104 million

Total coins: 136 million

Recommended exchange: Bittrex.com

Ark (ARK) is a truly impressive young blockchain platform. Like our other recommendations, it has its own cryptocurrency unit built into the platform. This is what we’re recommending you buy.

Ark is one of the fastest and most efficient cryptocurrencies. It generates new blocks roughly every eight seconds (compared with bitcoin’s 10 minutes). This generates lightning-fast transactions. It is also far more energy-efficient than most cryptocurrencies.

But ark is much more than a simple cryptocurrency. It is a highly flexible platform for building applications that can connect to other blockchains (like bitcoin or ethereum) and applications. I believe these exact types of developments will form the basis of our next monetary system.

Ark is also building its own smart contract platform, which it refers to as the “ARK Virtual Machine.” This will be somewhat similar to ethereum and opens up a huge opportunity in distributed applications.

There is too much on ark’s road map to cover entirely here, but here are some highlights…

- NFC technology for wearables and other hardware applications

- Point-of-sale hardware for merchants

- Push-button deployable blockchains for private use

- Debit-like cards that can spend crypto via ark

- Mobile wallets (Android/iPhone).

One of my favorite things about ark is its team of developers. It has an extremely experienced core team, including the former lead developer of lisk, a highly regarded crypto platform. The team does a great job communicating with the community and are hard at work upgrading this powerful young platform.

Ark has a unique “consensus mechanism,” which I believe is superior to older coins like bitcoin. A consensus mechanism is how disputes about upgrades are settled.

Ark has a fascinating delegate system. Fifty-one delegates are elected to run “nodes” that process trades, forge new coins and settle transactions. Delegates are elected from within the ark community. Every wallet with a balance gets votes in proportion to their ark holdings.

Delegates then share their transaction proceeds with their voters (an 8% profit share is typical). So there’s an incentive for users to vote for a delegate who has a good reputation, has demonstrated the technical knowledge and hardware to run it, and is trustworthy overall. There is also a system for removing troublemaking nodes. You can find a list of delegates and more information about finding a good one here.

The elegant “delegated proof-of-stake” governance system it has designed is working. It’s the best one I’ve seen in crypto. And, as we’ve seen with all the drama surrounding bitcoin upgrades, governance is important. Bitcoin is missing a dispute resolution system while ark has one built in from the start.

You can learn how to vote with ark on the official site here.

As you can probably tell by now, ark is a truly impressive project. It is building a blockchain ecosystem with tremendous potential.

The community aspects of ark are what makes this coin truly stand out to me. On social media site Reddit, there is a thriving ark community with more than 9,000 members. Ark users are involved and proactive, and are all working to help make ark a revolutionary platform and cryptocurrency.

Consistent Upgrades

Ark developers are constantly working on improving the code that runs their platform and cryptocurrency. They “ship” new upgrades regularly, do extensive testing before anything goes live and make the code open source so it can be audited by other blockchain experts.

Buying and Storing

We recommend you buy ark on Bittrex. The process is similar to the one we outlined in the decred recommendation above.

Cold (Offline) Storage

Ark can be stored on the Ledger Nano S, a hardware wallet that allows you to keep your coins offline. This is arguably the most secure way to store coins long term.

Disclosure: I own ark. And while I’m recommending ark to you as a short-term play, I currently have no plans to sell and will only do so after I have told members to sell.

Short-Term Play No. 3

Coin: High Performance Blockchain

Ticker: HPB

Price: $0.87

Market cap: $32.6 million

Recommended exchange: KuCoin.com

Portfolio classification: Speculative

Recommended investment size: Small (enough to make it interesting but not so much that a loss would materially affect you)

Note: This is a speculative recommendation on a small market cap coin. It operates out of China, so there is some additional regulatory risk.

This crypto project is called High Performance Blockchain (HPB), and I believe it offers more than enough upside to justify the risk.

I recommend going into this trade in at least two steps (due to market volatility). You can invest half your normal amount now, and I’ll let you know when we see another good entry point.

Since high performance blockchain, also referred to as HPB, is more speculative than our other coins, I recommend making a smaller investment. I would put enough in to make it interesting if it does well, but not so much that I’d be hurting if the project didn’t work out.

HPB is a Chinese project being built to expand the scalability of blockchain applications. All blockchain-based apps, whether they run on the ethereum network, neo, stellar or others, face restrictions on the number of transactions they can process.

We saw this with the rise of “CryptoKitties,” a collectible blockchain-based game that runs on the ethereum network. The app became so popular that the entire ethereum blockchain was affected. Transactions slowed dramatically.

CryptoKitties is the type of application that works only on a blockchain, so it needs that ethereum backbone. But the network simply can’t handle massive traffic yet.

All blockchain platforms are wrestling with scaling issues. HPB aims to enhance performance of the apps (like CryptoKitties) that run on them. Similar to how the ethereum network charges participants “gas” for transacting, HPB will charge for the network’s performance-enhancing services in its own cryptocurrency.

HPB uses a unique combination of both hardware and software to attempt to solve these scaling issues. It is currently at the prototype stage for its custom computer chips, boards and hardware acceleration engine.

The HPB team claims it will be able to process millions of transactions per second using this unique approach to scaling.

The hardware aspect brings incredible potential, along with some risk, to this crypto. HPB is a bet on a future in which decentralized, blockchain-based applications require more throughput.

Currently the project is in the testing phase. HPB launched its “testnet” earlier this year.

HPB’s team is one of its strongest qualities. The founding team has deep experience in the blockchain, hardware and software world. Co-founder Li Jinxing was a blockchain analyst at major Chinese securities firm Guotai Junan.

Lei Zhen, the founder of crypto exchanges Bibox and OKCoin, is an early investor in HPB. Zhen is a heavyweight in the crypto world, and his involvement is encouraging.

The hardware team includes former Huawei and Intel engineers, according to a report on Steemit. Testing is already utilizing custom hardware.

You can read more about the team on HPB’s official English language site here.

Execution So Far

HPB is a relatively new project. The coin started trading only in January.

But from what we’ve seen so far, it is executing according to plan. One of its first milestones was to launch a “testnet” (essentially an early version of its product) in the first quarter.

This target was hit, and the first private testnet is complete. The second phase of the testnet is ongoing.

Although it’s very early in the journey, HPB has demonstrated constant progress and good communication. If it can continue to expand its presence in both the East and West, this project could really take off.

You can read more about the testnet and other FAQs here.

Tokenomics

For now, HPB is an ERC20 token. ERC20 is a standard for tokens on the ethereum network. Eventually, HPB will launch its own blockchain and transfer coins there. This process has been completed many times before by many different coins, and it isn’t a major concern. We’ll let you know if you need to take any action.

There are currently around 29 million coins in circulation. Eventually there will be as many as 100 million. Some 19% of coins are held in reserve to support the project in the future. Early contributors, founders and investors also hold many of these coins.

The good news is that the vast majority of these coins are “locked” for one to five years. Insiders and early investors can’t sell immediately and must “vest” their coins for years.

More details on the coin distribution and lock periods can be found here. The team has demonstrated notable transparency with regard to its tokenomics.

If the project doesn’t progress well, we’ll look to exit the position before the bulk of these coins are unlocked because there’s a risk that insiders could sell and depress the price.

But we have a window of about eight months before a significant number of coins begin to be unlocked. If the project takes off, the insider sales won’t be a major concern. Many coins have large insider positions, and this gives their teams a strongly vested interest in the project succeeding.

How to Buy

We’re including detailed instructions on how to buy HPB here because using KuCoin can be a bit tricky.

First, you’ll need to register for a KuCoin account if you haven’t yet.

Note: Your verification email from KuCoin may go to your spam folder (mine did), so definitely check your spam folder.

Make sure you go directly to KuCoin.com. Do not search for it in Google and click on ads – they could be imposters. Now, once you’re logged in…

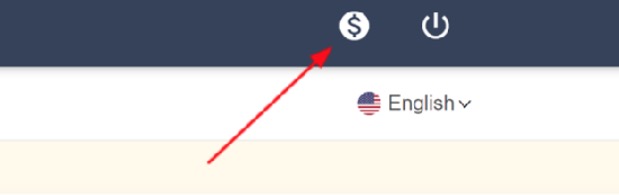

In the upper right corner of the screen, you’ll see a little circular dollar sign. Click on that, and it will bring you to another screen.

Once you’re there, click on “Deposit” on the left side of the screen.

Pick the coin you want to deposit. (I strongly recommend bitcoin for this trade.) If you don’t have any bitcoin yet, you’ll need to buy some at a crypto exchange such as Coinbase, Gemini or Kraken.

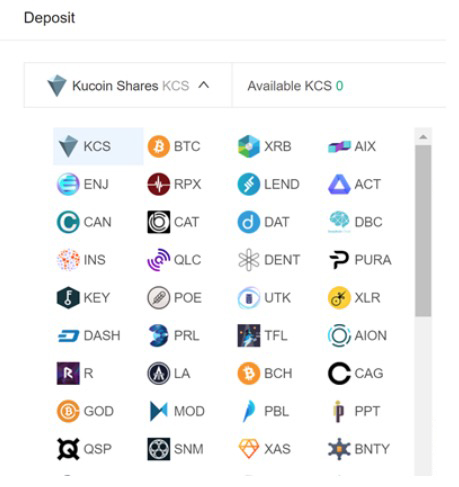

To select the coin that you want to deposit, click the drop-down menu where it says “KuCoin Shares.” That will bring up a menu of all the options.

The exchange will now show you a new wallet address where you can deposit that coin. Copy this new wallet address to your clipboard (CTRL+C on a PC).

In a separate browser window, log in to your other wallet or exchange where the bitcoin or ethereum is. (We’ll use Coinbase for this example.)

Now you need to send the bitcoin from your Coinbase wallet to the new KuCoin address.

Go to “Send” in Coinbase, and paste the KuCoin wallet address you copied earlier into the Coinbase “Send To:” field.

Double-check to make sure you are sending ONLY bitcoin to a bitcoin wallet address or sending ONLY ethereum to an ethereum wallet address, etc.

Once you have either bitcoin or ethereum in your KuCoin account, go to the “Markets” tab.

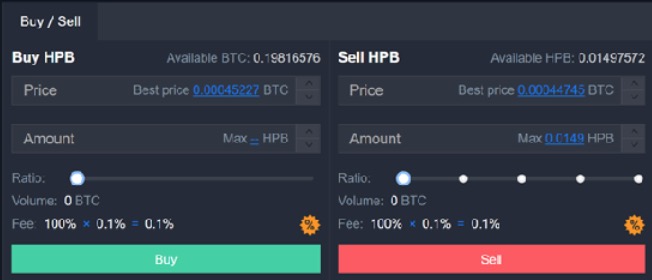

Search for HPB. It will say “HPB/BTC.” Click on that.

Next you’ll be brought to the trading page.

Entering orders will seem a little strange at first. The interface still needs a little work, and it’s all translated from Chinese (impressively, in my opinion).

If you want to make it easy, transfer to KuCoin only the amount of bitcoin or ethereum you want to spend on HPB. Then simply click on the numbers next to “Best price” and “Max.”

If you want to buy less, you can slide the “Ratio” bar in the middle that will move up and down, representing the amount of bitcoin or ethereum you will be spending.

Once you’ve entered the amount you wish to buy – I recommend using the best (market) price, unless you’re an experienced trader – simply press “Buy.”

You may be asked to enter your Google Authenticator code again here. And by the way, I do strongly recommend turning on two-factor authentication for KuCoin and all other exchanges.

To activate Google Authenticator on KuCoin, go to settings, and on the left-hand side select “Google 2-Step.”

Write down your backup code BEFORE scanning it into the Google Authenticator app. Keep it somewhere very safe. Triple-check everything.

Storage

For now, I recommend storing this coin on the KuCoin exchange where we’re buying it.

There is no official wallet available for download yet, and the coin will eventually move off of the ethereum network and onto its own platform. If you store on an exchange, the exchange will typically take care of this conversion process for you. We will let you know if there’s any action you need to take.

As always, make sure you use two-factor authentication and a strong, unique password for the exchange.

Risks

HPB is a new, ambitious project. It aims to increase blockchain scalability dramatically. It is a high-risk, high-reward investment.

As always with cryptocurrencies, do not risk money you can’t afford to lose. There are regulatory, adoption and other risks involved in this project and others.

BONUS PICK

Company: Draper Esprit VC Fund

Type: Stock

Ticker: LON: GROW

Current price: 645 pence (Note: Share prices on the exchange are listed in pence, not pounds)

This recommendation is a first for us. It’s a publicly traded VC firm.

The company is Draper Esprit (LON: GROW), which trades on the London Stock Exchange. By investing in this fund, you’ll get exposure to some of the fastest-growing tech companies in the world. Draper Esprit’s portfolio includes Ledger, one of crypto’s most attractive private enterprises.

I’ve been watching Draper Esprit since it went public in 2016. I’ve seen it add to existing positions, take profits on others and initiate new positions in promising young companies. Last year alone, the value of its core holdings increased an impressive 119%.

I’m convinced this is one of the best ways to gain access to a large portfolio of private “hypergrowth” technology companies.

Gaining exposure to fast-growing tech companies is harder than ever, mainly because the best companies stay private far longer than they used to. Two prime examples are Uber (worth around $60 billion) and Airbnb (worth around $35 billion).

Even when “hot” companies like Facebook do go public, they’re already worth $40 billion or more. So most of us are missing out on some of the world’s best growth opportunities.

It wasn’t always like this. Amazon went public with a market cap of $438 million. Microsoft went public with a market cap of a little more than $500 million. So everyone had a chance to get in early and make hundreds of times their initial investments.

Draper Esprit gives members an excellent way to invest in today’s hypergrowth opportunities.

The firm is well-positioned in Europe as one of the leading VC funds. And Draper Esprit focuses on “growth stage” companies. At this stage, these companies have proven themselves worthy of significant capital investment. It’s early enough that there’s plenty of money to be made, but not so early that the companies are likely to fail. I consider it the “sweet spot” in private markets.

The Crypto Angle

In January 2018, Draper Esprit led a $75 million investment in Ledger. You may be familiar with Ledger already. The French company makes hardware wallets and software for the cryptocurrency industry. Hardware wallets allow crypto owners to store their private keys offline (making them virtually impossible to hack).

Hardware wallets are widely regarded as the most secure way to store cryptocurrency and tokens. And Ledger has sold more than 1 million units so far.

Ledger’s most popular products are the Ledger Nano S and the Ledger Blue. Ledger has also announced it will sell an institutional product, the Ledger Vault, which helps institutions safely store large amounts of cryptocurrency for themselves or their clients.

Ledger is extremely well-positioned to benefit from growing interest in crypto from both retail and institutional investors. You can read more about Draper Esprit’s investment in Ledger here.

Just a Taste

Ledger is just a taste of what an investment in Draper Esprit offers. The firm is laser-focused on finding the best investment opportunities across the U.K. and EU. And due to the fact that there are far fewer VCs in Europe (compared with Silicon Valley, where if you throw a rock you’re likely to hit one), Draper Esprit has the luxury of being picky about the companies it invests in. More than 2,500 companies approach Draper Esprit for funding each year, and the firm selects only the most promising prospects.

Here’s a peek at Draper Esprit’s performance:

- 116% growth in gross primary portfolio in 2018

- 70% growth in gross primary portfolio in 2017

- Value of core holdings increased 119% in 2018.

Typically, you need to be a “limited partner” (investor) to get access to a VC fund investment like Draper Esprit. That means writing a very large check with lots of zeros. But because Draper Esprit chose to go public, anyone can invest. It’s a rare opportunity that’s not on most people’s radars.

Draper Esprit has a chance to become a legendary company – a “digital Berkshire Hathaway.” If it continues to exercise good judgment and make smart investments, this could be one of the best long-term investments of the next few decades.

The fund has more than 22 portfolio positions with successful “exits,” meaning an acquisition or IPO.

Here’s how Draper Esprit describes its vision and model:

Buy a share in Draper Esprit, and you’re getting access to Europe’s technology innovators, years of investor expertise and a sustainable investment model. We focus on four sectors and keep our portfolio diverse.

As our companies grow, we provide follow-on capital to build our stakes. 70% of our portfolio value is distributed in the top 10 to 15 companies, representing our core holdings. When the companies exit, cash goes back to the balance sheet so we can reinvest it in new opportunities. Sustainable growth for the long term.

It’s a model similar to Warren Buffett’s Berkshire Hathaway, but instead of industrials and banks, Draper Esprit invests in the tech companies poised to be tomorrow’s giants.

Portfolio

Draper Esprit has a large, diverse and fast-growing portfolio of more than 45 companies. Here are a few of my favorites.

- Revolut – Revolut is a digital bank and wealth management service with more than 2 million clients. To a certain degree, it’s the European version of Robinhood. It offers discount trading and banking to millennials and other digital-first clients. And it’s growing rapidly. See recent coverage from CNBC here.

- Lyst – Lyst is a leading search engine for fashion products with more than 65 million annual users. Draper Esprit’s investment of 2.6 million pounds is now worth 18.3 million pounds, or about $24.5 million.

- Graphcore – Graphcore is a hardware computing company building custom chips designed to accelerate machine learning and artificial intelligence. It recently raised $50 million. Draper Esprit has invested 2.3 million pounds in Graphcore, and that stake is now worth 23.4 million pounds, or $31.4 million. Read more here.

- Crowdcube – As the U.K.’s leading equity crowdfunding portal, CrowdCube is well-positioned to dominate this market for decades to come. The U.K.’s equity crowdfunding market is more well-established than our system in the U.S., and Crowdcube is an excellent way to gain exposure to this market.

- Seedrs – Draper Esprit also owns shares in Seedrs, another leading equity crowdfunding platform in the U.K. Seedrs is Crowdcube’s primary competition in the U.K.

- Realeyes – Realeyes is a cutting-edge tech company that uses software to read people’s emotions. The applications for this are broad but include more powerful advertising and entertainment experiences. More info here.

- Droplet Computing – Droplet is expanding the ways that companies can run and host applications. More information here.

These are just a few of the exciting growth-stage companies you buy a piece of through an investment in Draper Esprit. You can view the entire Draper Esprit portfolio here.

How to Invest

Draper Esprit trades on the London Stock Exchange under the ticker GROW. I mentioned earlier that this investment is under the radar of most investors, and I wasn’t exaggerating. Earlier this year, I was able to find only one online broker in the U.S. that trades GROW – Interactive Brokers. Later in the year, Draper Esprit began trading over the counter in the U.S. as well. You should be able to purchase Draper Esprit at most American online trading services or brokerages. The OTC ticker symbol is GRWXF:US.

If you don’t want to buy Draper Esprit over the counter, and you don’t have an account at Interactive Brokers, you can sign up for one here. You’ll need to fund the account in the way that works best for you. Interactive Brokers is one of the most popular online brokerages in the U.S. among both professional and retail investors. It has excellent pricing and service.

If you need help setting up your Interactive Brokers account, please contact its U.S. customer service at 1.877.442.2757. If you’re outside the U.S., you can find contact information here.

If you have an account at Merrill Lynch, Morgan Stanley, JPMorgan, Goldman Sachs, etc., your broker should be able to acquire shares for you. Tell them you wish to purchase shares of Draper Esprit, which trades in London under the ticker GROW.

Notes

- Shares of Draper Esprit are relatively thinly traded (there’s not a ton of volume). So please use limit orders and not market orders. I recommend making your offer a few dollars above the current price, and it should get filled relatively quickly.

- Please be aware that there is a U.S.-listed stock that trades under the ticker GROW. This is NOT Draper Esprit (Draper Esprit trades on the London Exchange). The U.S.-listed GROW stock is U.S. Global Investors and is not the stock we’re recommending here.

Now that you know what to buy, here’s how you do it.

- Open a Coinbase account to buy bitcoin.

- Buy bitcoin!

- Create a Bittrex account (or an account on another exchange like Binance).

- Transfer your bitcoin to another exchange (Bittrex, Binance, etc.).

- Buy our recommendations!

Below is our step-by-step guide to this process.

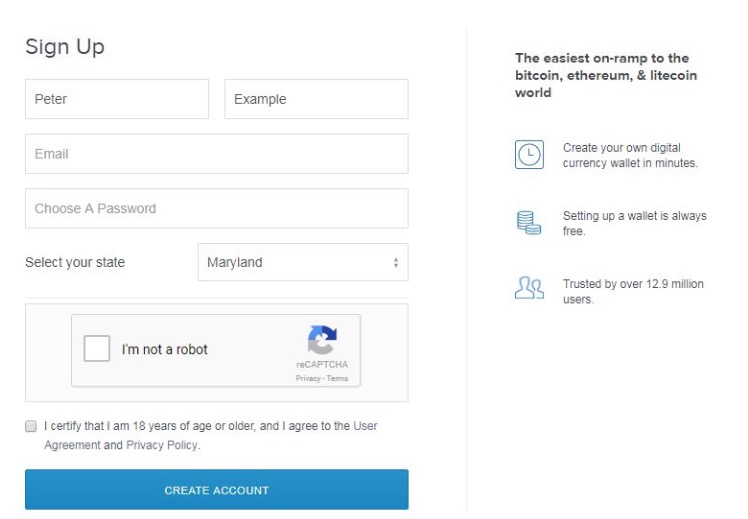

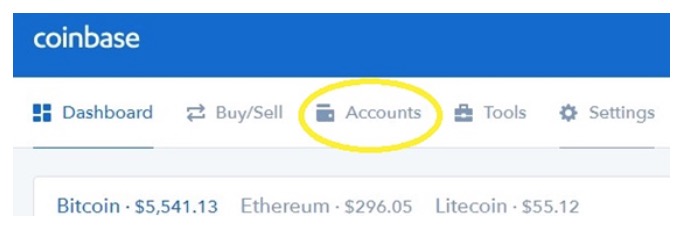

How to Open a Coinbase Account

Coinbase is a trustworthy cryptocurrency exchange used by millions of people around the globe. In Crypto Asset Strategies, Coinbase is the exchange I recommend for bitcoin purchases.

Setting up an account is quick and easy. All you’ll need is an internet connection and your smartphone. Once you’ve completed the process, you’ll also have a Coinbase wallet that you can use to hold any bitcoin that you purchase.

Step 1: Visit the Coinbase website and click on the “Sign Up” button in the upper right corner.

Step 2: Complete the required fields on the “Sign Up” page. Then check your email for a confirmation from Coinbase.

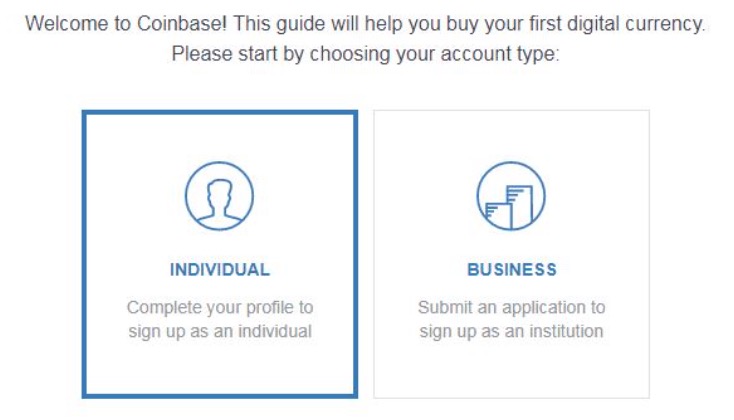

Step 3: Select your account type. For personal use, you would select an “individual” account.

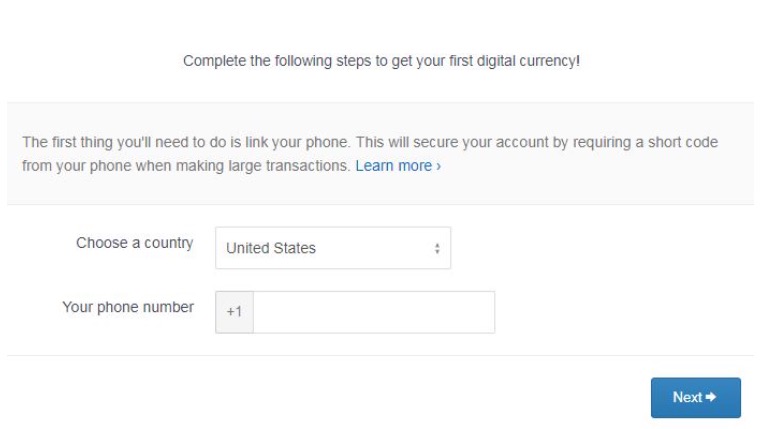

Step 4: Provide your country of residence and phone number.

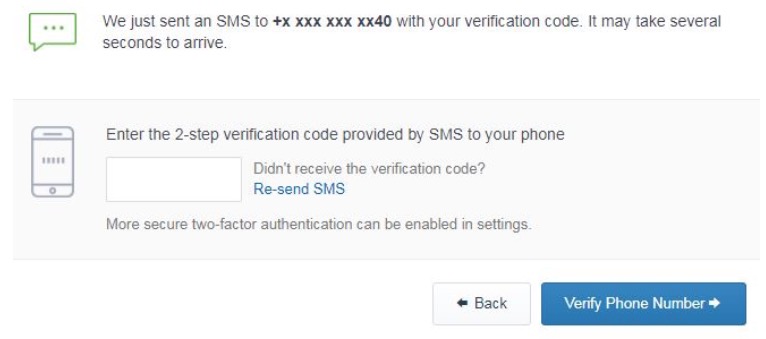

Step 5: Coinbase will send a confirmation code to your mobile phone. Enter the code when prompted to verify your phone number.

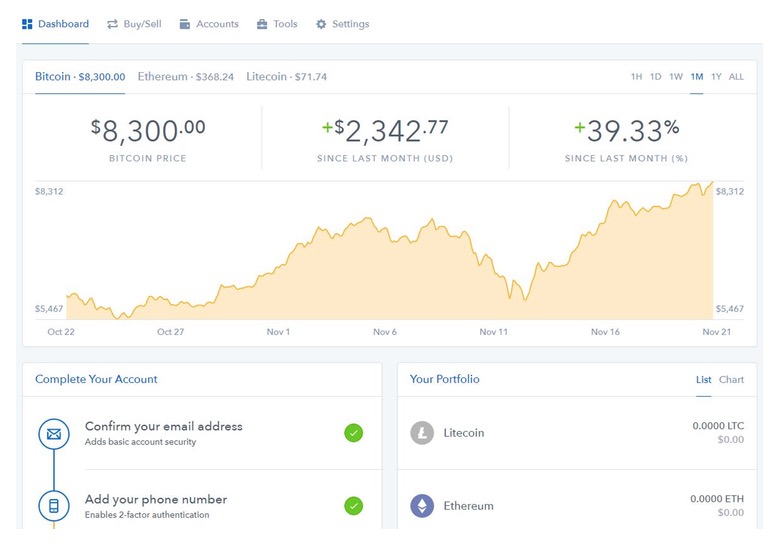

Step 6: Your account is created! At this point, you’ll see your members-only Coinbase dashboard. This shows you the current prices and trading histories for three major cryptocurrencies: bitcoin (BTC), ethereum (ETH) and litecoin (LTC). Once you buy some bitcoin, you’ll see your holdings reflected in this dashboard area.

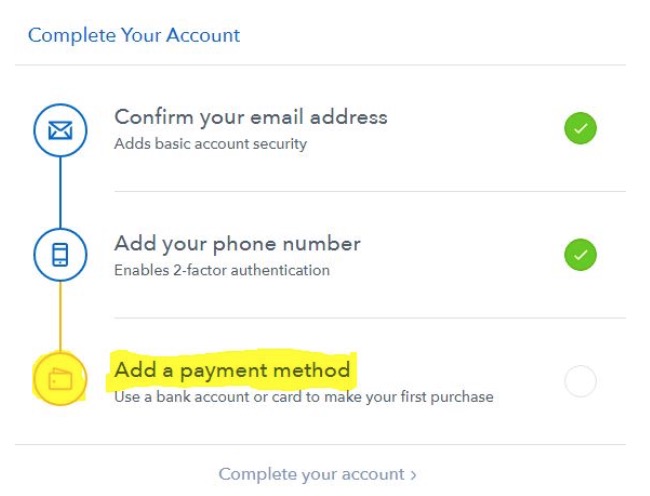

Step 7: Add your desired “payment method” so that you can begin buying cryptocurrencies. To do this, simply click on “Add a payment method” under the “Complete Your Account” header. (See below for assistance.)

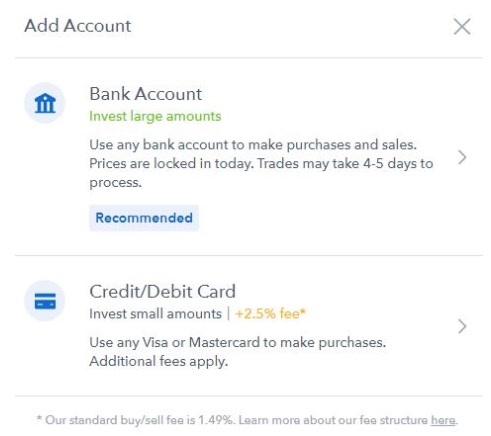

Step 8: You’ll be prompted to link a bank account or credit or debit card to your Coinbase account. Select the option you’re most comfortable with, and complete the setup process.

Step 9: After your payment method is linked and confirmed, your account is ready to go! You’ll be able to navigate your account using headings on the dashboard page.

![]()

Now all you need to do is buy some bitcoin!

How to Open a Bittrex Account

In order to trade the small exchange-traded coins and tokens we target in Crypto Asset Strategies, you’ll need to open a Bittrex account.

Like Coinbase, Bittrex is a reputable and secure cryptocurrency exchange. However, there are a few key differences between the two:

- Coinbase allows purchases of “large cap” cryptocurrencies (bitcoin, ethereum and litecoin) with U.S. dollars

- Bittrex allows purchase of smaller and emerging cryptocurrencies. It accepts only bitcoin and ethereum for purchases.

In Crypto Asset Strategies, you’ll need a Bittrex account (funded with bitcoin or ethereum) in order to buy our recommendations.

Please follow the instructions below to set one up. You’ll need your smartphone as well as a couple of forms of identification.

Step 1: Register for a Bittrex account.

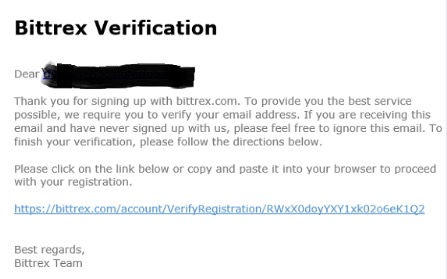

Step 2: Check your email for a verification email from Bittrex. It will look like this.

Step 3: Follow the prompts, then log in using your selected username and password.

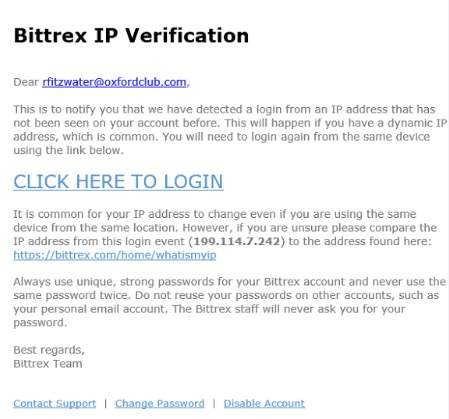

Step 4: For added security, Bittrex will require you to confirm your IP address. Click on the “click here to log in” link. It will look like this.

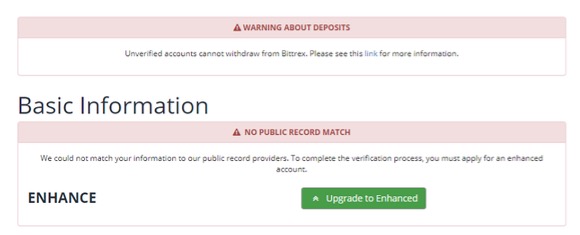

Step 5: Once logged in, select the green button that says “Upgrade to Enhanced.” This step will allow you to submit your ID documents, which is required in order to purchase cryptocurrencies.

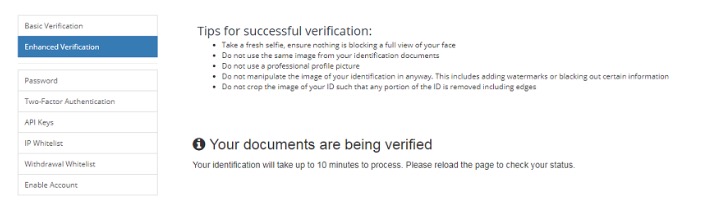

Step 6: For this step, you’ll need to provide Bittrex with photocopies of your driver’s license (back and front) or a copy of your passport. You’ll also need to provide an unobstructed photo of your face. Please follow the prompts to upload these documents. After successful submission, you’ll see a message (like this one) instructing you to refresh your browser after 10 minutes.

Step 7: After 10 to 15 minutes, you’ll refresh your browser and see a confirmation message letting you know that your identification documents have been received and verified. At this point, you’re ready to explore Bittrex!

Now that you have a Bittrex account, you’re ready to transfer bitcoin from your Coinbase account to Bittrex to buy my recommendations. That process is outlined below.

How to Transfer Bitcoin From Coinbase to Bittrex

As you’ve already learned, bitcoin is essentially the “reserve” currency of the crypto world. It’s one the largest, most actively traded cryptocurrencies. And in many cases, the prices of smaller exchange-traded coins are influenced by bitcoin prices.

As a crypto investor, it’s important to hold bitcoin for two reasons. First, it’s a valuable investment with strong price appreciation… and it’s likely to remain the foundation of the crypto world. Second, it’s the standard method of payment for smaller exchange-traded coins.

In Crypto Asset Strategies, we’ll use our Bittrex account to purchase other cryptocurrencies. Unfortunately, you can’t buy bitcoin using U.S. dollars in Bittrex.

So you’ll need to follow the instructions below to transfer some bitcoin from your Coinbase account into your Bittrex account.

Step 1: Log in to your Bittrex account.

Step 2: Click on the “Wallets” icon in the upper right corner.

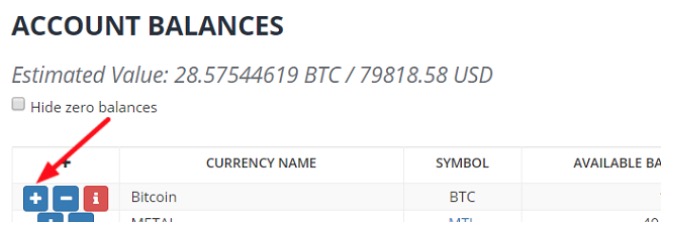

Step 3: Under “Account Balances,” you’ll see bitcoin listed. Click the blue “plus sign” next to bitcoin.

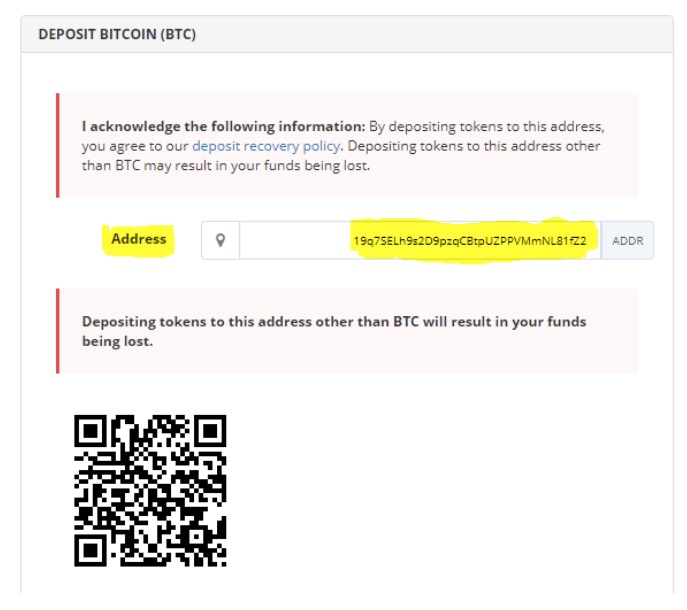

Step 4: A box will pop up providing you with a bitcoin public address. (See the image below for help.) Copy the address by selecting it and clicking CTRL+C on a PC.

Step 5: In a separate browser window, log in to your Coinbase account. (Note: You’ll need to have bitcoin available in your Coinbase account. If you’ve just purchased it, please be aware that your transaction may take a few days to process.)

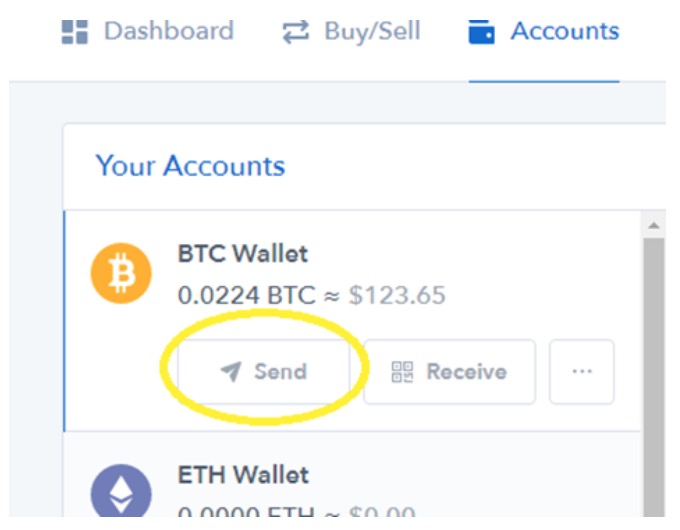

Step 6: Within Coinbase, click on the “Accounts” tab.

Step 7: Click on the “Send” icon within your bitcoin wallet.

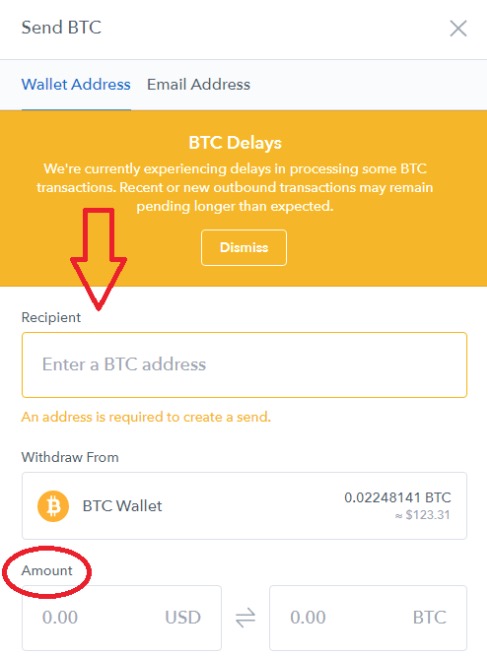

Step 8: A screen will pop up, asking you to provide details for your transfer. Press CTRL+V to “paste” your Bittrex wallet address into the highlighted box. Then fill in the amount you wish to transfer. You can enter your selected amount in U.S. dollars or in bitcoin.

NOTES:

Sending fractional amounts is fine. You can send .002 bitcoin, or 10 bitcoin. Just be aware that there are fees for sending bitcoin, so transferring less than $30 is going to be expensive. (Lower fees and faster transactions are a top priority of the bitcoin foundation, and fixes are in the works.)

Do a small test order before sending larger amounts. If you send to the wrong address, your coins could be lost.

Step 9: Click the blue “Continue” button to initiate your transfer.

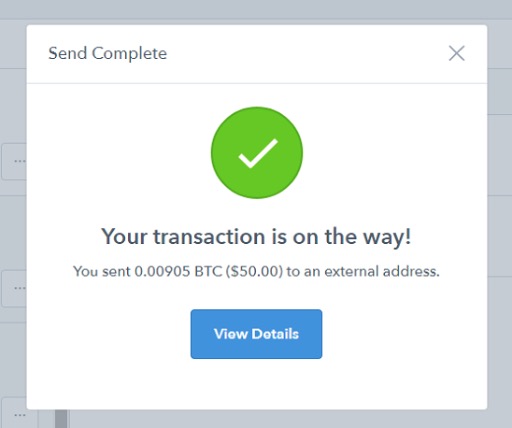

Step 10: A box will pop up prompting you to confirm your transaction. Review the transaction details to ensure everything is correct, then complete the SMS verification using your smartphone. Finally, click the blue “Confirm” button to complete your transfer.

Step 11: You should see a message indicating that the transaction was successfully completed. It will look like this:

Step 12: Please allow four to five hours for the transfer to appear in your Bittrex wallet. You will see the deposit listed as “pending” in Bittrex before it arrives. Once the transaction is confirmed by the network, your coins will arrive in your Bittrex wallet.

Coinbase will email you a receipt for your records. Once the transfer has occurred, you will see it reflected per your bitcoin balance in both Coinbase and Bittrex. Coinbase will also keep a record of the transaction under the “Accounts” tab, which you can reference at any point in the future.

How to Buy Our Recommendations on Binance

Binance is the world’s largest cryptocurrency exchange (by volume). Its headquarters are in crypto-friendly Malta, but the exchange has offices throughout the world and a strong presence in Asia. The fees are low at around 0.1%, and even lower if you buy with its native cryptocurrency, Binance Coin (BNB).

Binance employs top-notch security and blockchain engineers. It keeps the vast majority of coins in “cold storage,” and I consider it to be an extremely secure exchange.

These are our recommendations that trade on Binance:

- OmiseGO (OMG)

- Nano (NANO)

- Ark (ARK).

First, you’ll need to register for an account with Binance here. You may be asked to upload a picture of your license or passport for verification purposes. This is normal, and exchanges do it because of “know your customer” (KYC) laws.

You’ll receive a verification email. Be sure to check for that and follow the instructions.

Binance is a “crypto only” exchange. You can’t buy with dollars or other fiat money. Most coins are priced and traded in bitcoin (BTC). So you’ll need to purchase (or move) bitcoin from somewhere else first and then transfer it to your Binance BTC wallet.

You can buy the bitcoin on Coinbase, Gemini or a local exchange if those aren’t available in your country. Personally, I like Coinbase because of its rock solid security reputation, insurance, etc. (You pay a little more at Coinbase, and the customer service isn’t great, but we’re still in the early days of crypto.)

Let’s go through the transfer and buying process now. It doesn’t take long, and once you figure it out, it’ll be a piece of cake.

Moving Bitcoin to Binance

Step 1: Log in to Coinbase or the wallet where you’re sending bitcoin from. Now switch to your Binance account and click on the “Funds” tab. (On a desktop, it should be in the upper right corner.)

Step 2: Click on “Funds,” and then select “Deposits.”

Step 3: You will then see a message that says “Select coin to deposit.” Search for bitcoin or BTC, and click on it. Make sure you select “BTC-Bitcoin.”

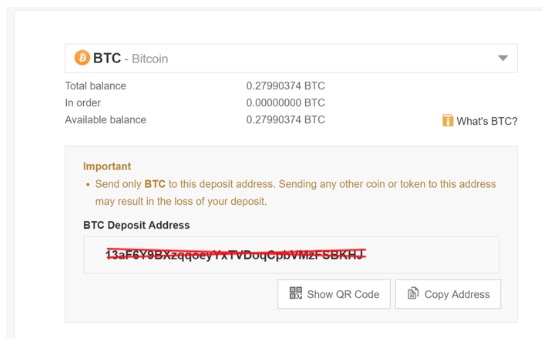

You will then see a screen like this. (Note: Don’t use the address from this image. Binance will give you a unique one.)

Step 4: Under “BTC Deposit Address,” you will see the address that you will send coins to. Select the address and copy it (you can click the “Copy Address,” or use CTRL+C on a PC).

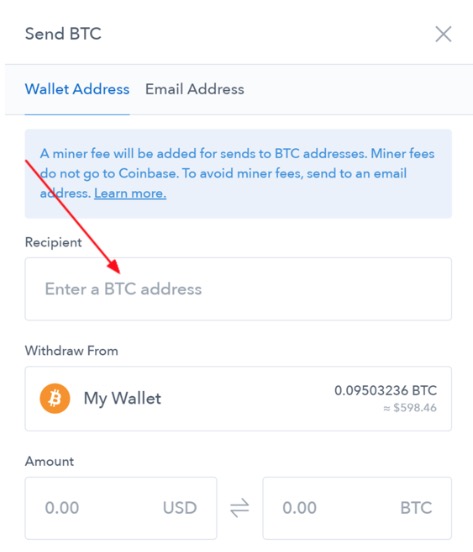

Step 5: Now switch back to Coinbase, or wherever you’re transferring the bitcoin from. If you’re in Coinbase, click on Accounts. Now select your bitcoin wallet you want to send from. Click “Send.”

Step 6: Under “Recipient,” paste your Binance deposit address (from the first image above).

Step 7: Select the amount you want to send, then click continue. You may be asked to enter your two-factor authentication code again (from the Google Authenticator app).

I recommend sending a small test amount first. Once the deposit comes through on Binance, you’ll know you did it right and can send the full amount you want to invest on Binance.

How to Buy

Now that you have some bitcoin in your Binance account, you can make your purchases. I strongly recommend doing this on a laptop or desktop computer.

Return to the homepage of Binance. From there, click on “Exchange” and select “Basic.”

![]()

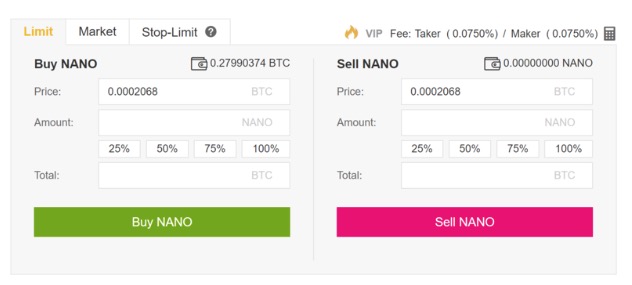

In the upper right corner, you’ll see a search box. Search for the ticker of the coin you want to buy. For example, if you wanted to buy nano, you’d search for NANO and select NANO/BTC. This is the “trading pair” where you can buy nano with bitcoin.

Now look to the middle of the page, past the charts. This is where you place trades. Remember, these coins are all priced in bitcoin (so the pricing is going to look strange). Remember, we’re buying a coin that may cost $1 with a coin worth $6,000. So we’re using only tiny fractions of a bitcoin to buy each altcoin.

I’m going to continue using nano as an example here.

If you’re new to trading, I recommend using the “Market” buy tab. This will automatically buy the lowest priced coins currently being offered.

Enter the amount of coins you want to buy (and the price if you’re using a “limit order”). Then click on the green “Buy NANO” button (or whichever coin you’re buying).

Confirm the order, and if asked to, enter your Google Authenticator code to confirm the trade (this is a security measure).

Congratulations, you’ve made your first purchase on Binance. It’s a leading crypto exchange, and it offers access to many of the leading altcoins from across the world.

You’re ready to invest in crypto!

Now that you’ve set up your trading accounts, you’re ready to become a full-fledged investor in the crypto markets. Our recommendations are good place to start. But you should also take the time to learn more about the market – and what makes a good investment. That’s why I’m including my 10-point checklist for evaluating altcoins and ICOs below. This checklist gives you a framework to think about crypto investments. And you might even find it useful in other industries as well!

Happy investing.

10-Point Criteria for Selecting Altcoins and ICOs

Vetting a cryptocurrency opportunity is no simple task… And subscribers often ask us how we evaluate emerging opportunities in the altcoin and ICO markets.

Below you’ll find the 10 fundamental elements we look at to determine the future potential of any coin, token or ICO.

1. Core Development Team

- What’s the level of experience?

- Are the primary coders committed, competent, transparent and well-liked?

2. Distribution Structure

- Has coin distribution been fair, or do a handful of people hold the majority of the coins and therefore the power? (More distribution equals more decentralization. This is a good thing.)

3. Legal Risk

- What is the coin being used for? (Currencies and enterprise services are the safest from regulatory risk).

4. Network Activity

- Is the coin widely used, and is its demand sustainable?

5. GitHub Activity

- Is it active on GitHub? (This is where open-source projects can share their code and collaborate. The more active a project is on GitHub, the better!)

6. Scale

- Is there a plan in place?

- How many transactions can the business support?

7. Security

- How safe and protected is the network?

8. Code Quality

- When we review the base code, how clean and well-organized is it?

9. Contributing Developers

- Is there a healthy stable of non-core developers contributing to the product?

10. Social Activity

- Community analysis. What is the quantity of activity and quality of discussions involved with a coin’s following on channels like Reddit, Twitter and Slack?